Modi Win Spurs Jump in Indian Stock Futures, Rupee Forwards

This article by Abhishek Vishnoi for Bloomberg may be of interest to subscribers. Here is a section:

India’s stock futures and currency forwards jumped after Prime Minister Narendra Modi’s bigger-than-expected win in state elections increased expectations for a continuation of his reform agenda.

Modi’s Bharatiya Janata Party won 312 seats in the 403- member assembly of Uttar Pradesh, according to the Election Commission of India, up from 47 in 2012. The results of the race in India’s largest state were seen as a litmus test of Modi’s popularity and reforms, including opening up the country to more foreign investment and seeking to introduce a goods and services tax, ahead of general elections in 2019.

“Though markets expected the BJP to do well in polls, the ultimate result surpassed even the most optimistic assumptions,” said Vivek Rajpal, a rates strategist at Nomura Holdings Inc. in Singapore. “These election results increase the expectation toward further reforms” and will be treated “very positively,” by markets, he said.

The surprise demonetisation announced by Modi on the same day as the US Presidential election introduced a calculated bet that the inconvenience it introduced for many regular people would be outweighed by the perception that large holders of cash would feel even more pain. It was a risky bet which has paid off considering how wide the BJP’s lead was in the Uttar Pradesh election. Modi should now be emboldened to step up his push for reform which to date has been relatively modest.

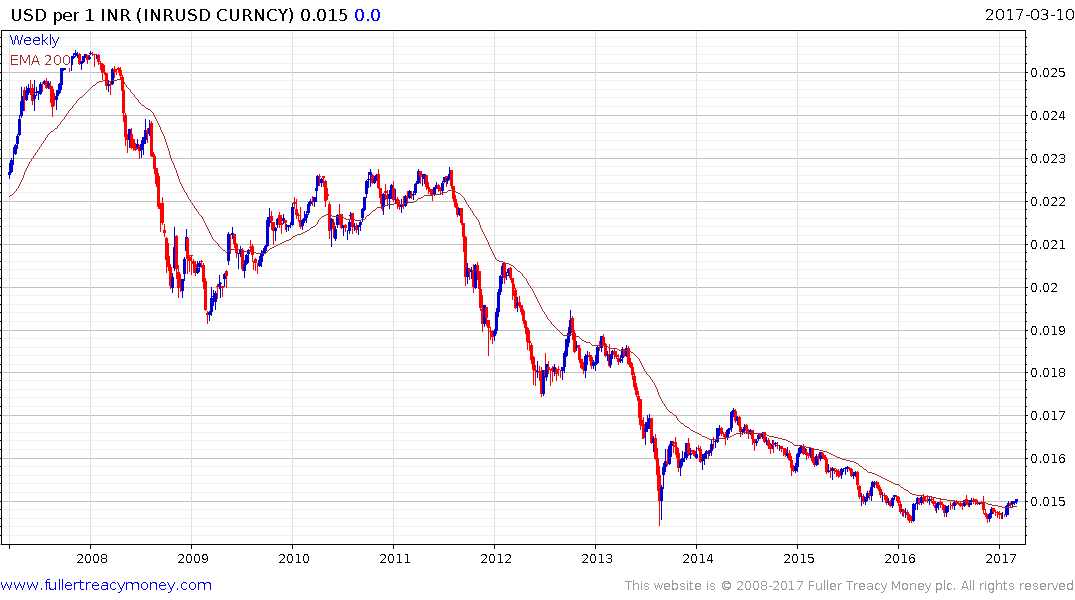

The Rupee is trading above its 200-day MA, but only just. It needs to sustain a move above $0.152 to confirm a return to medium-term demand dominance.

