Oaktree Client Memo

Thanks to a subscriber for this note by Howard Marks. Here is a section:

So today’s high asset prices may be justified at today’s interest rates, but that’s clearly a source of vulnerability if rates were to rise. (Note that today’s 1.40% yield on the 10-0year Treasury note is up from -.52% at he low in august 2020 and from 0.93% in just the last seven weeks)

The Fed says rates will be low for years to come, but are there limitations on its ability to make that happen? Can the Fed keep rates artificially low forever? On longer-maturity bonds? And what about inflation? Can the 10-year Treasury note still yield 1.40% if inflation reaches 3%? Will people buy it a negative real yield? Or will the price fall so that it yields more? Where could inflation come from? The price of goods may not rise in dollar terms, but reduced respect for the dollar (or increased quantities of dollars in circulation) could cause it to depreciate relative to the price of goods: same result.

Here is a link to the full report.

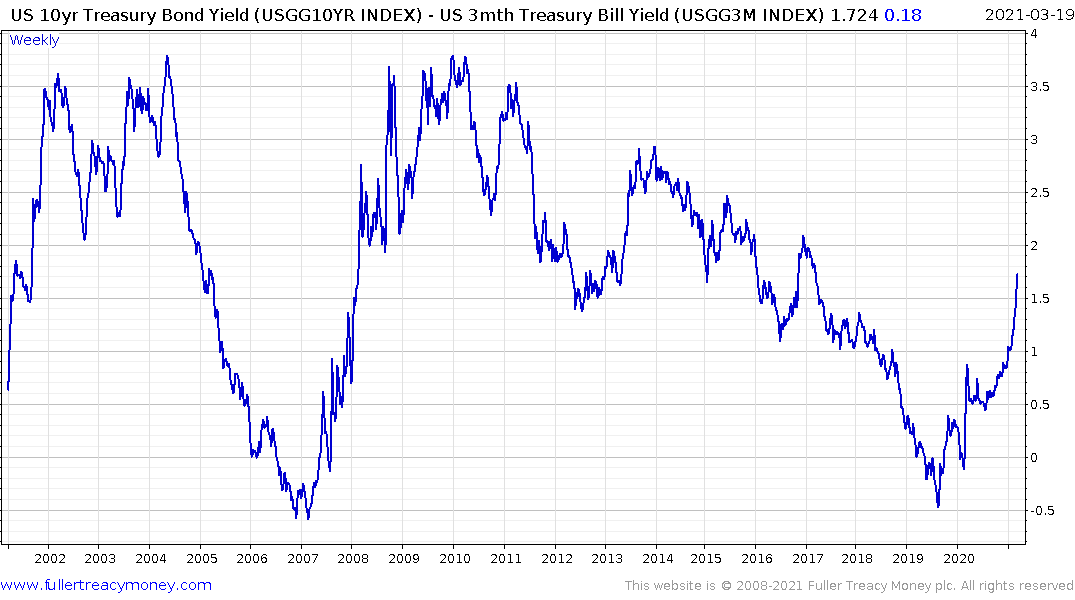

These questions are seeking an answer in real time as Treasury yields trend higher. At present Treasury yields are pausing near 1.75% and the Personal Consumption Expenditure inflation measure is at 1.5%. The bond market is therefore insisting on a positive real yield to justify buying.

However, since a clear and consistent trend is in evidence bond investors are also pricing in the potential that the PCE will continue to also trend higher. Bond investors have become accustomed to central bank assistance. There was no revolt at the beginning of the quantitative easing era because the Fed was supporting the market.

With quantitative tightening the Fed took dollars out of circulation and yields rose because there was less assistance being provided to the bond market. In late 2018 10-year yields topped 3%. There was widespread fear we were entering a secular bear market with significant scope for inflation.

