Melting Up Is Hard to Do

Here is a link to the full report. and here is a section from it:

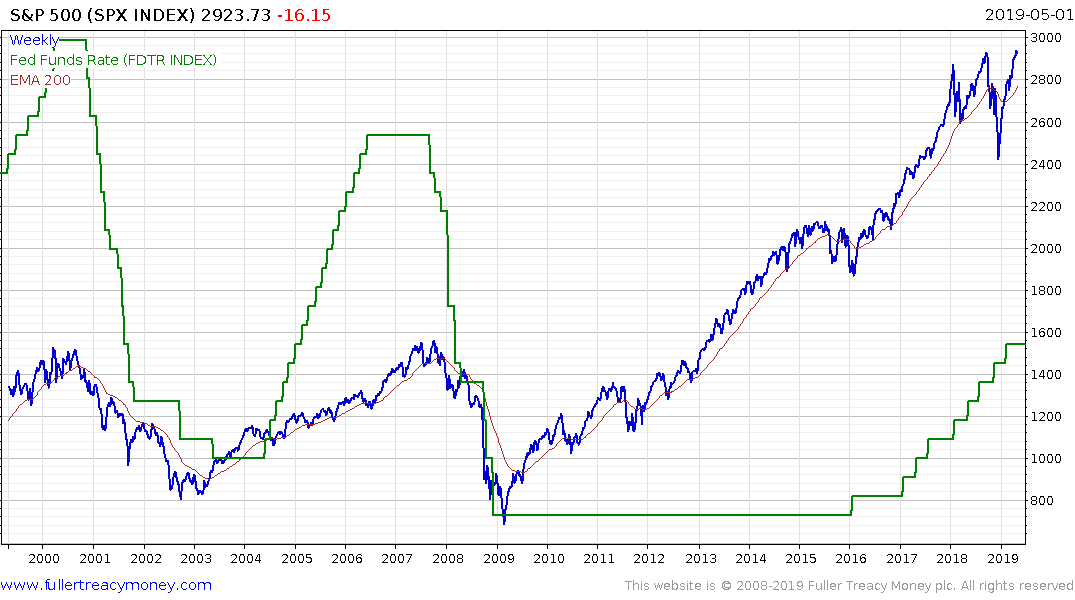

The punchbowl remains on the table... As the rally continues, investors are growing more excited about the possibility of a 'melt-up' – a further sharp move higher in the US market fuelled by a dovish Fed, stabilising data and light investor positioning.

...but melting up is hard to do: Define a 'melt-up' as a historically large move from a high starting point, and they account for just 1-2% of historical observations. Similar to today, they usually occur with the Fed on hold and yields declining. Unlike today, they usually start after modest returns and occur with stronger underlying earnings growth and greater levels of investor fear/negativity.

Could a 'melt-up' happen? Of course, but we'd look elsewhere: We've thought that the market was overpricing a benign 'Goldilocks' environment, and underpricing both tails. But we are sceptical about a US melt-up for two specific reasons: i) Our economists don't see the Fed making an 'insurance' rate cut; and ii) We are below consensus on 2019 earnings growth. While bullish investors are looking to the US, we instead think that the more likely 'bull case' lies overseas, if better growth in China pulls up other regions.

Strategy implications: While hitting our equity strategists' S&P 500 bull case of 3,000 is likely, the probability of a larger 'melt-up' is not high enough to warrant buying the market here. For investors worried they are under-exposed to a more bullish scenario, we think call options offer the best risk-adjusted way to add beta. During 'melt-ups', the S&P 500 rose an average of ~13% over three months, yet credit spreads only fell ~7bp and volatility was largely unchanged. Credit and volatility need to price in some of the risk that a speculative rush creates.

It really is all about money supply. The market has priced in the potential for the Fed to announce the imminent end of quantitative tightening instead of the planned September date and when that did not occur profit taking began.

No one is under any illusion that the Fed is ready to lend assistance when needed, but the message from yesterday is that it is not required when the market is at an all time high. The clear signal then is prices will need to be lower before further assistance is provided. Therefore, there is clear risk of mean reversion. Medium-term, the melt-up thesis is still a possibility, but perhaps not quite yet.

The bigger picture is that the greatest risk to stock markets is not when the Fed pauses but when they start cutting rates. That was true of the last two hiking cycles. When the Fed pauses, the market is capable of rallying further but they generally only cut rates when there is objective evidence the economy is at risk of contraction.

Therefore, the best-case scenario is the Fed pauses with interest rate hikes but ends its reduction in the size of the balance sheet.