Petrobras Switches From Asset Seller to Buyer as Debt Slumps

This article from Bloomberg may be of interest to subscribers. Here is a section:

“Petrobras has solid financial metrics, and took advantage of a market liquidity window,” Moody’s senior analyst Carolina Chimenti said in an interview. “So far there’s been no drastic change in its financial strategy.”

While the yield on the firm’s latest bond is above its weighted average rate, there are several US-dollar transactions that were first priced at more expensive terms, according to data compiled by Bloomberg. For instance, the firm has over $710 million of 7.375% bonds due in 2027, which was first priced at par. The securities are quoted at about 104 cents on the dollar.

“With this resource we’ll improve the profile, paying debts that have a higher rate” said Leite, without disclosing the specific securities that could be included in a transaction which may happen later this year.

The CFO expects investors to be more optimistic about Brazil in the short-term. Talks with bankers suggest the accounting scandal that toppled Brazilian retailer Americanas SA was restricted to the segment, Leite said. “They thought it would be a gunpowder fuse, but it was just a match.”

Petrobras cut its dividend shortly after Lula won the Brazilian election. That was a precautionary measure in response to populist accusation the company was looking after investors better than the interests of the country. The share quickly dropped in response to that decision and that ensured the dividend yield has dropped to a less politically objectionable 12.29% compared the Selic rate of 13.75%.

The share is currently back testing the upper side of its range and is unwinding its short-term overbought condition. That suggests scope for the yield to increase in the near term.

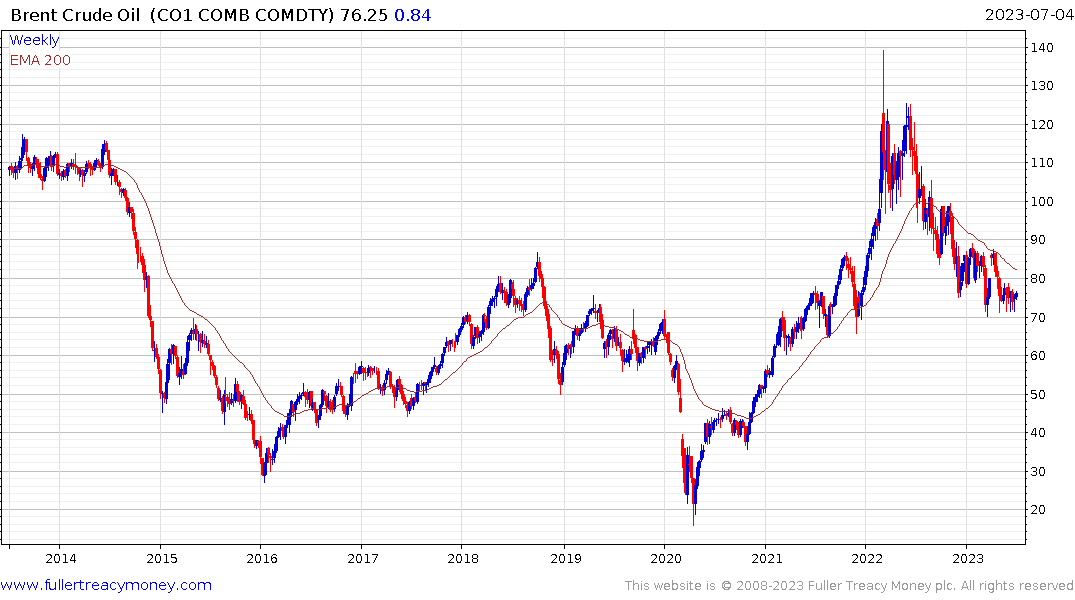

Crude oil prices remain locked in a tight range. This inert trading environment where prices swing from gains to losses from one day to the next will not last indefinitely. When the breakout comes it will be dynamic.