Morgan Stanley IM Says the Decade of Emerging Markets Has Begun

This article from Bloomberg may be of interest. Here is a section:

“Every decade, there is a new leader in the market. In the 2010s, it was US stocks and mega-cap tech,” Kandhari said in a phone interview. “Leaders of this decade can clearly be emerging-market and international stocks.” Morgan Stanley IM has $1.3 trillion in assets under management.

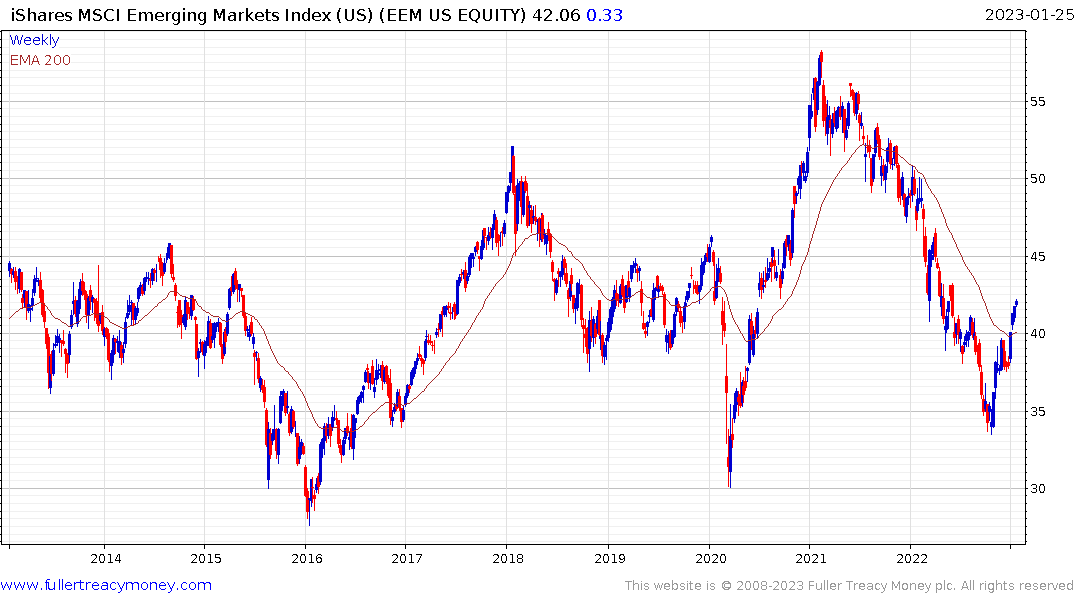

The asset class has had a strong start to the year, with the MSCI emerging-markets index soaring 8.6% compared with a 4.7% advance for the US benchmark. The gains come as China’s pullback from its strict Covid Zero policy brightens the economic outlook, while investors position for the end of aggressive central bank interest-rate hikes. Many also still see US stocks as expensive, with those in emerging-markets trading at a nearly 30% discount.

There’s a growing disconnect between US’s shrinking share of the global economy and the size of its stock market capitalization, Kandhari said. Along with fund allocations to emerging-markets that are well below historical averages and inexpensive currencies, that gives them a lot of room to outperform, she said.

“What really drives this asset class is the growth differential, and that growth differential of the EM is improving relative to the US,” she said.

The risk of a US recession is increasingly being priced into equity markets. At the same time, China has just exited its three-year quarantine. US money supply is now negative on a year over year basis for the time. China is boosting monetary and fiscal support for its markets. Even with arguments about trade wars and competing systems, it will still be easier to make money in China this year.

