Junk Debt Is So Hot Investors Are Giving Issuers the Upper Hand

This article by Laura Benitez for Bloomberg may be of interest to subscribers. Here is a section:

“With all the features combined, you could say this is a new low,” Alastair Gillespie, an analyst at Covenant Review, said. “When deals like this close, the question must be asked whether our marketplace and investors are well served.”

Spokespeople for Foncia and Partners Group declined to comment when contacted by Bloomberg News.

The provision was likened to the so-called trapdoor stipulation that U.S retailer J. Crew used it to its advantage in 2017 and that allows the company the flexibility to pay itself dividends. It also enables the firm to transfer value away from bondholders and leave them with less collateral claim in the event of a default.

The low interest rates era is breeding all manner of market dislocations in the bond markets. When yields are negative investors will do anything to achieve a positive yield. In the debt markets that means covenant lite provisions but that has been the case for years already. That emboldened issuers to seek even better terms. It’s another example of how high yield debt has turned into a seller’s market.

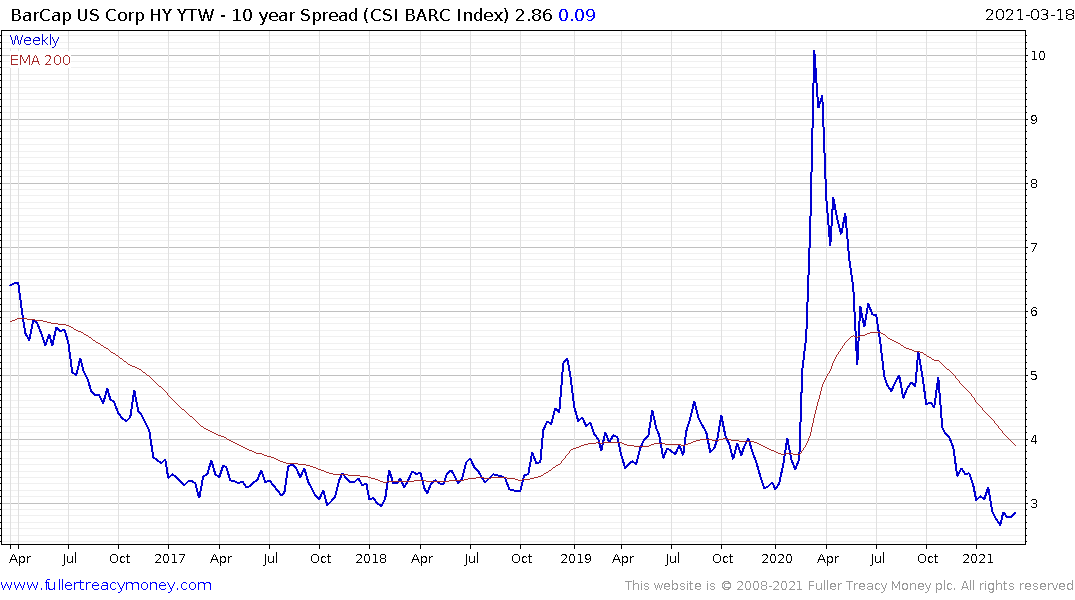

The spread over Treasuries remains close to all-time lows which provides ample evidence for how accommodative policy remains.

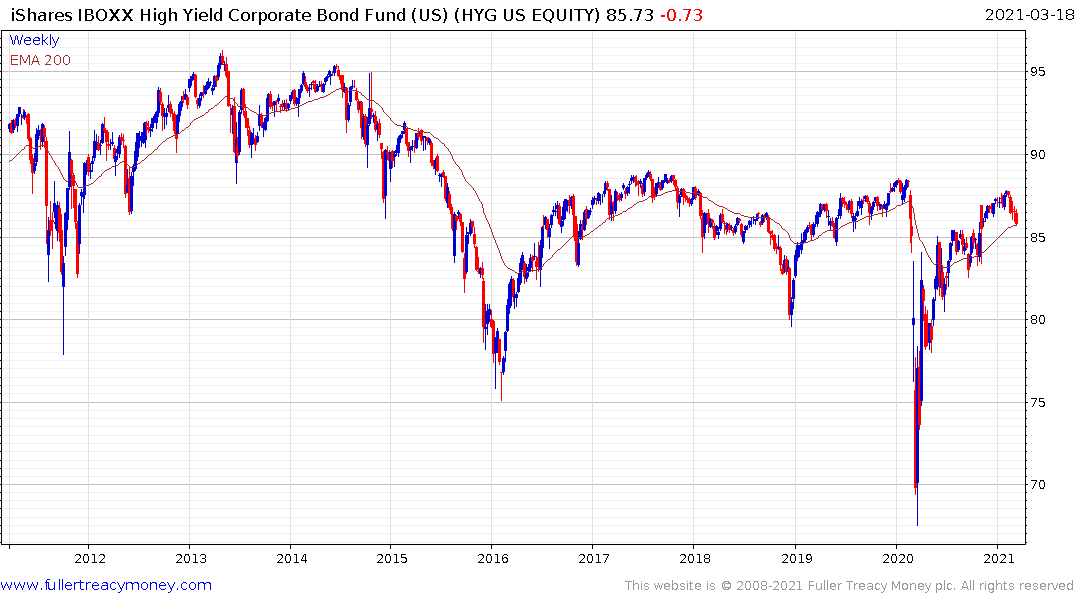

The iShares IBOXX High Yield Corporate Bond Fund (HYG) fund has returned to test the region of the trend mean which suggests the sector is not immune to selling pressure even if the spread is tight. The fund has been prone to downdrafts since the 2013 peak and a sequence of lower major rally highs is clearly evidence. It will need to continue to bounce hold the $85 area if the recovery is to remain intact.