Miningball

Thanks to a subscriber for this well-argued report by Tyler Broda and colleagues at RBC making the case for a bull market in industrial commodities because they are still cheap and prices are likely to rise. Here is a section:

The data shows, unsurprisingly, that the sector is cyclical. What we find fascinating is that the downturn from 2012-2016 was so intense that most of the data sets are now showing extreme cyclical levels. As we have anecdotally pointed out at numerous times, the behaviours of the mining management has changed (for now). Starting with the success from cutting excess thermal coal and zinc production, Glencore was able to take leadership in focusing on meeting market demand rather than “maximising” sunk capital utilization. This has spread to the iron ore industry where Rio Tinto’s “Value over Volume” mantra is noticeable shift in strategic culture following the change of CEO. We are seeing more rationality in production across the board and financing remains sparse for greenfield projects. Investors are demanding discipline and management teams are largely delivering.

Although the rhetoric suggests that this time is different, and an appropriate level of skepticism is advised, the data does back up the above anecdotal trends. In our view, the sector has rarely been positioned in as constructive a position as it is now and will take time to unwind with the inflexibility of certain data sets (for instance, total production is likely to fall over the medium term if expansion capex is nearing zero) as well as vastly improved cash situations (free cash flow yields have never been higher).

Total copper equivalent production has stayed relatively flat through the 2013-2016 period as the initial impacts of slowing capex levels began to reduce growth trends. Additionally, the removal of production has reduced the production base (either via some small divestments or by closure due to lower prices). This should increase the productivity of the remaining assets as it would be presumed these are better assets and there is more management focus that can be applied where it matters.

The rolling 3-year production growth is now down to sub-2% growth rates and we would not expect (beyond a copper and iron ore led production uptick in 2018) that this will be able to grow with such low levels of planned expansion capex and the lead times that it takes from project start to finish.

Here is a link to the full report.

Mining has long been known as a highly cyclical sector. In fact, because investing in new supply is so capital-intensive it requires evidence that can be brought to creditors so they will make the money available to break ground. That takes time and everyone is waiting for the same data so when one company gets the wherewithal to expand so do many more. That means the capital intensive nature of the extraction business ensures its cyclicality because new supply often comes to market at the same time.

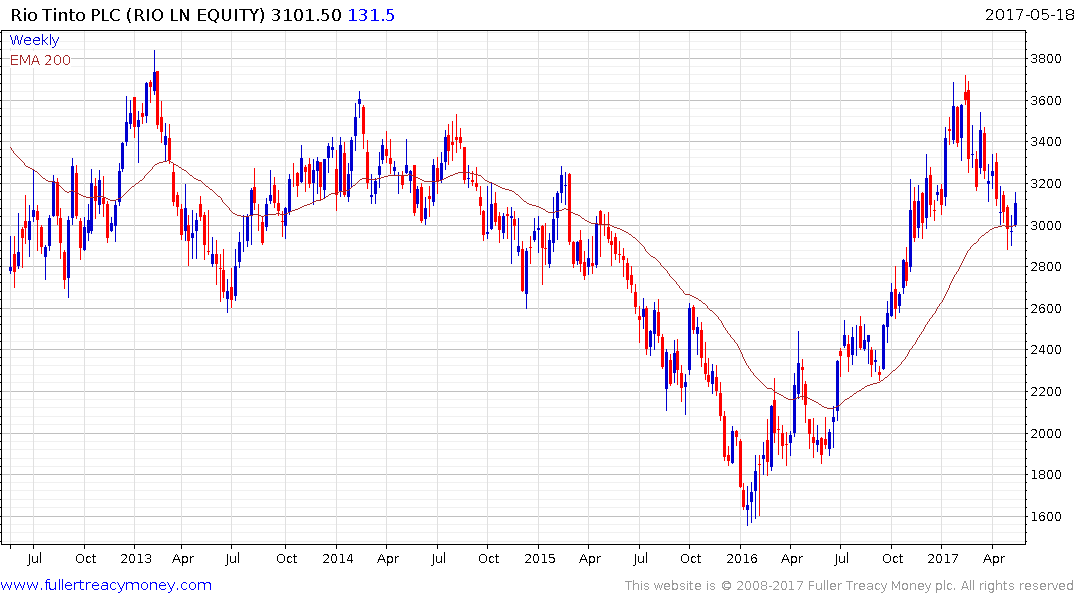

The five-year selloff that began in 2011 chastened animal spirits in the mining sector. CEOs were fired, cash flow was prioritised and plans to invest in new supply were abandoned. The result was that the sector was deeply oversold at the early 2016 lows and an impressive relief rally took place. That did not result in much spending on additional supply but the explosive move has taken a breather so far this year.

The FTSE350 Mining Index is now trading in the region of the trend mean following what has been the largest pullback in a year. While the pace of last year’s advance is unlikely to be repeated this year a more sedate advance is possible provided the Index holds the region of the trend mean.

Glencore (Est P/E 11.42, DY 1.86%) shares a relatively similar pattern.

Rio Tinto (Est P/E 8.7, DY 4.33%) has also firmed from the region of the trend mean.