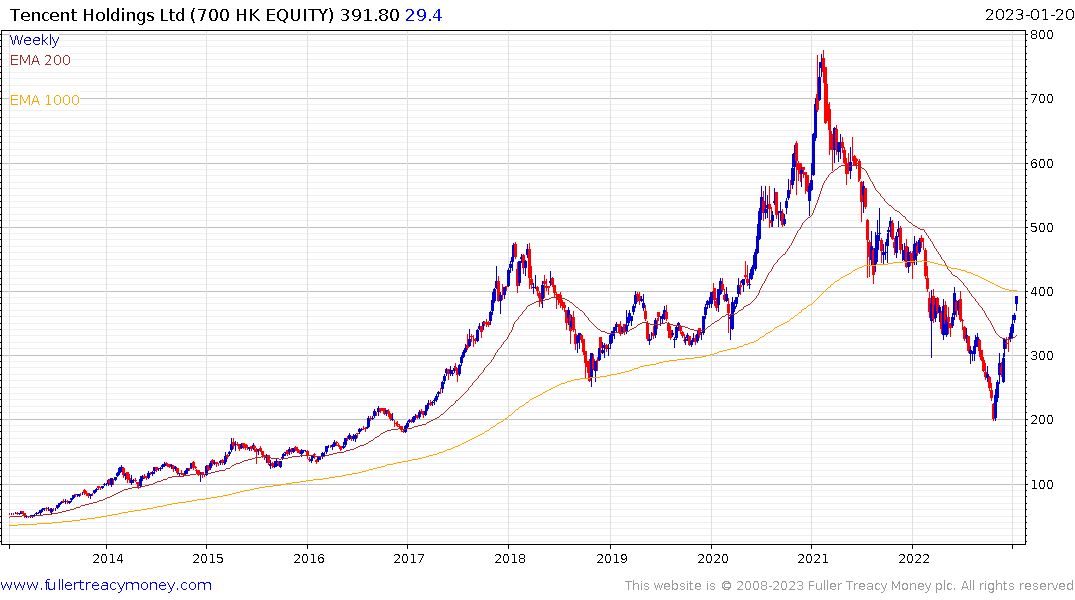

Tencent has not looked back since the end of COVID-zero. That’s the biggest holding in the MSCI Emerging ETF.

This article from Forbes is also relevant. Tiktok is not listed but the continued exposure of its nefarious actions threaten to sour sentiment. Spying on journalists is not exactly good business practice outside of China.

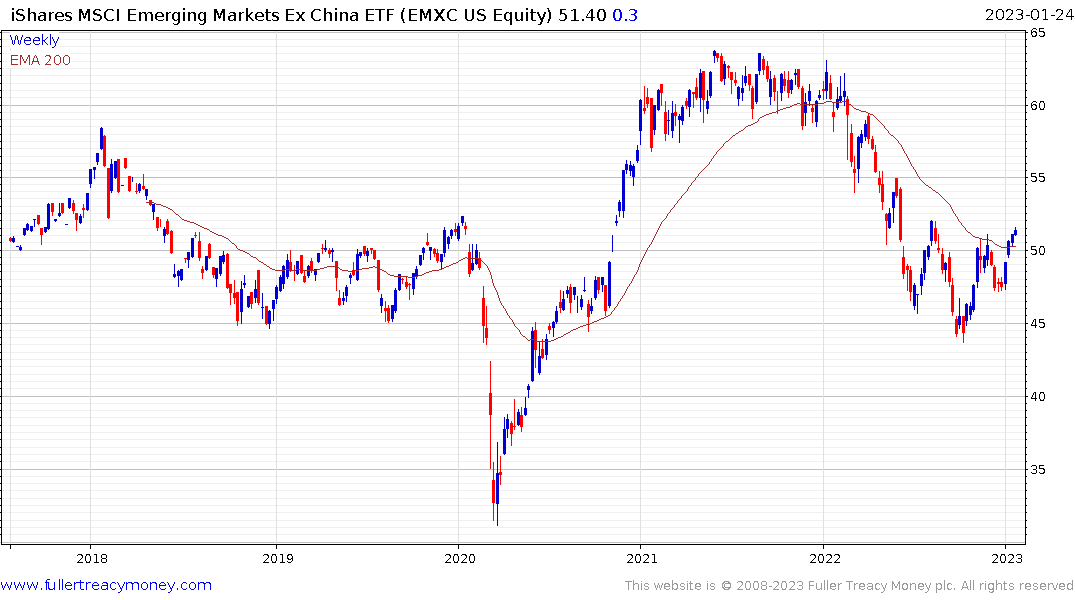

Meanwhile the iShares MSCI Emerging Markets Ex China ETF is also firming and is now trading above the 200-day MA.

Vietnam is also 30% of the frontier ETF and the VanEck Vietnam ETF is also bouncing from the region of the 2020 lows.

Vietnam is also 30% of the frontier ETF and the VanEck Vietnam ETF is also bouncing from the region of the 2020 lows.

This article by Pippa Malmgren focusing on African investment risk may also be of interest.

Back to top