The incredible plan for a 170-km-long skyscraper in the Saudi desert

This article from NewAtlas may be of interest to subscribers. Here is a section:

The Line was unveiled by HRH Crown Prince Mohammed bin Salman and no construction date or expected completion date has been announced. Indeed, given the size of complexity of such an undertaking, it would be more than fair to be a little skeptical about it ever being realized, even just the basics like transporting enough building materials and pouring the foundations seems like it would be a considerable undertaking.

But if anyone could make it happen it’s someone with the deep pockets and capability of the Saudi Crown Prince, who with an eye to a fossil fuel-free future is very keen to transform his country’s oil-dependent economy into a tourist-friendly one. With this in mind he has already unveiled a slew of ambitious projects including BIG's so-called Giga Project.

Breaking ground on the tallest building in the world has generally coincided with major market tops. It’s often referred to as the skyscraper effect by analysts of past cycles. The logic is clear. It takes an historically high sense of optimism to engage in building the tallest building a country or the world has ever seen. That peak of optimism is generally coincident with the peak of the global real estate cycle where prices have been rising for long enough to dispel any doubt they will continue to do so.

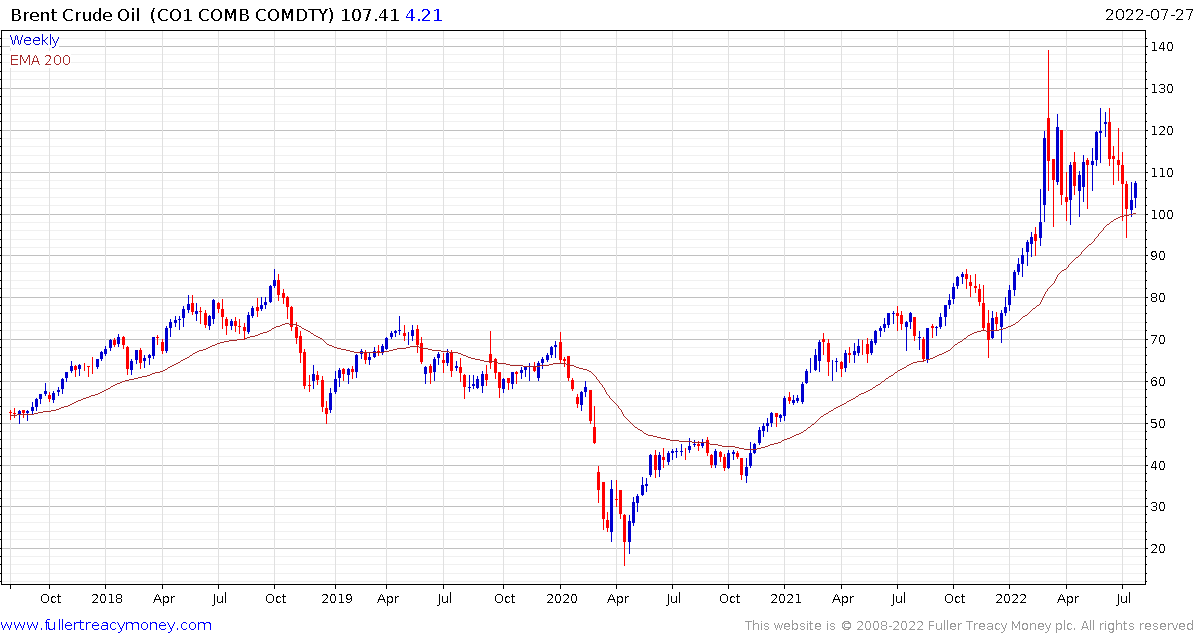

Saudi Arabia may have despaired at the thought oil prices would ever approach the historic peaks as recently as two years ago. The war in Ukraine and reluctance of companies to re-engage with offshore drilling means the country is back on the surplus side of the ledger.

Nevertheless, high prices encourage substitution in every commodity cycle so we can expect continued efforts to use less oil and development of more efficient batteries and electricity production. When Saudi Arabia has funding and resources in place to begin construction of their ambitious construction projects it is likely to coincide with a peak of enthusiasm for the country’s ability to afford whatever they want.

The iShares MSCI Saudi ETF is steadying in the region of the December low and a sustained move below $40 would be required to question near-term scope for additional upside.

Brent crude continues to steady from the psychological $100.