NVIDIA GPU Cloud: It's Not What You May Think It Is

This article by Karl Freud for Forbes may be of interest to subscribers. Here is a section:

This initiative, which probably could have been better named something like the “NVIDIA Deep Learning Portal”, will actually set NVIDIA up as a channel and demand aggregator for these partners' cloud services, not compete with them. The tool will provision the latest tested versions of AI software stack and development frameworks and then will deploy these software containers on hardware infrastructure provided by the NVIDIA’s partners, initially on Amazon Web Services and the Microsoft Azure Cloud.

Through this new program, NVIDIA will basically manage a cloud registry and repository of the latest 3 versions of tested applications, optimized libraries and frameworks, which are continually evolving through the open source community. In fact, NVIDIA regularly optimizes these frameworks and then offers these improvements back to the open source community for inclusion upstream. The software is put in an NVDocker container, which is then deployed on the user’s hardware of choice. Think of this as the next generation of CUDA and CuDNN, now expanded to the complete set of Machine Learning software and integrated with container provisioning.

Nvidia is on a mission to own the graphics card market. It already has a dominant position but the growth markets for its chips rest not in its traditional gaming sector but in artificial intelligence and autonomous vehicles. The creation of a portal to help companies manage the development of related software using its chips helps to lock them into its ecosystem and cement the firm’s dominant position.

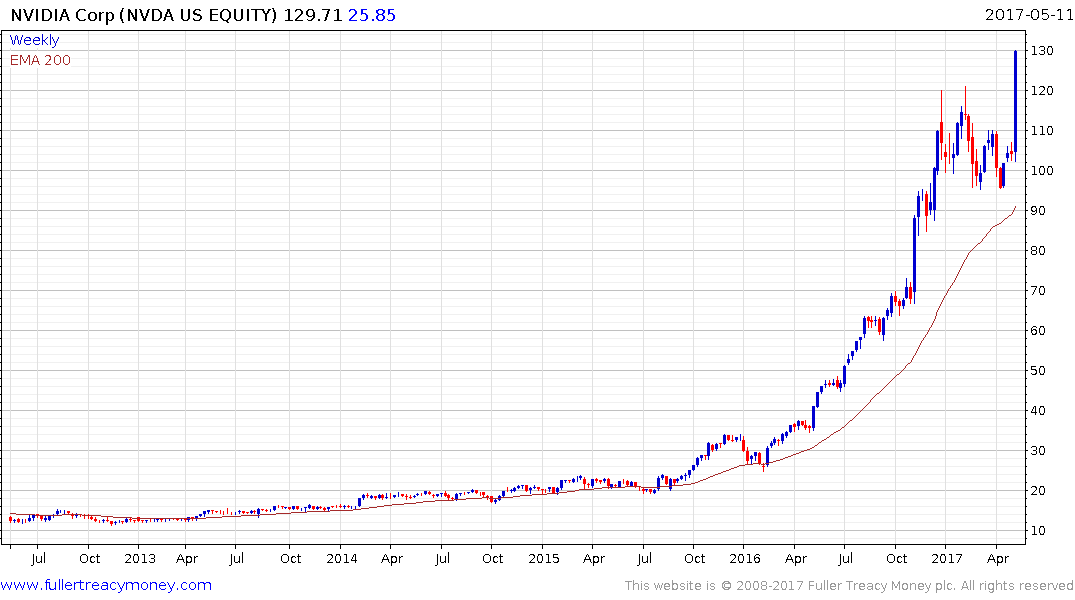

The share rallied impressively yesterday ahead of this news and broke out to new highs today. Nvidia was last year’s best performer and it has spent most of 2017 to date ranging in what was a relatively steady reversion back towards the mean. Today’s breakout reasserts the medium-term uptrend and a sustained move below $110 would be required to question potential for additional upside.