Morgan Stanley's Slimmon Recommends Bargain Hunting in August

This article from Bloomberg may be of interest to subscribers. Here is a section:

For Slimmon, the beat-down in consumer sentiment has gone far enough to warrant betting on a turnaround.

“There’s a very low expectations in those stocks right now. What if the direction of change is actually higher for consumer sentiment?” he said. He views the risk-reward as attractive.

“Those stocks might recover dramatically because they’re down so much.” He plans to snap up shares “well into the weakness” in August, which is among historically the worst months for equities as volumes are thin and workers are on vacation.

Stock market moves during this period are usually dominated by macro events. “The macro story this year is not very good,” he said, citing a global geopolitical crisis and the lack of an August meeting among Fed officials.“The focus of the market shifts from what ultimately long-term drives stocks, which is earnings. And when the shift goes to other things like macro events that creates volatility.”

As for those areas he will likely stay away from, he offered two sectors. “If you think about what’s worked year-to-date on a relative performance basis, there are two groups that have really done well: energy and defensives,” he said. “It’s a little late to be selling the energy stocks. They’ve been so creamed. I wouldn’t be aggressively buying those stocks.”

Many investors are anticipating the Jackson Hole conference in August will be a time for central bankers to declare the peak for inflation is in. The most risk tolerant traders are initiating long positions today to ensure they have the cushion of rebound ahead of that event. There is clear scope it will be a buy the rumour and sell the news event if central bankers fail to deliver.

The Fed raised rates by 75 basis points today but is only beginning to shrink the balance sheet. More than any other factor that process siphons money out of the system and has historically contributed to rising deflationary fears. The Fed is unlikely to err from its program of tightening financial conditions until unemployment rises significantly.

The stock market rebounded emphatically on the assumption inflation’s peak is close and that the Fed is very flexible in how much they are willing to hike. Strong forward guidance by Microsoft, to the effect that it expects to gain market share during a slowdown lent fuel to the rebound this morning. Google’s stronger than anticipated ad sales revenue also supported risk appetite. Apple hiring a senior Lambourghini executive for its EV also helped renew enthusiasm about the company’s next big thing.

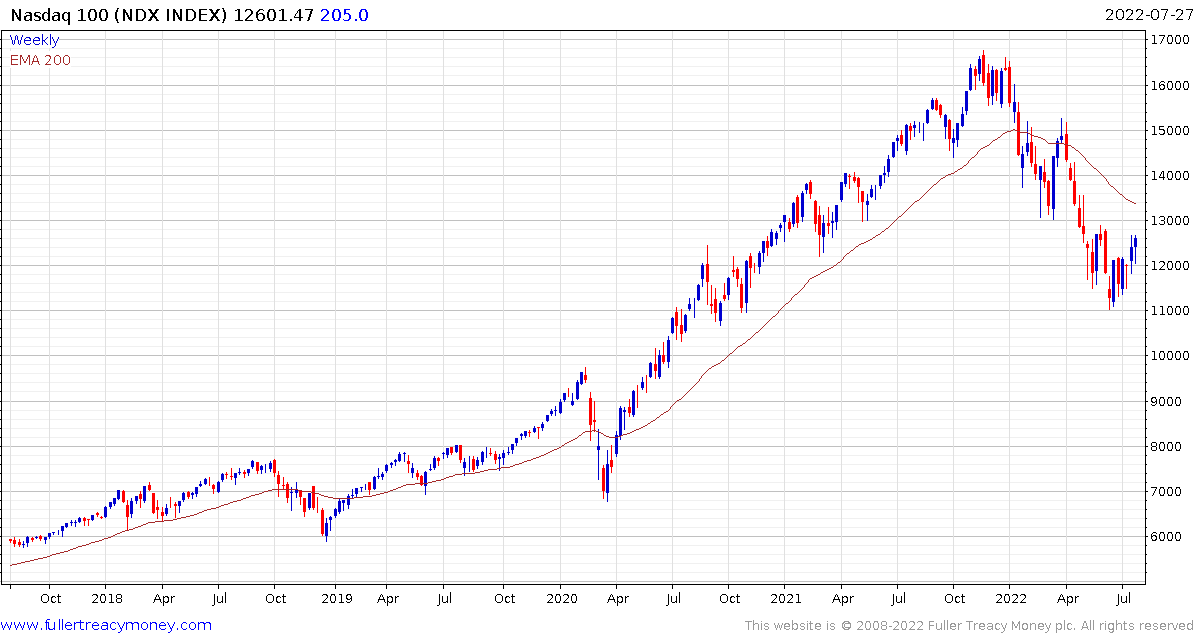

Both the S&P500 and the Nasdaq-100 continue to rebound from their respective 1000-day MAs. They need to break their sequences of lower rally highs to confirm more than short-term rebounds.

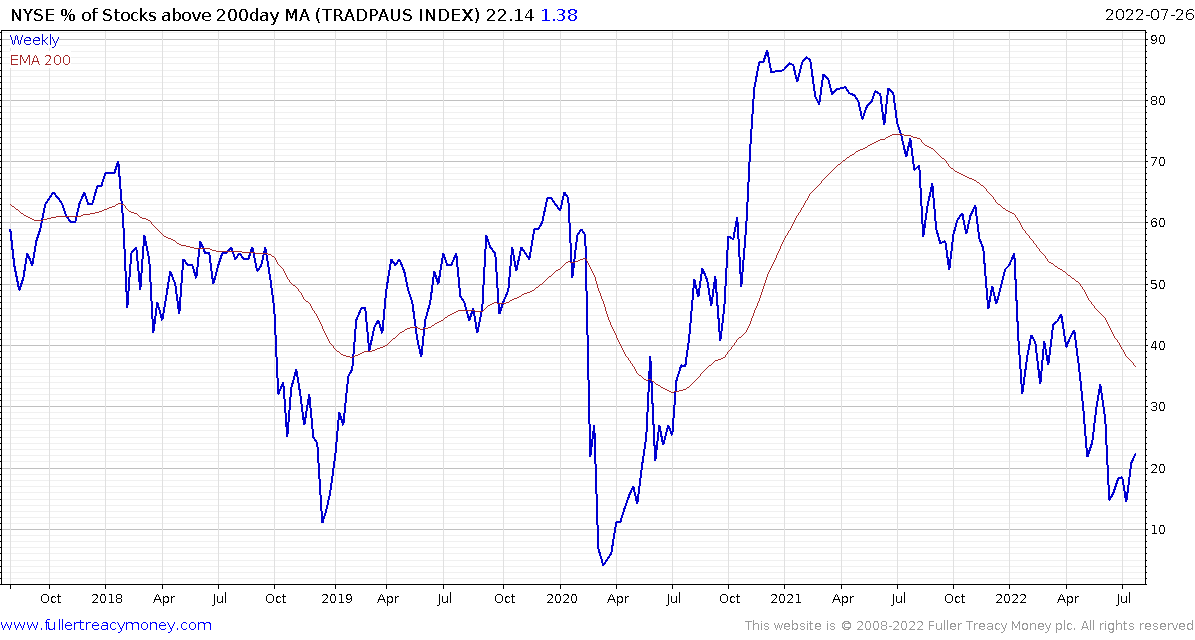

The Percentage of NYSE Stocks Closing Above 200 Day Moving Average Index is firming from the region of the 2016, 2018 and 2020 lows which supports the argument that many shares are likely to rally further than their respective 200-day MAs.

The Percentage of NYSE Stocks Closing Above 200 Day Moving Average Index is firming from the region of the 2016, 2018 and 2020 lows which supports the argument that many shares are likely to rally further than their respective 200-day MAs.