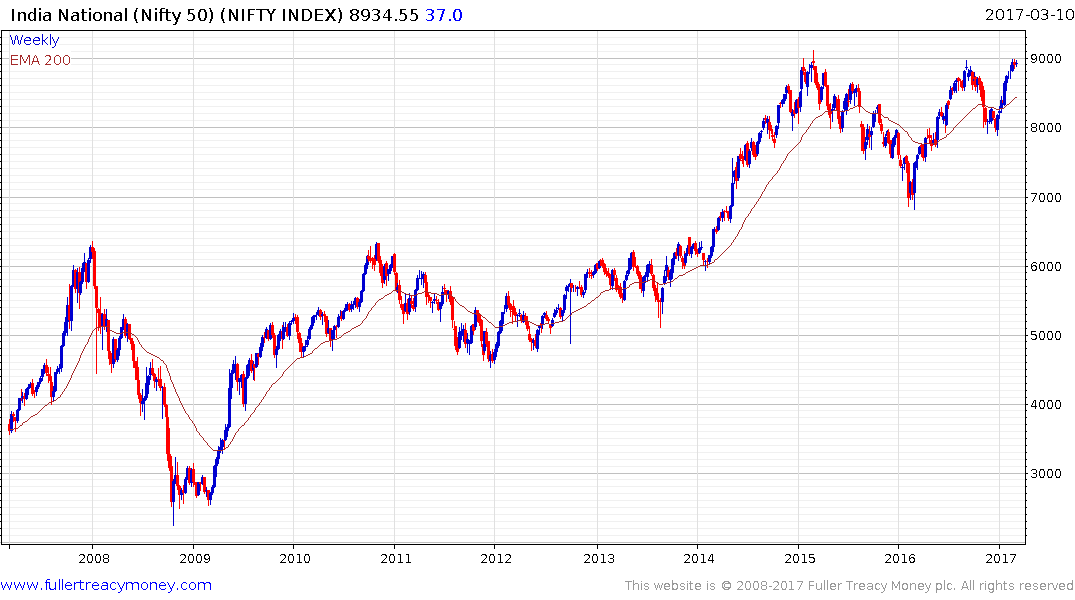

The Nifty Index continues to test the upper side of a two-year range and a break above 9000 would confirm a return to demand dominance.

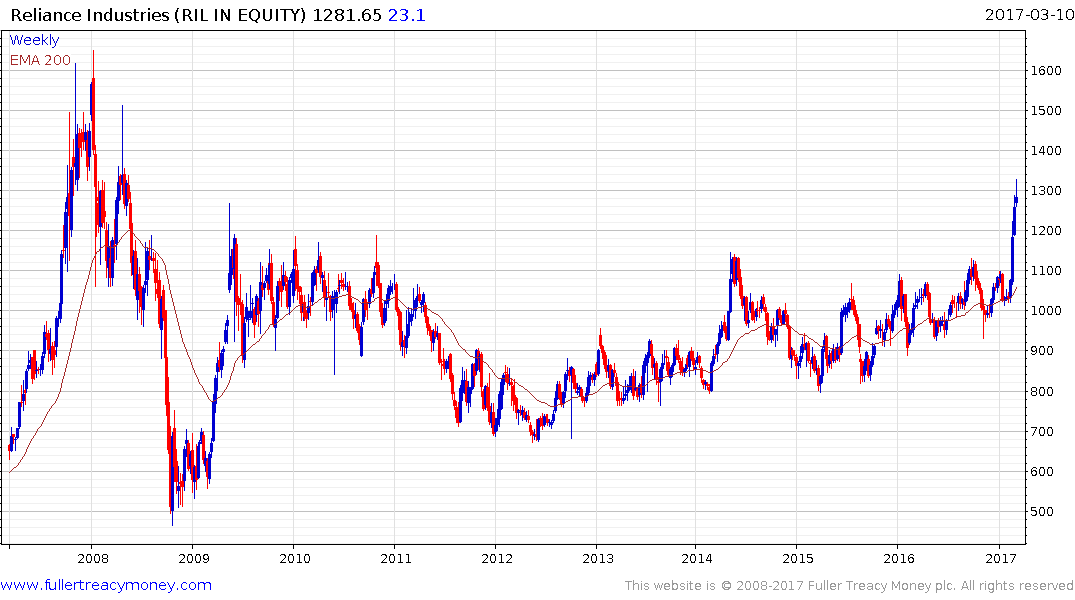

Reliance Industries’ successful breakout may represent a lead indicator for the wider market while a successful breakout by the Bombay Banks Index would also support the medium-term bullish hypothesis.