Markets Show China Needs a Stimulus 'Bazooka' to Woo Investors

This article from Bloomberg may be of interest to subscribers. Here is a section:

“The measures over the past weekend are not enough to stem the downward spiral” and their impact will be short lived if not followed by measures for supporting the real economy, Ting Lu, chief China economist at Nomura Holdings Inc., wrote in a note. “Without additional and more aggressive policy stimulus, these stock-markets-focused policies alone have little sustainable positive impact.”

Earlier this year, it looked like there could be a run on a large number of regional banks. The Federal Reserve waded into the market and backstopped every deposit. That was a strong clear signal that no one should worry about the security of their bank accounts. The sector rebounded emphatically over the next several months despite the Fed continuing to raise rates. Did the Fed’s action contribute to moral hazard? Yes. Was it the right decision at the time. Also yes.

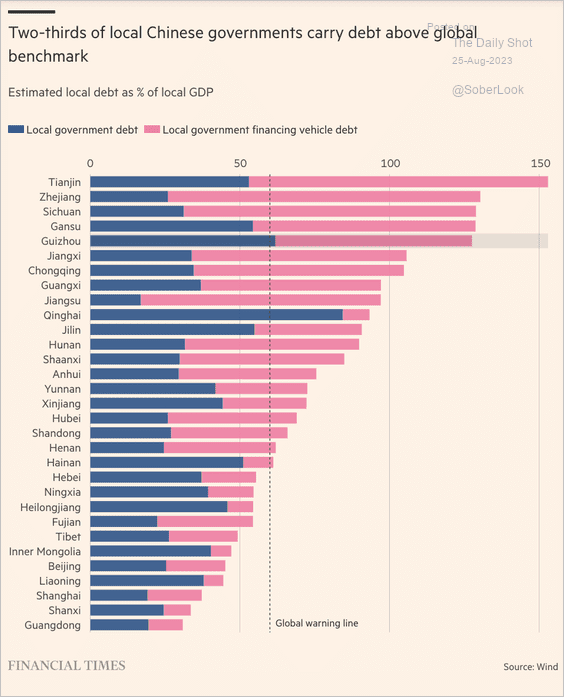

The time to deploy counter cyclical policy is when everything is going well. That is certainly not the case in China today. Property developers are going bust at an accelerating pace. There is $9 trillion in local government off balance sheet liabilities. $2 trillion of that is in corporate bonds which is half the entire corporate bond market.

$486 billion in LGFV bonds need to be restructured in 2024. Debt restructuring is underway. Moving LGFV bonds on the balance sheets of regional governments is aimed at providing confidence they will be paid back. To convince investors the low is in that process needs to be formalised and clear support for local government finances implemented.

This helps to highlight just how big of a bazooka needs to be aimed at the Chinese financial sector. A bailout would mean the central government and central banks open their balance sheet to back stop regional governments and banks. That would allow the misallocation of capital which has driven the massive buildout of construction and infrastructure capacity to be managed down gradually.

The initial response to the news today offers a picture of what to expect when more substantive measures are implemented. The CSI300 jumped 5.5% at the open in response to the above announcements. The rally failed to hold because it is still not a big enough commitment to convince investors that the central government is committed to doing what is necessary to support the economy.

The lesson from decades of watching these kinds of events playing out in China is they will do what is necessary eventually. The alternative is too dire to contemplate. That suggests the 3500 is a meaningful area of potential support for the CSI300.