May's Brexit Agreement Is a Betrayal of Britain

This article by former Bank of England governor, Mervyn King, may be of interest to subscribers. Here is a section:

Leaving the EU is not the end of the world, any more than it will deliver the promised land. Nonetheless the country is entitled to expect something better than a muddled commitment to perpetual subordination from which the U.K. cannot withdraw without the agreement of the EU.

Many MPs will argue that “we are where we are,” that it’s too late to change course, and that May’s deal is the only deal available. But remember, this is a political not an economic crisis. If Blair and Johnson, from opposing political viewpoints, can see the fatal weaknesses of this proposed deal, politicians of all hues should try to do the same. This deal will not end the divisiveness of the debate about Britain’s relationship with the EU. The Remain camp will continue to argue, correctly, that to align the country indefinitely with laws over which it has no influence is madness, and a second referendum is vital to escape from this continuing nightmare.

And the Leave camp will argue, also correctly, that it is intolerable for the fifth largest economy in the world to continue indefinitely as a fiefdom.

If this deal is not abandoned, I believe that the U.K. will end up abrogating it unilaterally — regardless of the grave damage that would do to Britain’s reputation and standing. Vassal states do not go gently into that good night. They rage. If this parliament bequeaths to its successors the choice between a humiliating submission and the abrogation of a binding international treaty, it will not be forgiven — and will not deserve to be.

It’s hard to see how Theresa May’s minority government is going to survive the Brexit vote on December 11th. Without the DUP and the unity of her party she is going to need a mass defection from the opposition which is unlikely if that event would shore up her government. Being forced by Parliament today to release the details of the legality of the deal is a further sign of her weak position.

It was always likely that a deal would be struck but equally likely that it would be difficult to get through parliament considering how many concessions the UK negotiating team made even before the talks started. I agree with King that this deal is a non-starter so now we are back at polarised outcomes, All-in versus all-out.

This note from Dr. David Brown, following my comments over the weekend may be of interest:

Your perspective makes much more sense to me than that of SocGen, which sounds more like wishful thinking.

I took a look at the CAC 20-year chart. The French index is still below the 2007 high whereas US indices are much higher. Worse still, it's below the 1999 high and there does seem to be a pattern of lower highs from 1999 to 2007 to today. Now, let me guess when the euro replaced the Franc! Not that France or SocGen could admit this since they were the drivers for instituting the Euro as a challenger to the dollar.

Then I took a look at the DAX. That has escaped the bounds of 1999 and 2007. Germany reluctantly went along with the French, as a price for German reunification, and they have been the main beneficiaries, not France!

What about other European countries?

Spain: Ibex is below the 1999 and 2007 peaks and in a downtrend.

Portugal: yikes - the PS120 index is barely one-third its level at the 1999 and 2007 peaks.

Italy: Same picture as Portugal.

Greece: Even worse - the ASE Index is at 630, compared with over 5000 in 1999 and 2008!

So, Germany is benefiting while many other countries are in despair, with no possibility of escape by adjustments to their currency.

Maybe Society Generale have a very serious reason to engage in wishful thinking - did they lend money to those countries, money which has zero chance of ever being repaid? Do you know?

Finally, as a Brit this highlights for me the biggest worry about the current state of Brexit. If the antidemocratic Remainers finally win the chance for a second referendum, and they win, will the EU then demand that the price for Remaining is that the UK must join the Euro? I have not heard anyone mention this concern. It worries me more than any of the other options under discussion. The political class and the press seem amazingly ignorant of the inevitable disastrous effects of implementing a 'single currency' without a parallel fiscal union with ability to make compensating fiscal transfers to regions suffering from the 'one size fits all' currency.

Soc Gen derives about 45% of revenue from France and 37% from the rest of Europe so it is reasonable to expect they have some exposure to the wider EU. However, the view that markets will likely range in 2019 is approaching consensus if the reports I see are any guide.

The EU answered your question last night with an ECJ official stating that the UK could re-enter on the same terms if it revokes Article 50. I don’t think it is likely the EU would insist on Euro membership any time soon but the direction of policy is towards federalism and a united budget. That is what the austerity program was all about, because it is only with similar debt to GDP ratios that fiscal union could even be considered.

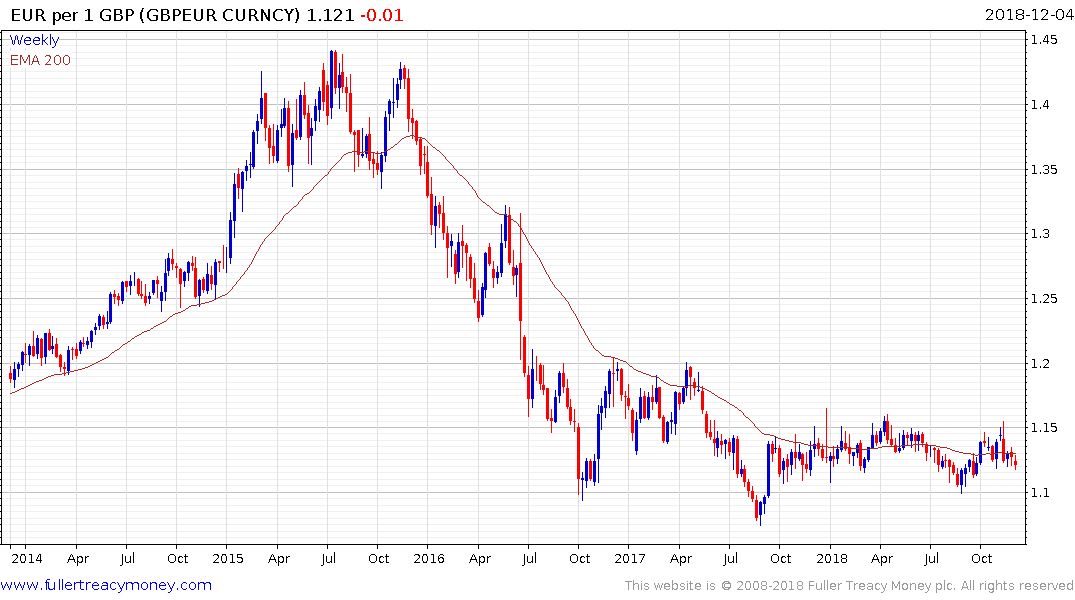

The Pound is back testing its August lows against the Dollar and hit a new reaction lows against the Euro today suggesting the market is being to price in the potential for a hard-out outcome again.