Mortgage Shock Awaits UK Homebuyers After Pandemic Tax Break

This article from Bloomberg may be of interest to subscribers. Here is a section:

The UK’s tax holiday on property purchases during the pandemic seemed like a dream chance to buy a home. For many who did, it may soon look more like a nightmare.

A huge cohort of purchasers opted for cheap two-year mortgages and are due to refinance by September 2023. But borrowing costs have risen to a multi-year high, meaning their new monthly housing payments may be 25% higher, or even more.

The relief on the stamp-duty levy ran from July 2020 to September 2021. About 42% of borrowers in that period, which includes those remortgaging, fixed for only 24 months, according to data from UK Finance.

The ticking clock means homeowners are quickly having to come to terms with something they haven’t dealt with in years -- sharply higher interest rates and a risk of a housing correction. Traders are betting the Bank of England will raise its key interest rate by 250 basis points to 4.25% by March. A year ago, the benchmark was just 0.1%.

That’s just one of multiple shocks battering consumers right now as energy bills surge and inflation jumps above 10%, the fastest in four decades

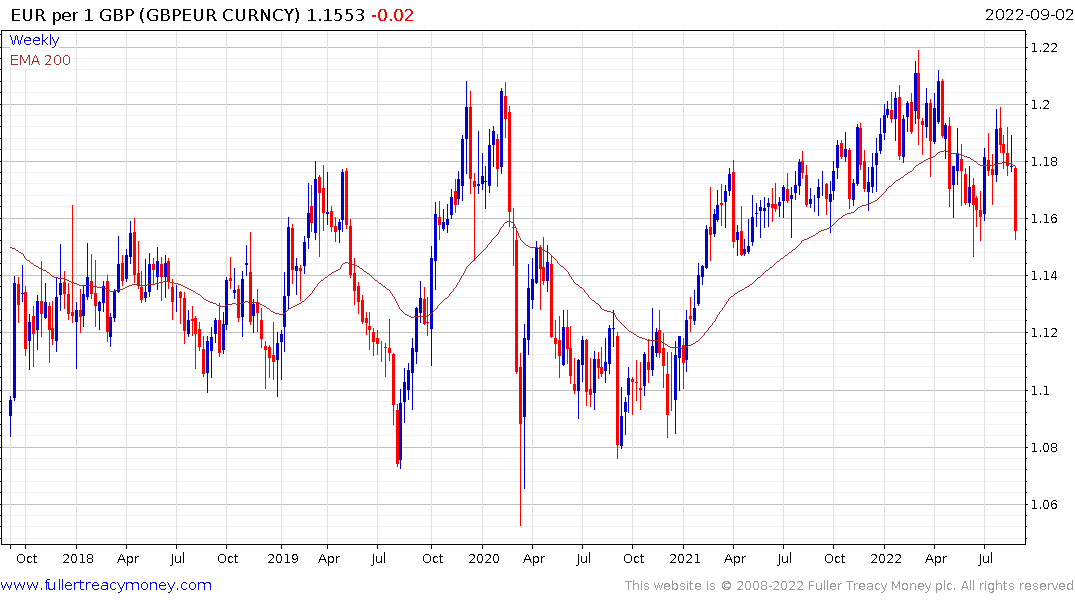

The Pound remains in a downtrend against the dollar but is now also pulling back sharply against the Euro. The weight of energy prices, interest rates and inflation are hitting consumer spending and contributing to negative sentiment.

The minimum wage in the UK is around £9. As the Pound falls that is becoming progressively more attractive for foreign direct investment. The harsh reality is the rerating of the UK economy will succeed in making it much more competitive as a place to site export-oriented businesses.

The UK housing market is much more interest rate sensitive than other countries. The government’s debt is especially long duration so the primary risk rests with consumer balance sheets. Gilt yields are surging higher and while very overextended a clear downward dynamic will be required to signal a return to demand dominance.

The UK housing market is much more interest rate sensitive than other countries. The government’s debt is especially long duration so the primary risk rests with consumer balance sheets. Gilt yields are surging higher and while very overextended a clear downward dynamic will be required to signal a return to demand dominance.

The next prime minister will have the dual challenges of both electricity and mortgage rates resetting higher at the same time. That virtually ensures heavy handed government intervention to control prices. The “excess profits” of energy companies have a clear target painted on them.

That’s likely to weigh on the best performers in the FTSE-100 which is rolling over at present.

That’s likely to weigh on the best performers in the FTSE-100 which is rolling over at present.