Kiwis Fall Behind in Debt Payments as High Interest Rates Bite

This article from Bloomberg may be of interest to subscribers. Here is a section:

New Zealand’s central bank has tightened aggressively in the past year and a half, taking the Official Cash Rate to its highest since 2008 and driving up the costs of home loans, vehicle finance and personal borrowing. The rising cost of repayments is adding to a squeeze on consumer spending, adding to the risk of sluggish economic growth for the remainder of 2023.

“There’s no question some Kiwi households and businesses are walking an economic tightrope,” said Centrix Managing Director Keith McLaughlin. “It’s no secret a recession was the Reserve Bank’s goal to help curb spending. What remains to be seen is how the rest of 2023 plays out for consumers and businesses on the front line.”

New Zealand was in recession earlier this year, and most economists expect another contraction will hit later in 2023, although their view on the timing is mixed. The RBNZ has said a recession was needed to slow demand and bring inflation back to the 1-3% band it targets.

New Zealand has a long record of taking hard medicine when required. It is common sense that demand needs to take a shock if persistent inflationary pressures are to be overcome. That’s especially true when wage demands are rising, and the interest rate sensitive portions of the economy have already been addressed with higher rates. Other central banks are on a similar trajectory but are not as forthcoming in sharing their intentions.

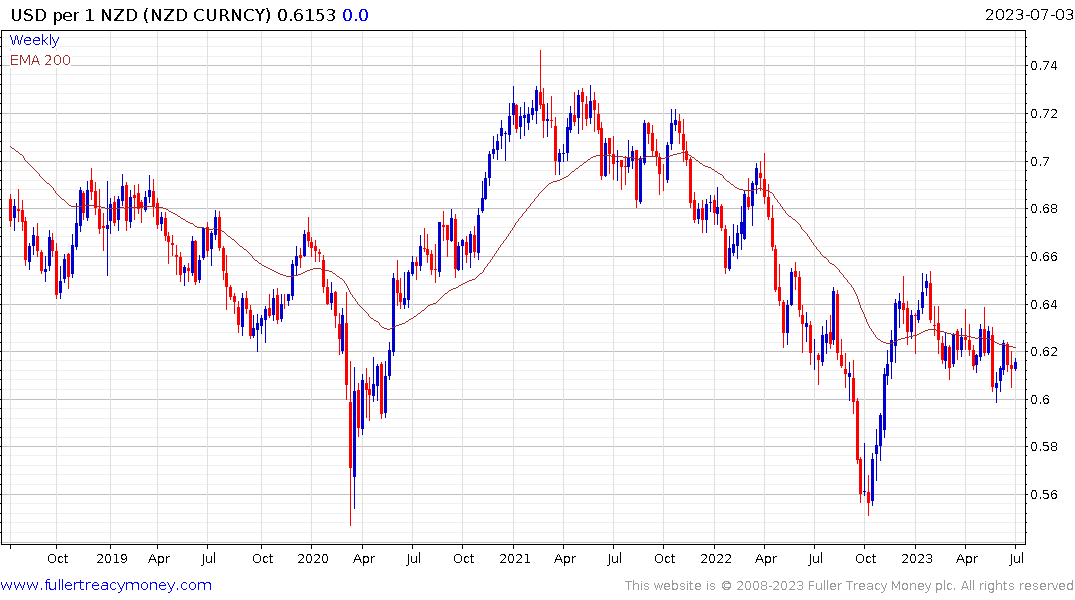

The New Zealand Dollar has firmed over the last couple of weeks but has yet to break the medium-term sequence of lower rally highs.

The New Zealand 50 Fully Gross Index hit a medium-term low in June 2022 and has held a sequence of higher reaction lows since. It is currently firming from the region of the 200-day MA.

Buy-now-pay-later (BNPL) loans were a particularly popular phenomenon in both Australia and New Zealand. That represented a new form of credit made available to young people who had little experience with managing repayment schedules. They are also likely to be many people’s first experience with insolvency.

Block (Square) acquired Afterpay for a princely sum during the pandemic and the share has made the full round trip to pre-pandemic levels. The business model for these kinds of loans is entirely dependent on animal spirits in the younger generation and availability of credit. They are likely going to require easier monetary conditions to support that.