Sentimental Journey

Thanks to Iain Little for this edition of his Global Thematic Investors’ Diary. Here is a section:

Where next? The best comment, as it also applies to us, comes from one of our managers, Terry Smith: “Our companies should demonstrate a relatively resilient fundamental performance in such circumstances, and the only type of market which ends in a recession is a bear market.”

We are reminded by another market veteran we’ve followed for 40 years, Ed Yardeni, that the FAANGS, the mega tech US stocks which led the 2014 to 2021 bull market, still inflate the PER market rating. Without the FAANGS, the forward market multiple is only 16.7x, making it barely 2 points higher than the long-term average. Bearish commentators claim that earnings are about to take a hit, raising the PER, and rate rises are still in store. (Remember that 2 main factors influence share prices: the valuation of earnings, influenced largely by interest rates, and the earnings themselves). There may indeed be something to the bears’ claim.

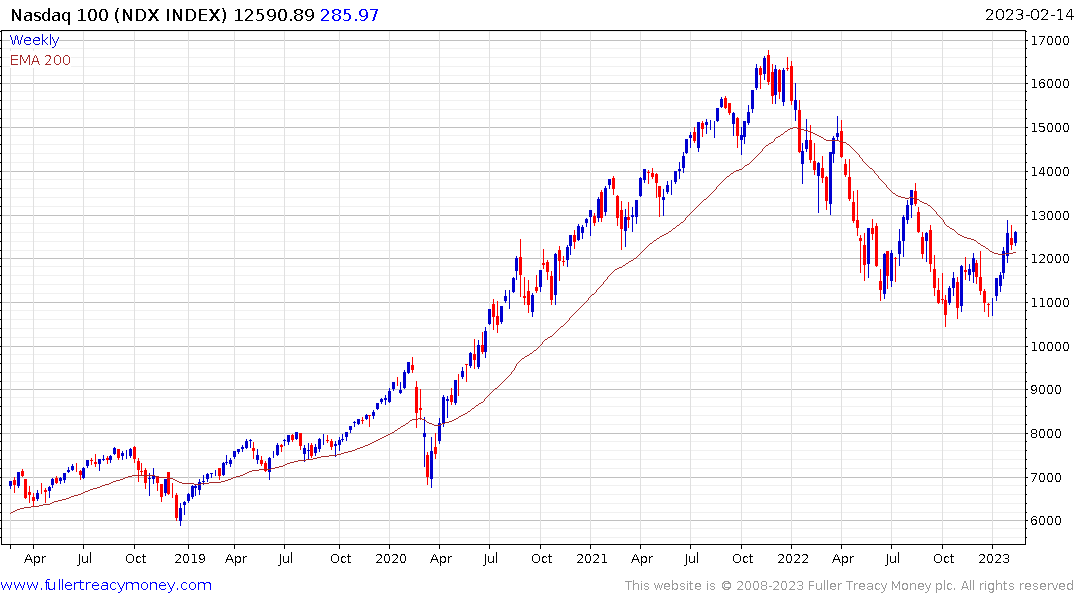

Some of the biggest movers in the US market since the beginning of January have been the eight mega-cap household names stocks. Tesla and Nvidia rebounded impressively while Alphabet has been a clear laggard and all largely because of enthusiasm about the promise of AI.

There has also been a great deal of speculation about the prospect of rates peaking soon and the associated belief that a recession will be avoided entirely. At its root, the big question is whether this time is really different.

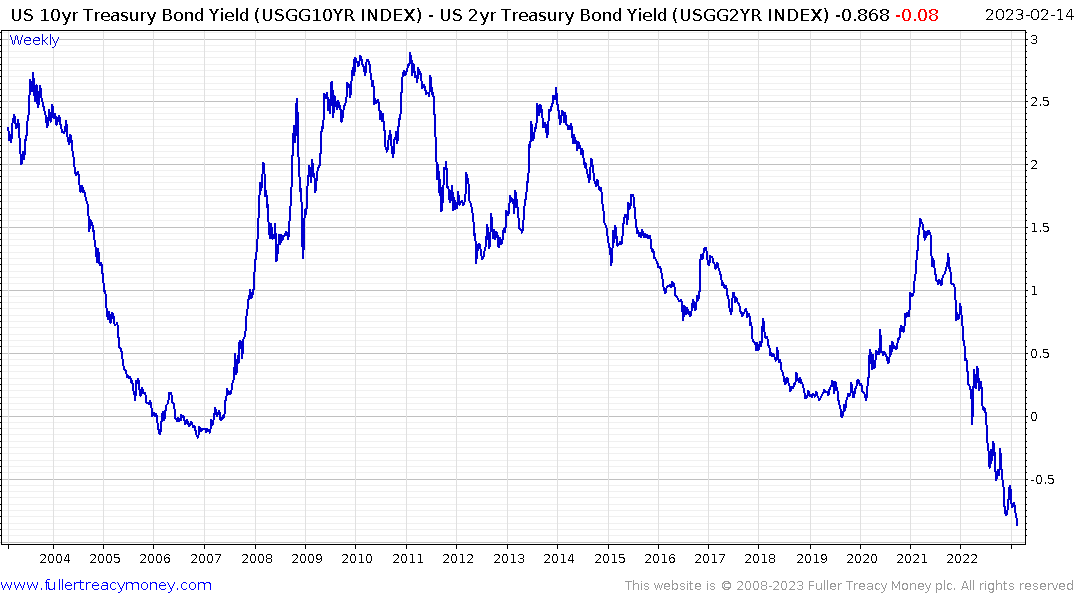

If the most reliable lead indicators are still worth looking at an inverted yield curve, negative money supply growth, collapsing demand for mortgages, high oil prices and full employment point to a recession and potentially a deep one.

If the pandemic is the exception that proves the rule and the en masse retirement of baby boomers leads to a lengthy shortage of workers, then employment stays high and inflation declines gradually. That would ensure a significant correction in corporate profits is avoided and could deliver the unicorn a profoundly soft landing

It seems to me that betting on the best case scenario because this time could be different is a big leap. To truly prove this time is different, high equity valuations will need to be sustained when the yield curve moves from inversion back into positive territory.

It is quite normal for the market to rally between when the yield curve inverts and when it eventually moves back above the zero bound. That’s exactly what is happening now, so the benefit of the doubt can be given to the upside until the yield curve reverses the inversion. That’s usually associated with central banks panicking because growth is surprising on the downside.

I’ve accepted an invitation to the go to the ALTLA conference next month. Most of the speakers are public and private sector pension funds investing in private assets. I am very interested to take the temperature of appetites for investments in hard to value assets in a rising rate environment.