Intel to Acquire Mobileye

This press release may be of interest to subscribers. Here is a section:

“As cars progress from assisted driving to fully autonomous, they are increasingly becoming data centers on wheels. Intel expects that by 2020, autonomous vehicles will generate 4,000 GB of data per day, which plays to Intel’s strengths in high-performance computing and network connectivity. The complexity and computing power of highly and fully autonomous cars creates large-scale opportunities for high-end Intel® Xeon® processors and high-performance EyeQ®4 and EyeQ®5 SoCs, high-performance FPGAs, memory, high-bandwidth connectivity, and computer vision technology.

Intel missed a trick when mobile phones took off. It had simply ignored the market for years, preferring instead to concentrate on desktops where it has a strong lead in what is a declining market. When mobile phone demand exploded in popularity companies like ARM Holdings and Qualcomm took the initiative and the bulk of the profits. Since the market for desktop computers is shrinking Intel can’t afford to miss out on the evolution of autonomous vehicles since it is likely to become a major destination for both chips and sensors over the next decades.

By acquiring Mobileye, Intel is signalling it is not willing to cede the market for autonomous vehicles to the likes of Nvidia, Tesla and Alphabet.

Intel has been ranging for nearly two-years in what has the appearance of a first step above its more than decade-long base formation. Some consolidation is likely with the announcement of this acquisition but a sustained move below $30 would be required to question medium-term recovery potential.

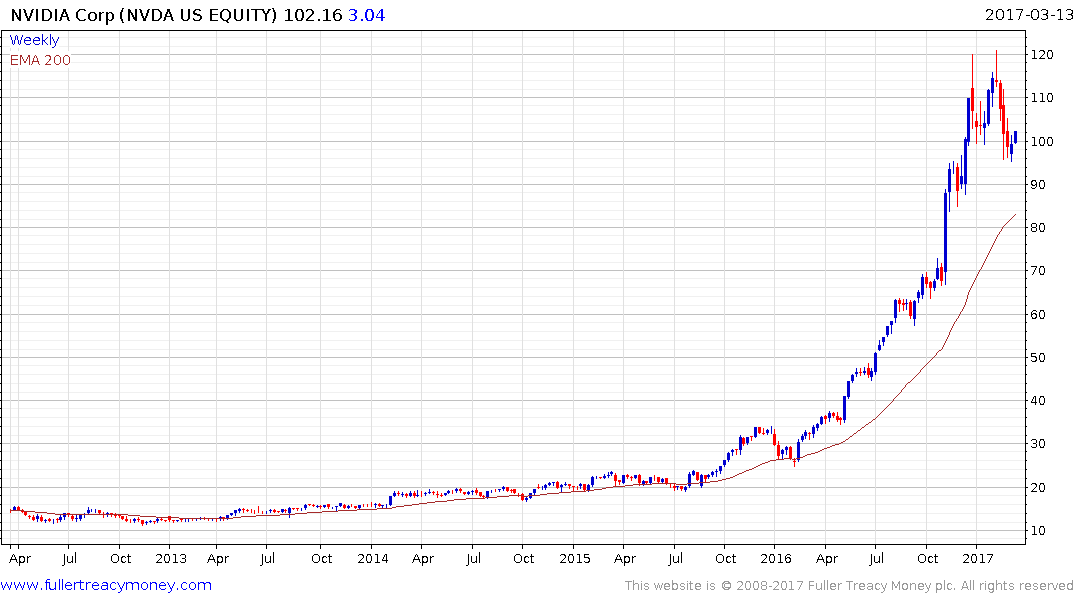

Nvidia was last year’s best performing stock and it has predictably entered a period of consolidation since January. This has at least partially unwound the share’s wide overextension relative to the trend mean but it will need to hold the $100 area to avoid a swifter process of mean reversion.

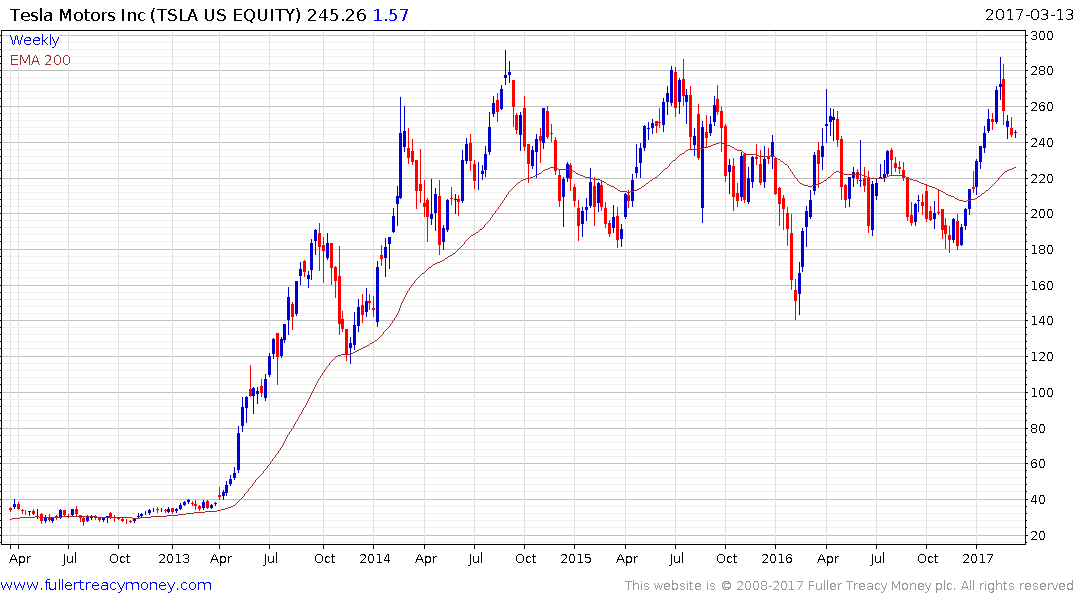

Tesla’s share has been mostly rangebound since it announced the construction of its battery factory but it is also among the leaders in autonomous vehicle technology. In fact Tesla was a Mobileye customer before it decided to develop technology in-house. It pulled back from the upper side of its range from mid-February and has at least paused in the region of the $240.

