Musings From the Oil Patch March 20th 2018

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB which may be of interest. Here is a section:

Here is a link to the full report and here is a section:

For those who assume that all oil is equal, their focus on the potential growth of U.S. shale oil production volumes, and how much may be exported may lead to an incorrect conclusion about the evolution of the global oil market. One reason so much of this light oil being exported is that the U.S. has too much supply to efficiently refine given the way our domestic refineries are set up. At the same time that we are exporting light oil, we are importing heavier crude oils to feed our domestic refineries. As the chart prepared by Art Berman, based on data from the Energy Information Administration (EIA), shows, 88% of 2017’s average daily U.S. oil imports was crude oil with gravity ratings of 35o or less, and more than half of it had a gravity rating of under 25o. This data demonstrates the imbalance in the mix of domestic crude oil production between light and heavy oil.

Just as the debate about whether the surge in U.S. light oil production and its growing export volumes would overwhelm the world’s oil market, along comes Exxon Mobil Corp. (XOM-NYSE) announcing a light oil refinery expansion program. ExxonMobil said it is going ahead with a multi-billion-dollar expansion of its Gulf Coast refining capacity that would double its light oil refining capability. While the expansion will not be complete until the next decade, it fits with another strategic undertaking of ExxonMobil. The company recently announced plans to expand its crude oil production by 25%, or one million barrels a day, by 2025, including a five-fold increase in its Permian Basin output, which will likely be light oil. Based on its huge upstream spending plans, expanding its downstream refining capacity to handle the additional future light oil output makes sense.

The International Energy Agency (IEA) projects that U.S. oil production will reach 12.1 million barrels a day by 2023, a two million-barrel a day increase over current output, with nearly half coming from additional shale wells. As shale oil output grows, other changes are underway in the fuels market. Diesel fuel is under assault globally due to its greater air quality pollution, which was highlighted by the recent emissions’ testing scandal in Europe and the United States. In the EU, governments and cities are aggressively moving to ban diesel cars from their streets, and eventually to ban all internal combustion engine (ICE) vehicles.

Shale oil is typically of the light variety which is used for gasoline production rather than diesel. Europe has favoured diesel for a long time and the aftermath of the Volkswagen cheating scandal suggests it will be using less in future. A lot of the new supply that has become economic over the course of the last 15 years has been of the heavy variety but that is now changing with the evolution of US domestic onshore tight resources. That represents a significant retooling risk for European refineries while the US sector will also need to evolve to cater to the prolific supply coming on line domestically.

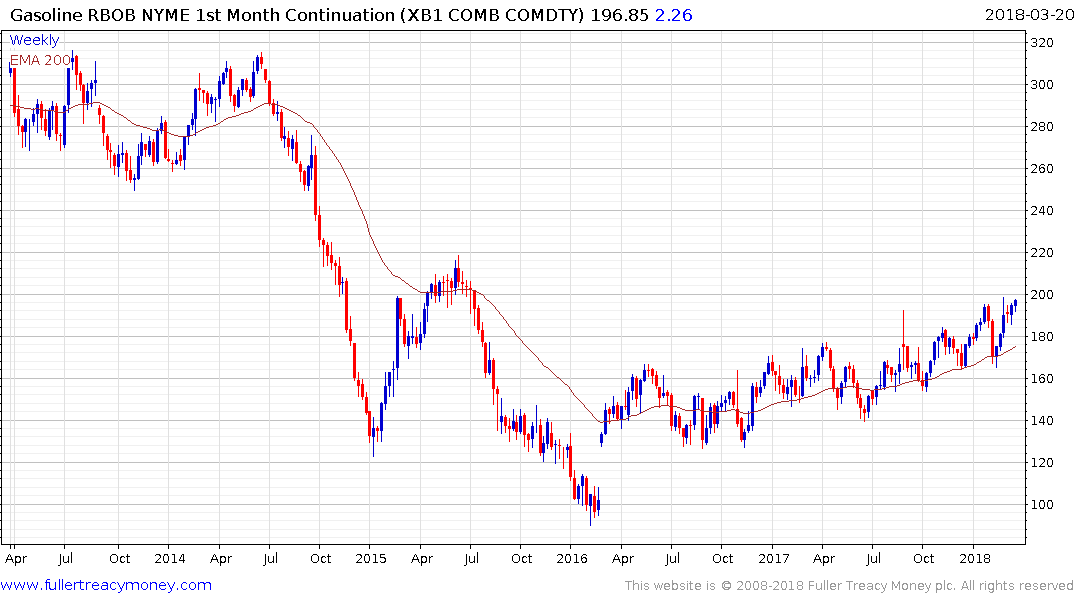

Taking a step back, gasoline is likely to gain market share over diesel in Europe over the course of the coming years, at least until battery powered vehicles gain greater penetration in the market. Gasoline remains on an upward trajectory as it continues to hold the progression of higher reaction lows evident since 2016. A sustained move below the trend mean would be required to question medium=term scope for continued upside.

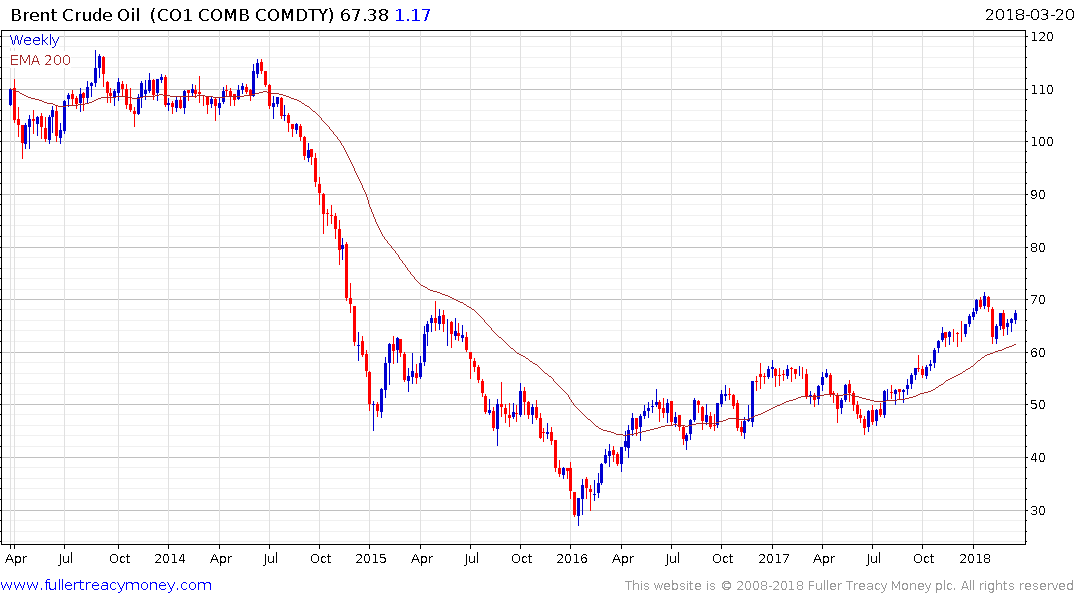

Meanwhile oil prices firmed over the last two days on the potential the Trump administration will announced sanctions or tariffs on Iranian exports. Brent crude has firmed from the region of the November/December lows near $62 and a sustained move this month’s low near $63.25 would be required to question current scope for continued higher to lateral ranging.