Musings from the Oil Patch September 20th 2016

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB. Here is a section:

So looking forward in a world of slow economic activity as experienced for the past decade, we can see VMT growth slowing and potentially a shift toward more fuel-efficient vehicle purchases – both not positive for gasoline demand. We then have the question of the impact of greater millennials in the population and the impact of the disruptive factors we enumerated earlier.

A Ford Motor Company (F-NYSE) senior executive told an analyst meeting recently that the company expected autonomous vehicles to represent 5% of the auto fleet sales in 2025, or potentially a million cars per year. Self-driving vehicle technology seems to be moving toward the mainstream faster than many anticipated. The City of Pittsburgh, Pennsylvania is now allowing Uber to test an autonomous vehicle taxi service. The cars are equipped with 20 cameras and seven sensors to help them navigate the city’s streets. The taxis will be required to have a human driver behind the wheel in case control of the vehicle needs to shift, along with an engineer in the front seat. Right now the service is free, and it has attracted many reporters who will publicize it. Will it attract many customers? Unless a taxi causes significant traffic disruptions or a life-threatening accident, we suspect the test will be declared a success. The industry, however, is still awaiting the federal government’s issuance of guidelines about how self-driving vehicle regulations should be constructed. Traffic laws are primarily under local control, but basic national standards are important for the regulatory process and the vehicle manufacturing process, including vehicle safety and emissions standards. Steering wheels and pedals, or not?

Self-driving technology’s primary benefit is to reduce and/or eliminate accidents and especially deaths. In 2014, according to data from the U.S. Department of Transportation, which is responsible for the Fatality Analysis Reporting System, there were 29,989 fatal motor vehicle crashes in which 32,675 deaths occurred. This represented 10.2 deaths per 100,000 people and 1.08 deaths per 100 million vehicle miles traveled. Some 38% of the deaths involved car accidents, while 25% related to pickup and SUV vehicle accidents. Only 2% of the deaths involved large trucks while the balance was accounted by motorcyclists, pedestrians and bicyclists. All deaths from large truck crashes were 12% of total vehicle deaths.

There remain a number of legal issues about self-driving cars that need to be resolved. Who is given a ticket for a self-driving car failing to heed traffic rules or becoming involved in an accident: the passenger, a driver in the vehicle, the owner of the vehicle, or the engineer who wrote the software? These issues will be overcome with time, but the impact on energy markets will likely come in dramatic fashion. Once auto companies feel comfortable that their self-driving cars will not be involved in accidents, they can begin designing vehicles for greater passenger comfort and entertainment, while using lighter materials since the heavy steel cages required now to protect passengers in accidents will no longer be needed. Reducing vehicle weight will make vehicles much more fuel-efficient and thus reduce future fuel consumption.

Here is a link to the full report.

Three themes of autonomous vehicles, electric vehicles and new ownership models tend to be conflated when speculation about the future of transportation is discussed. These could all have an effect on the number of miles travelled but could also break the link between that measure and gasoline consumption.

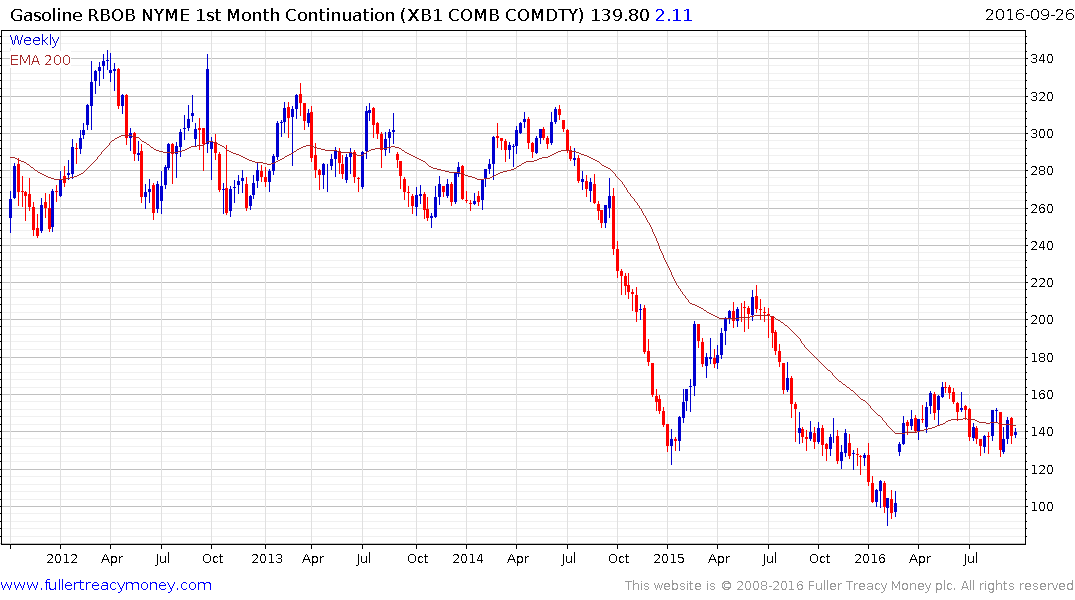

Gasoline has been ranging mostly below the trend mean since July and a sustained move above $1.50 will be required to begin to signal a return to demand dominance beyond short-term steadying.

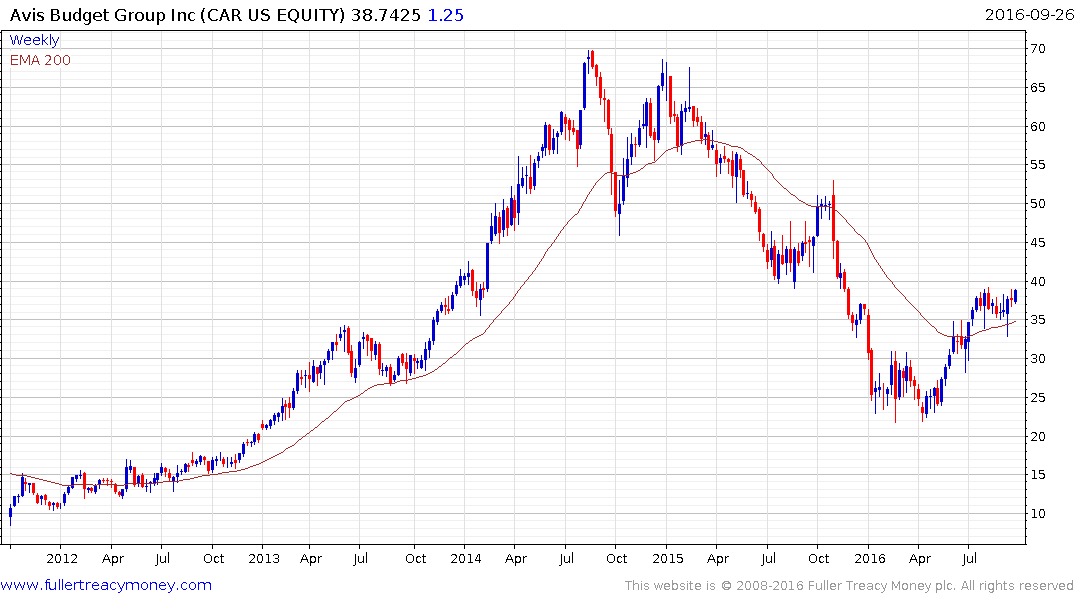

Avis acquired ZipCar in 2013 to expand its offering into the very short-term rental market. The share trended lower for much of last year but found support from January and has been consolidating above the trend mean for much of the last two months. A sustained move below $34 would be required to question medium-term scope for additional upside.