Labor 2030: The Collision of Demographics, Automation and Inequality

This report from Bain & Co. by Karen Harris, Austin Kimson and Andrew Schwedel may be of interest to subscribers. Here is a section:

We expect the magnitude of workforce change in the 2020s to match that of the automation of agriculture from 1900 to 1940. However, the transition of farm workers into the industrial sector was spread out over four decades. In the case of the automation of manufacturing, the impact was over a shorter time period (roughly 20 years), but the share of labor force in manufacturing jobs was relatively small in the US. Investment in automation is likely to proceed moderately faster than agricultural automation or manufacturing automation unless other forces act to impede its progress, and it will affect a larger percentage of the total workforce.

The tension between the push to offset slowing labor force growth with automation and the pull to slow automation's rollout to prevent massive disruption will play out over the next 10 to 20 years. But once the first companies begin deploying new forms of automation, others are likely to follow suit rapidly to stay competitive.

The base-case scenario

Based on the magnitude and speed of change, our base-case scenario could result in about 2.5 million jobs per year lost or not created because of automation. Previous transformations provide an interesting comparison. The automation of agriculture transformed national economies and disrupted labor markets, culminating in the Great Depression. But if that event occurred today, scaled to the current population and labor force, it would displace 1.2 million workers per year. The rate of reabsorption from the automation of agriculture was about 700,000 workers a year.

Here is a link to the full report.

Technology is disruptive and inherently deflationary. The rise of the robot represents a significant secular theme and for the millions of workers who are going to be affected their only resource is likely to be at the ballot box.

The number of indicators pointing towards an inflationary outcome are rising and yet it is reasonable to ask how is that possible when the deflationary forces of technological innovation and the potential inability of the economy to tolerate higher rates are acting against its rise. The increasing polarization of the political process is a testament to how the lopsided response to the last crisis resulted in large swathes of the population being left behind economically. They have now voted for revolutionary policies in the hope of a better standard of living and that process will persist for as long as it takes to get the result they wish. With a procyclical strategies like tax cuts when unemployment is already at record lows, the argument for socially driven inflation is the only argument that makes sense if one is predicting an inflationary outcome.

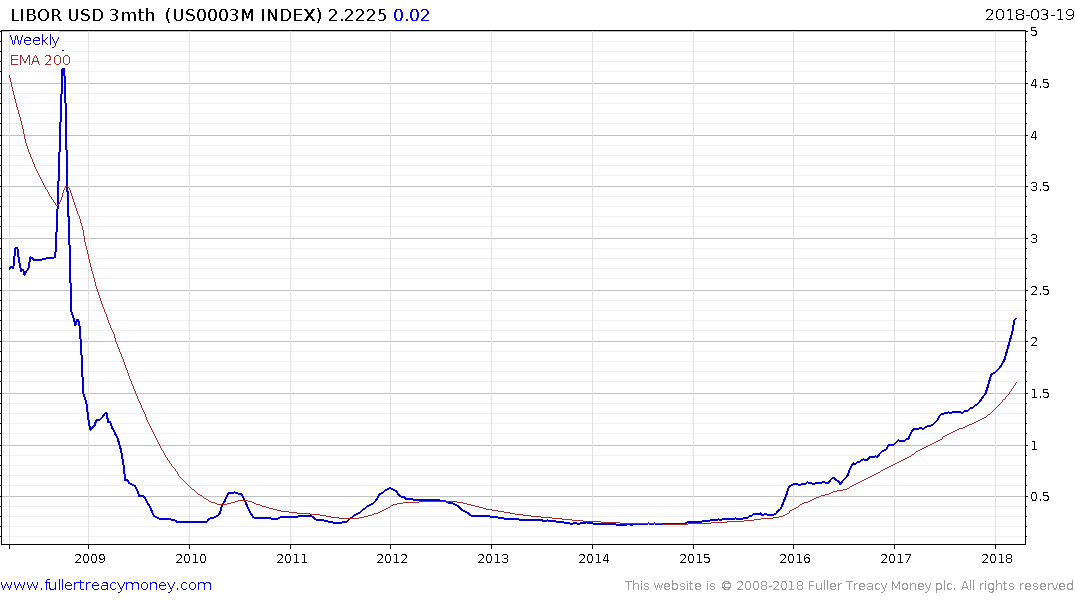

3-month LIBOR is finally starting to react as if interest rate hikes are not an anomaly but reality. It continues to trend higher and the pace of the advance is picking up. A clear downward dynamic would be required to check momentum.

The 5-year US Treasury yield completed a first step above its base in November and has paused over the last six weeks below 2.7%. It is now testing the upper side of that short-term range and looks more likely than not to break upwards.

It would be an odd set of circumstances if the yield on the 5-year exceeds that of the 10-year but right now there is only 19 basis points separating them and the impetus appears to be for the 5-year not least because so much additional supply is due at that maturity this year.

There is still a lot of debate about whether the 10-year is going to break higher but with upward pressure on yields coming from the short-term maturities it looks like an inevitability. Jeremy Powell’s statements tomorrow have the potential to be a catalyst for the market.