Email of the day on zero down mortgages

Today I heard on the BBC news that in the US the banks are giving mortgages with "0" down payments. Is this correct, and if so how serious do you think is the risk of a similiar financial crises as we had in 2008.

As always thanks a lot for the wonderful service

Thank you for your kind words and this question. As you are no doubt aware NINJA loans (No Income, No Job, No Assets) were popular ahead of the credit crisis as lax lending standards made property available to people who had no chance of ever paying back the loans.

100% mortgages do exist in the USA and are not a new feature. For example the USDA (Department of Agriculture) offers zero down mortgages for rural development and the Veterans’ Administration (VA) offers even more attractive terms to veterans. This article from themortagereports.com may also be of interest.

Wells Fargo offers a Federal Housing Authority (FHA) backed loan for 3.5% down but which also includes mortgage insurance. These loans are primarily offered to Latin American immigrants, who it is assumed have many people living in the same home, and therefore the income of family members, who are not necessarily on the loan, can be used to meet loan-to-income requirements.

While these are representative of easy lending standards for some groups of people, I am not aware of banks that offer zero down mortgages.

However it is also worth considering that private equity firms represent much larger participants in the housing market today than they did in 2006/07. This article from the New York Times may be of interest. Here is a section:

In making such a large investment in housing — $9 billion buying and renovating mainly foreclosed homes over the last four years — Blackstone effectively bet on which communities would emerge from the housing crisis as winners.

It bet correctly. The firm, which now owns about 50,000 homes in 14 markets, recently reported that the fund holding its Invitation Homes rental subsidiary has generated a 23 percent annualized return for its investors.

More broadly, private equity’s investment in housing helped stabilize home prices across the country. The Obama administration supported private investment in foreclosed homes, with Timothy F. Geithner, then the Treasury secretary, remarking in 2011 that it would “support neighborhood and home price stability.”

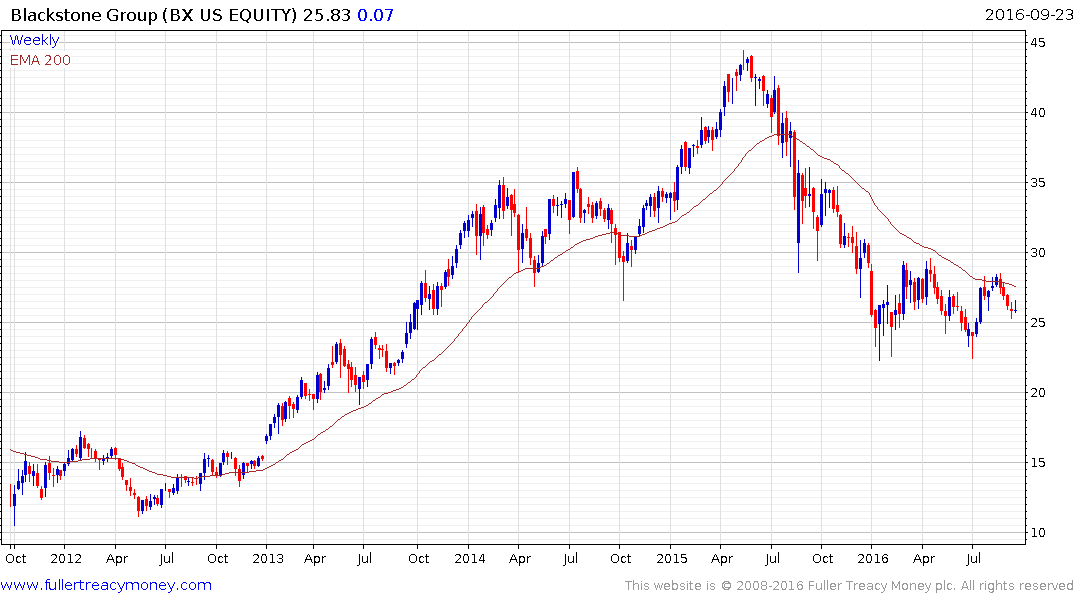

Blackstone LP is one of the largest landlords in the USA and real estate represented about 40% of revenue in 2015. The share has been mostly rangebound this year following last year’s steep decline and a sustained move above $28 will be required to signal a return to demand dominance.

Here is a link to DoubleLine’s thought leadership piece from earlier this month where they highlight their belief that policy is turning “bond unfriendly.” If that is indeed the case, and yields hold their low during the current rally and succeed in moving above the trend mean to break the medium-term progression of lower rally highs, that could potentially act as a headwind to additional advances in the property market as it would put pressure on leverage ratios.