The impending Model-3 delivery represents a potential catalyst for the share but it will need to at least hold the region of the trend mean if the case for consolidation is to win out over volatile ranging

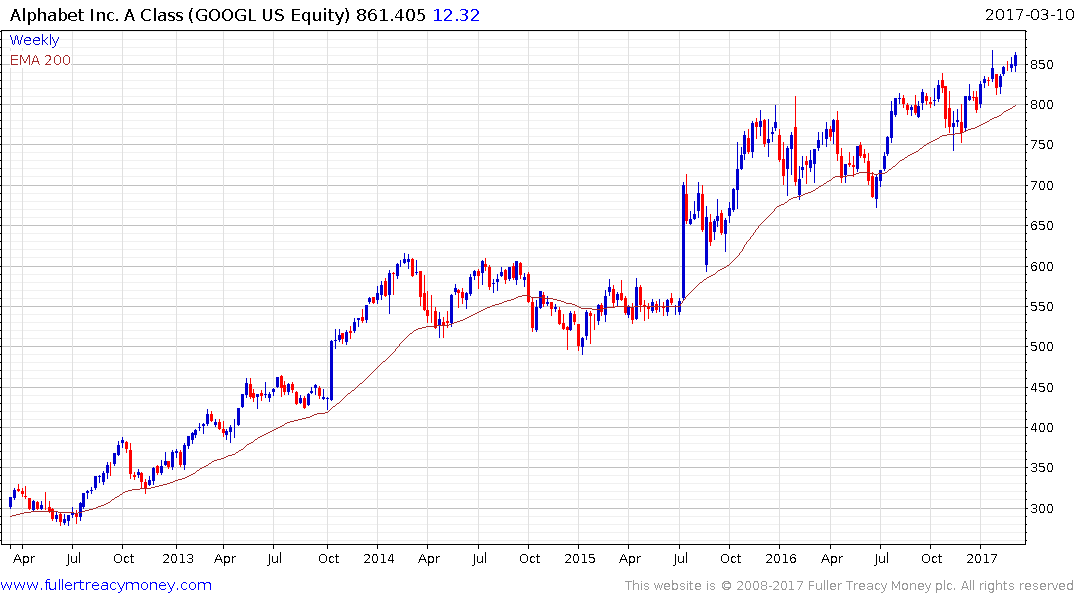

Alphabet (Google) posted a downside key in November and pulled back to the region of the trend mean. It has since rallied back to test its highs and a clear downward dynamic would be required to confirm resistance in this area and to check current scope for additional upside.

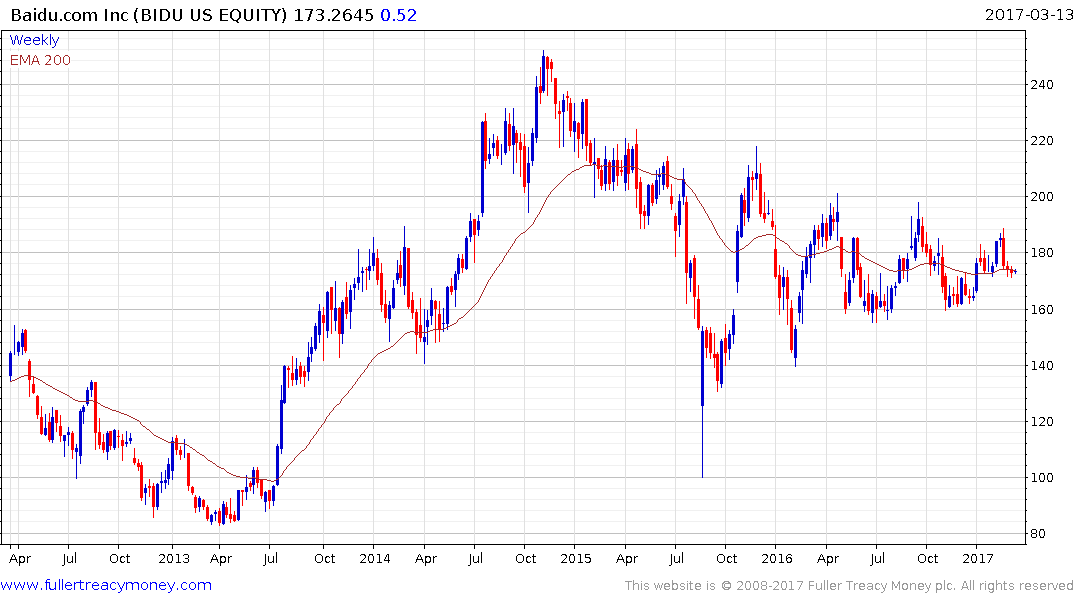

Baidu announced last week it plans to spin-off its self-driving car unit when it reaches critical mass. In the meantime, the share remains in a medium-term triangular pattern where the amplitude has been contracting over the last few months. It has stabilised over the last week near $170 but needs to sustain a move above $190 to signal a return to demand dominance.