Flooding hits northeast Arkansas rice hard

This article by David Bennett for Delta FarmPress may be of interest to subscribers. Here is a section:

“At this point, we’re estimating over 150,000 acres of rice will have been lost by the time this is over,” says Jarrod Hardke, Arkansas Extension rice specialist. “Of course, soybeans and corn will be taken out, but to less an extent. There wasn’t as much of those crops planted in the region being affected – especially corn, which is typically planted in lighter soils on higher ground.”

The May 1 NASS report said 89 percent of Arkansas’ expected 1.2 million-acre rice crop had been planted.

“Once rice is 10 days submerged, you can start writing it off. Some will survive but once that 10-day mark is hit you’re on the downhill side of expectation for a good rice crop. Rice may like a flood but doesn’t like to be submerged. And while it may survive being submerged longer than other crops it has a breaking point.”

In many cases, says Hardke, “the water isn’t going down but is leveled out. And farther downstream the flooding is getting worse. The additional rain last week just added insult to injury. More rain is forecast for (the week of May 8).

The soft commodity sector has been acting as a drag on the wider commodity complex for much of the year but there are initial signs of some respite emerging. The low price of grains and beans was pricing in close to a perfect crop this year but adverse weather has at least partially ameliorated that situation.

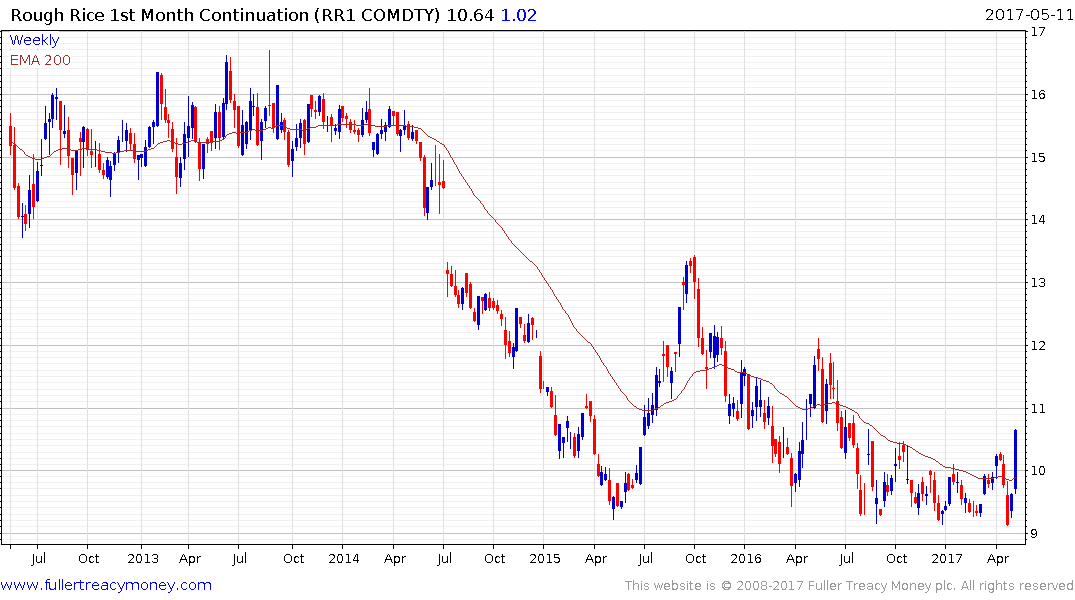

Rough Rice has been ranging mostly above $9 for a year but rallied impressively this week to break the medium-term progression of lower rally highs. A sustained move back below $10 would now be required to question current scope for additional upside.

Cotton has held a progression of higher reaction lows for more than a year and bounced impressively today from the region of the trend mean to confirm a return to demand dominance.