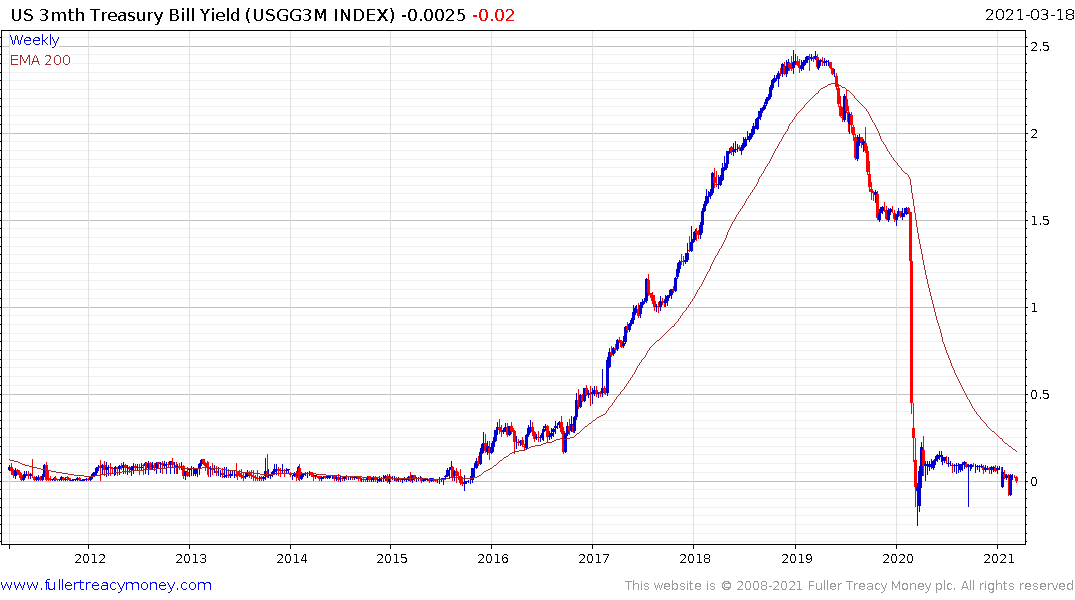

Money market liquidity shortages and a 20% stock market pullback caused a reassessment at the Fed. They started cutting rates in 2019, supplied hundreds of billions to the repo market and when the pandemic hit, they ramped up assistance. That took yields to historic new lows amid fears of global deflation.

In this quarter, the US Treasury is issuing more debt that the Fed is planning to buy. That has put the onus for purchases onto the private sector, who are unaccustomed to having to be the marginal buyer. They are demanding higher yields as a result. That’s less about inflation and more about simple market clearing.

At the same time the US Treasury is drawing down $1 trillion in reserves to fund the latest stimulus program. A lot of that money is heading for direct deposits at consumer accounts which is creating demand for short-dated paper. Everything out to 3-month maturities now has a negative yield.

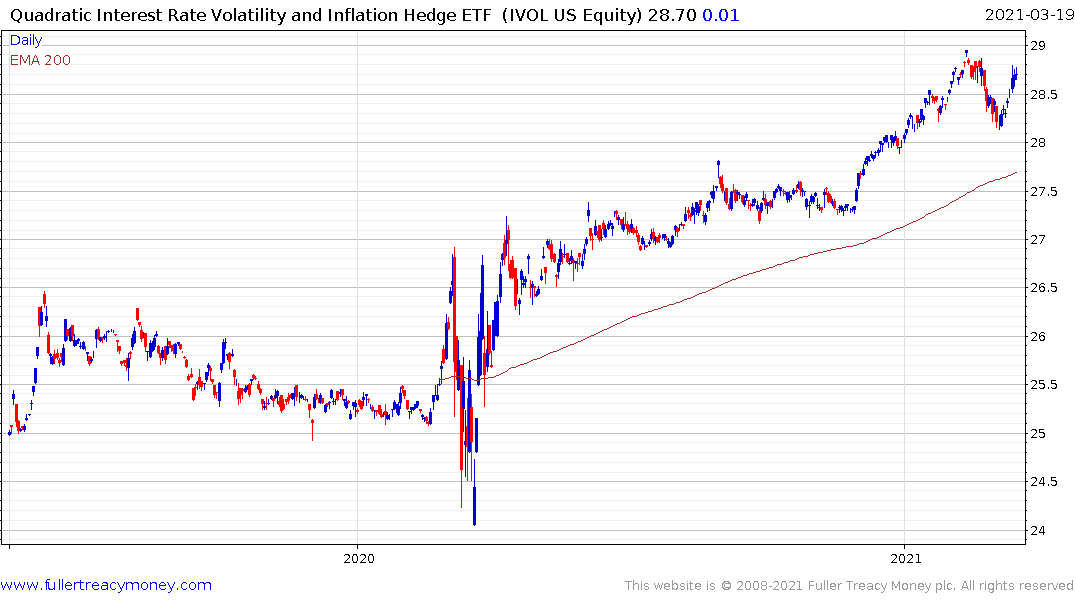

The Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL) is designed to benefit from a steepening yield curve and continues to trend higher.

Simultaneously, the Fed has allowed banks’ exemption from Standard Liquidity Ratio (SLR) requirements to expire. Banks will now either need to reduce liabilities and/or increase assets to come back inside the prescribed bands.

To ease that burden the Fed has increased what it will accept via reverse repos. The net effect will be that the money coming out of the Treasury’s account will flow directly back into the Fed’s balance sheet via the repo market.

There are a lot of moving parts to what is going on in the bond markets at present, but there are some conclusions that are clear. The Fed is unlikely to act to assist markets until there is disorderly activity. The market has a way of delivering disorder in the form of stock market and money market volatility.

The second is that the inflation question is unanswered. No one really knows if inflation is going to make a significant comeback, but investors are willing to give it the benefit of the doubt since the Fed is unwilling to raise rates and monetary conditions remain accommodative.

That is a secular headwind for the Dollar because no one really believes the Fed is insensitive to asset prices. It is infinitely more preferable for public officials to devalue the currency than to make hard choices about spending, benefits and taxation. Nevertheless, in the short-term, the relative attraction of the higher yield on the Dollar is creating stability.

This report from Brandywine Global Investment Management may also be of interest.

Back to top