Billionaire Forrest's Hydrogen Unit to Speed Expansion Plans

This article from Bloomberg may be of interest to subscribers. Here is a section:

The unit expects to begin output of green hydrogen from 2024 at a small scale in the hundreds of thousands of tons, before quickly ramping up to hit its 2030 goal, he said. Fortescue has announced agreements over future supply deals with companies including Germany-based E.ON SE and JC Bamford Excavators Ltd. in the UK.

“When I think about how big this market is, it’s as big as replacing the entire fossil fuel market in the world, and it’s real now,” Hutchinson said, speaking on the sidelines of a government-hosted jobs and skills summit.

Forrest told investors earlier this week he’d been approached by fund managers over a potential $20 billion separate listing of FFI, though the firm argues there’s better value in retaining the hydrogen developer alongside the world’s No. 4 iron ore exporter.

“Once we get going at scale and just looking at the projects we have, it’s enormous,” according to Hutchinson.

7% of global natural gas supply is devoted to the production of ammonia. Decarbonising the production of fertiliser is a major aim of the green movement. Hydrogen is also a major intermediate product for the hydrocarbons industry.

Green hydrogen production is aimed squarely at taking over the market share of natural gas and coal in producing ammonia. In fact ammonia is being proffered as a transportation mechanism for hydrogen.

Capturing market share for oil products, in the transportation sector, is aspirational and depends on a series of additional factors falling into place.

This section from an IEA report on the ammonia market may be of interest to subscribers.

Governments’ role is central. Governments will need to establish a policy environment supportive of ambitious emission cuts by creating transition plans underpinned by mandatory emission reduction policies, together with mechanisms to mobilise investment. Targeted policy is also required to address existing emissions-intensive assets, create markets for near-zero-emission products, accelerate RD&D and incentivise end-use efficiency for ammonia-based products. Governments should ensure that enabling conditions are in place, including a level playing field in the global market for low-emission products, infrastructure for hydrogen and CCS, and robust data on emissions performance.

The physical, governmental, environmental and social limitations of building hundreds of new lithium, copper, nickel, cobalt and manganese mines have been proposed as the basis for a massive bull market in industrial commodities.

However, that strikes me as a circular argument. If there are severe supply shortages and prices explode on the upside, the cost of making batteries will be uneconomic. That either means they will not be built, or the chemistries will be engineered around the problem. In either case it implies less demand.

The route to increasing production of hydrogen is in its infancy but may be easier and would remove some of the intense competition for mined resources. It may be a necessary step in enabling the growth of the EV sector, by ensuring there is enough metal to go around.

Fortescue Metals is still an iron-ore miner, and the price of the commodity is falling. That’s pulling downward pressure to the price. Separately listing the hydrogen arm of the business would probably be a better value creation strategy but Forrest probably wants to hold off until he can capture maximum value.

The Australian Dollar remains in a medium-term downtrend even as exports of energy continues to improve.

The Australian Dollar remains in a medium-term downtrend even as exports of energy continues to improve.

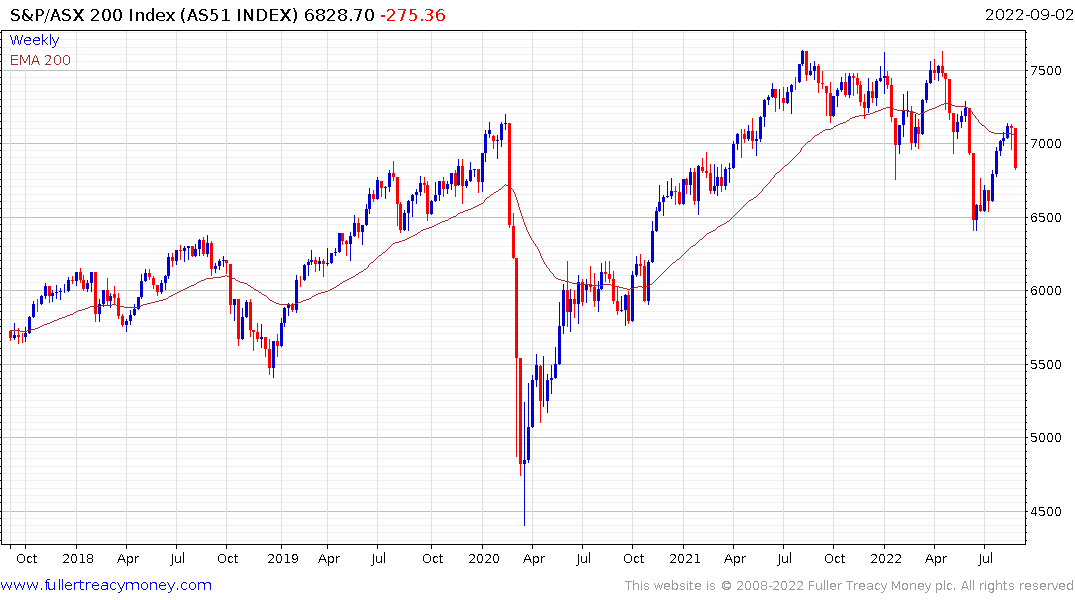

The S&P/ASX 200 Index continues to hold its sequence of lower rally highs and pulled back in a very dynamic manner this week to confirm resistance in the region of the 200-day MA. The overall pattern is a completing Type-2 top formation with evolving right-hand extension. Some significant improvement in prices will be required to offset potential for additional downside.

The S&P/ASX 200 Index continues to hold its sequence of lower rally highs and pulled back in a very dynamic manner this week to confirm resistance in the region of the 200-day MA. The overall pattern is a completing Type-2 top formation with evolving right-hand extension. Some significant improvement in prices will be required to offset potential for additional downside.