Startup extinction season is going to kick into high gear - and there's likely going to be a bloodbath soon for some of the 50,000 VC-backed startups

This article from Business Insider may be of interest. Here is a section:

Venture capital funding was overly abundant in the latter half of 2020 and all of 2021. There were nearly 19,000 deals done that year, according to PitchBook, until things started to taper off in 2022.

Stanford points out that the average time between funding rounds is now around 1.5 years. – basically what it was before the pandemic boom times. So, hypothetically, if a company last raised capital in the first quarter of 2022 (one of the most active in terms of deal count, PitchBook data shows), many startups will be on the hunt for new capital in the fourth quarter of 2023.

Every company's situation is a little different based on their operating expenses and whether they've gotten fresh funding already. Though, unless you're an AI startup, the chance of a VC check has been slim to none. So what are their options? Likely a sale or shutting down.

But it's not just VCs who are being stingy. All those crossover firms that wanted to get in on the action like Tiger Global (which by the way, did 335 deals in 2021, according to Crunchbase) and Coatue, aren't doing the kind of deals that they used to. Participation has dropped from more than 550 deals and a quarterly peak of nearly $50 billion in 2021 to fewer than 200 deals and a quarterly peak of around $15 billion in 2023, Stanford wrote.

"We believe that a large portion of the supply-side deficit is derived from the crossover and other nontraditional investors that have pulled back from VC to more traditional strategies," he wrote.

China is not the only play where unprofitable enterprises have been starved of investment capital. Higher for longer interest rates are taking a toll everywhere and the breadth of what is capable of securing funding continues to contract. It’s AI or nothing at present.

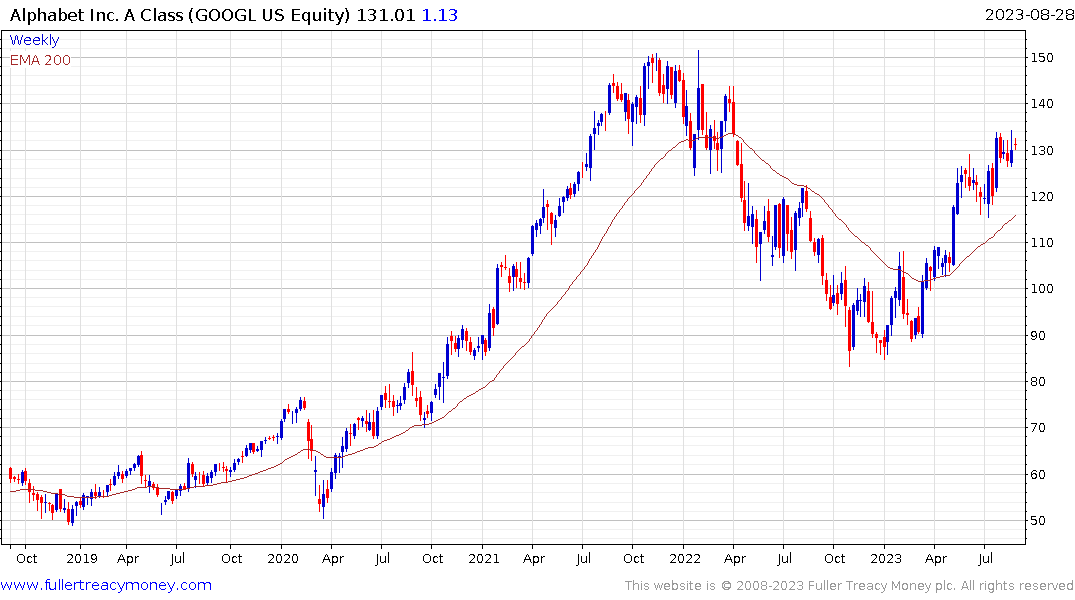

While this is bad news for companies struggling without venture funding, it is also a threat for the larger companies selling them services. Microsoft, Amazon and Google are major suppliers of database space and middle office software for startups. If the start up sector fades, that will reduce their growth potential. This is the time to be particularly vigilant about the consistency of their trends.