Summers Says Job Report Is a Step Down Road to US Soft Landing

This article may be of interest to subscribers. Here is a section:

Summers also reiterated his concern about the widening US fiscal deficit, and the need for Washington to wrestle with raising the government’s revenue over time. One reason why the economy has been so strong in the face of high interest rates has been a fiscal swing of “perhaps 3%” of gross domestic product this year compared with 2022, he said.

Shutdown Warning

“It would be helpful if we could get to more realistic views about the fact that we’re going to need more revenues,” he said. He also warned lawmakers against failing to enact annual appropriations bills that are needed to keep the federal government funded after the start of the new fiscal year on Oct. 1.

A shutdown caused by an impasse over spending bills “doesn’t save any money, and further serves to disillusion people with Washington,” he said.

The hiring and wage figures were encouraging today while inflation figures remained elevated in the Wednesday report. That gives the superficial impression that inflation will been overcome as hiring moderates. This is where the backward nature of economic figures and the forward looking nature of markets comes into conflict.

Treasury yields jumped today to form an upside key reversal. That confirms support in the 4% area. Upside follow through on Monday would greatly increase scope for another leg higher in yields. That is not at all what the economic data implies as hopes for a Fed hiking pause grow.

Treasury yields jumped today to form an upside key reversal. That confirms support in the 4% area. Upside follow through on Monday would greatly increase scope for another leg higher in yields. That is not at all what the economic data implies as hopes for a Fed hiking pause grow.

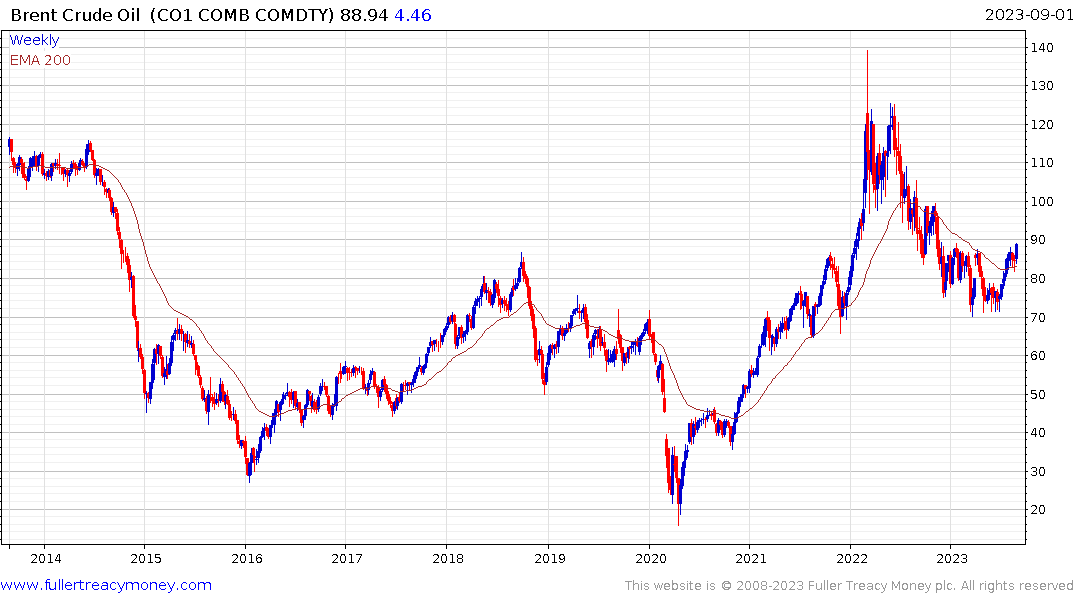

The most pressing inflationary pressure is the oil price. Brent crude made a new recovery high today and has clearly broken the medium-term downtrend. There is a realistic possibility oil prices will put upward pressure on inflation figures and the Fed will have no choice but to respond.

The most pressing inflationary pressure is the oil price. Brent crude made a new recovery high today and has clearly broken the medium-term downtrend. There is a realistic possibility oil prices will put upward pressure on inflation figures and the Fed will have no choice but to respond.

That’s independent of the third unofficial mandate of the Fed which is to ensure there is a functional market for Treasuries. Higher yields reflect continued investor disquiet at the profligate spending of the US government. Investors are rightfully beginning to question if deficits will ever improve if the logical trend of Fed tightening is to push the economy into recession which will ultimately result in more money creation.

Personal savings have more than reversed the trend of improvement that followed the global financial crisis. The “you only live once” (YOLO) attitude to life has been greatly facilitated by the continued strength in asset prices. Higher rates, unaffordable rents, and education loan repayments starting next month, suggest a winnowing process will unfold in personal expenditures. The market environment with some clear winners and losers looks set to continue.

Personal savings have more than reversed the trend of improvement that followed the global financial crisis. The “you only live once” (YOLO) attitude to life has been greatly facilitated by the continued strength in asset prices. Higher rates, unaffordable rents, and education loan repayments starting next month, suggest a winnowing process will unfold in personal expenditures. The market environment with some clear winners and losers looks set to continue.