Norfolk Southern Drops as EPA Asks It to Pay for Ohio Cleanup

This article from Bloomberg may be of interest to subscribers. Here is a section:

Norfolk Southern Corp. fell again as the railroad faced growing fallout from a train derailment that spilled chemicals in Ohio early this month.

The US Environmental Protection Agency notified the company of its “potential liability” and encouraged Norfolk Southern to reimburse the agency for its costs related to the crash. The EPA urged a quick response in its Feb. 10 letter.

The railroad said it received the EPA’s request and “will continue to perform or finance environmental monitoring and remediation,” according to an emailed statement. Norfolk Southern’s hazardous materials team was at the scene within an hour of the accident and continues to work with authorities, the company said in the statement.

The 150-car train derailed at 8:55 p.m. Eastern time on Feb. 3. It was hauling about 20 railcars with chemicals, including vinyl chloride, ethylhexyl acrylate and isobutylene, according to the EPA.

Those chemicals were released into the air, surface soils and surface waters near East Palestine, Ohio.

Norfolk Southern slid 1.2% Monday in New York, the fourth decline in six trading days since the spill. The shares are down 2.7% this year, while the S&P 500 Index is up 7.8%

The spill and burn off of butyl acrylate into the Ohio river, which provides drinking water for millions of people, has understandably put consumers on edge. There will certainly be class action lawsuits if there is a hint the spill has led to health issues, particularly following the evacuation from a wide area around the spill.

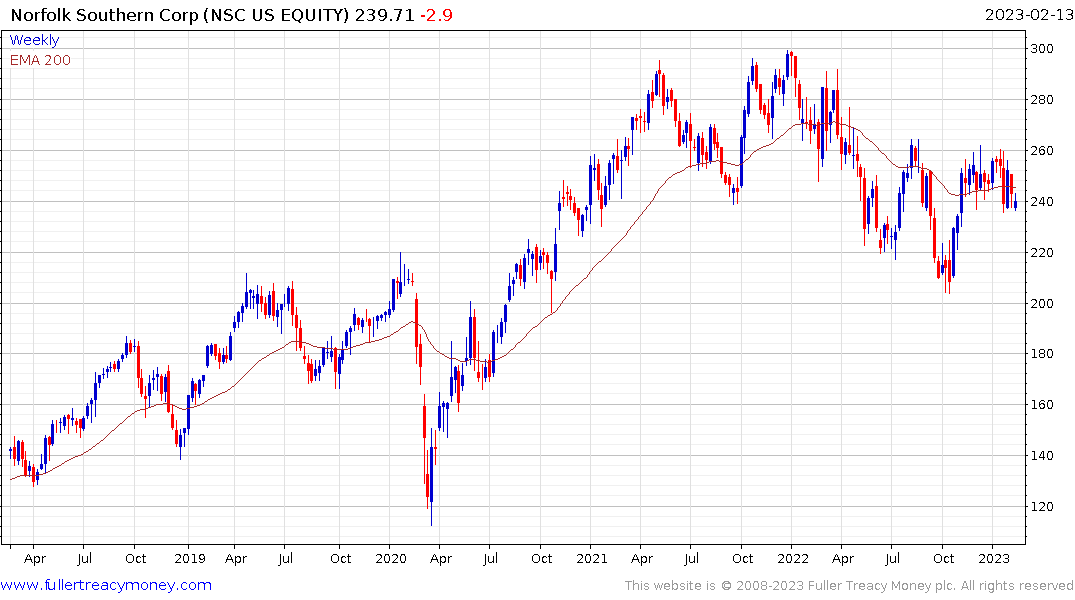

Norfolk Southern appears to be putting in a first step below the Type-2 formation and a clear upward dynamic will be required to check the downward bias.

Norfolk Southern appears to be putting in a first step below the Type-2 formation and a clear upward dynamic will be required to check the downward bias.

The bigger question is whether the severity of this spill will result in tighter regulations for the transportation of chemicals by rail. So far, this has not impacted the shares of chemicals companies which are mostly firming in the region of their respective ranges.

.png) Linde continues to pause in the region of its all-time peak but a sustained move below the 200-day MA would be required to signal more than temporary supply dominance.

Linde continues to pause in the region of its all-time peak but a sustained move below the 200-day MA would be required to signal more than temporary supply dominance.