Mexico Peso Nears Worst Day Since March as Banxico Unwinds Hedge

This article from Bloomberg may be of interest. Here is a section:

Operating conditions in the exchange market “have returned to adequate levels” of liquidity and depth, Banxico said in the statement. “Credit institutions and other economic agents have the conditions to cover their risks related to the exchange rate directly in the exchange market.”

The shift is “a clear sign that the peso might be too strong,” said Benito Berber, chief economist for the Americas at Natixis.

Hedges will be rolled over once and for 50% of the current amount starting next month. For six-month operations, the term will be reduced to one month with the renewal only applying to 50% of amount. Operations with nine and 12-month terms will be left to expire.

Mexico having one of the strongest currencies in the world for two years in the row is not something anyone is accustomed to reading. In fact, this trend of outperformance is the longest time the Peso has traded above the 1000-day in decades. It’s natural that the central bank wishes to slow down the pace of appreciation so a reversion towards the mean is underway.

The performance of the Mexican stock market has been flattered by the appreciation of Peso. In fact, the nominal price is up only 9.5% this year while the US Dollar version of the Index is up 24.8%. That’s good news on the way up but the market’s sensitivity to the currency was on full show over the last two days. The iShares MSCI Mexico ETF is susceptible to a deeper pullback, at least until the Peso steadies again.

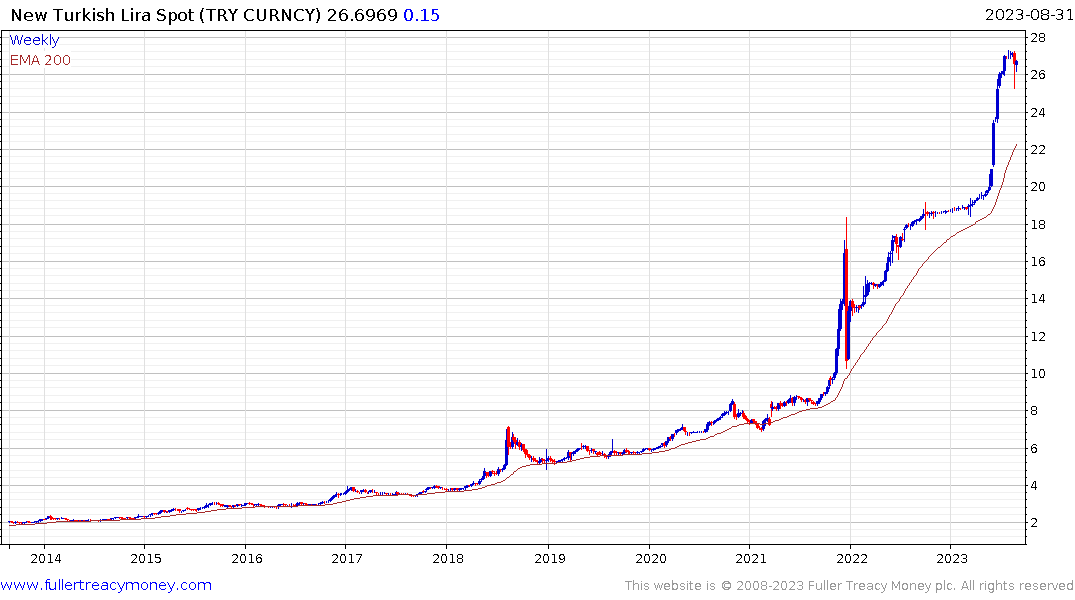

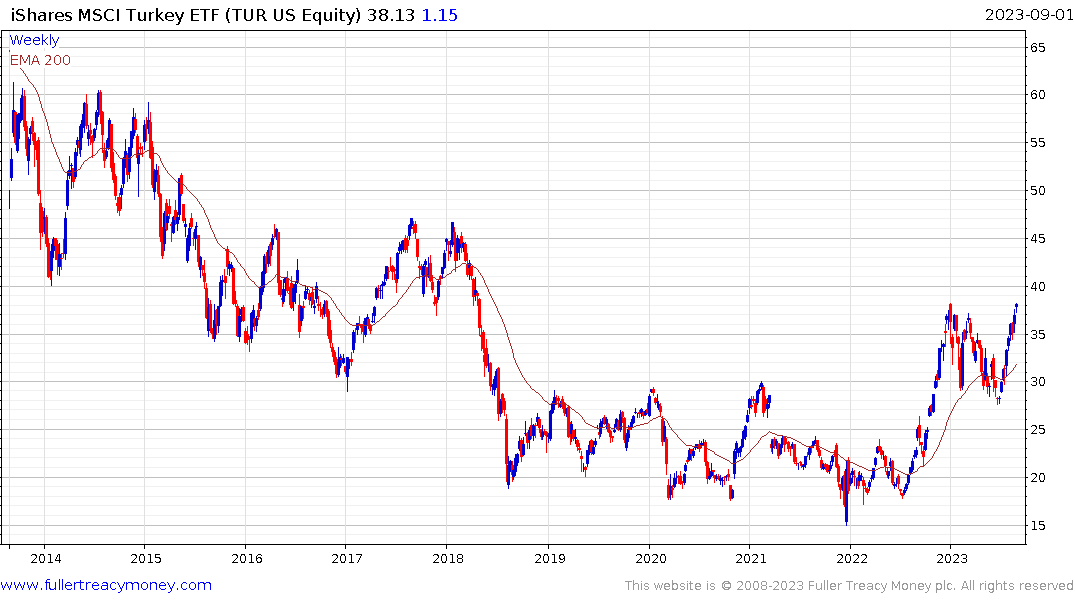

At the other end of the currency spectrum, the Turkish Lira posted a strong upward dynamic at the beginning of the week. There is a still a lot of doubt about fiscal and monetary conditions, but the value is so low already that the competitive benefits for the economy are flowing through into the stock market.

At the other end of the currency spectrum, the Turkish Lira posted a strong upward dynamic at the beginning of the week. There is a still a lot of doubt about fiscal and monetary conditions, but the value is so low already that the competitive benefits for the economy are flowing through into the stock market.

The iShares MSCI Turkey ETF hit a new recovery high today, to complete its first step above the base.