JPMorgan, BlackRock Warn of Contagion Pummeling Emerging Markets

This article by Ben Bartenstein for Bloomberg may be of interest to subscribers. Here is a section:

Some investors have seen the selloff as an opportunity to buy on the basis of stronger fundamentals, such as easing inflation, trade surpluses and widening growth differentials between emerging and developed markets.

"One of the interesting things contagion sets up is a selloff in the weak and the strong," said Arjun Jayaraman, who helps oversee $4.8 billion at Causeway Capital Management LLC in Los Angeles. "That’s when you have to step up and buy the strong currencies, the exporting, current-account surplus countries."

Stocks from India, South Korea and Taiwan look attractive in this environment, according to Jayaraman. Amoroso said investors will eventually want to step into local debt, while Goldberg said he would prefer hard-currency sovereign debt if trade concerns ease.

That may not be on the horizon yet. Pressure on emerging markets will probably persist for now, with Turkey, Argentina, South Africa, Pakistan, Brazil and India among the weakest links, Wolfe Research strategists including Chris Senyek wrote in a note to clients. The New York-based firm said default probabilities in Asia, interbank lending markets in Europe and credit-default swap spreads from individual banks show some similarities with the 1997 emerging-market crisis, suggesting broader fragility in the asset class.

"Our EM ‘blow-up’ monitor suggests that weakness is spreading across the most vulnerable EM countries," Senyek said.

One of the reasons emerging markets are popular among global investors is because they hold out the potential to benefit from simultaneous capital and currency market appreciation as well as scope for higher yields to boost total return. However, when emerging market currencies decline they erode profit potential for these markets and foreign investors sell.

That does have the potential to create a daisy chain effect for two reasons. The first is because people sell where they have profits to cover losses elsewhere. The second is because so much buying is now done via ETFs. When redemptions rise selling tends to be indiscriminate.

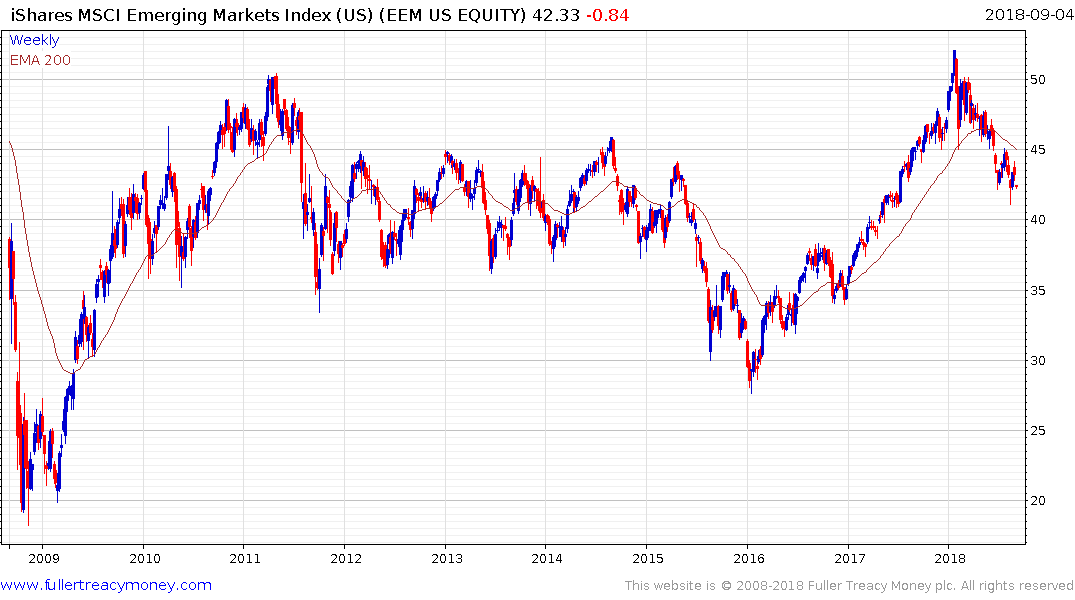

The $30 billion market cap iShares MSCI Emerging Markets ETF is currently trading at a small discount to its NAV. The generally only occurs when there is a surfeit of sell orders and the pricing engine cannot redeem units quickly.

The fund encountered resistance in the region of $50 in 2007 and again in 2011 and is now falling back from that level again. China represents almost 27% with South Korea at 14.7% and Taiwan 12.1%. India, South Africa, Brazil, Hong Kong, Russia, Mexico and Malaysia represent a combined 30% of the fund. A break in its progression of lower rally highs will be required to signal more than a low of short-term duration has been reached.

The Blackrock Latin America Investment Trust has 91.5% of its holdings in Brazil (64.5%) and Mexico (27%) and trades at a discount to NAV of 13.9%. It is short-term oversold as it tests the region of the June low so there is scope for some steadying or possibly a reversion back towards the mean but a sustained move above 435p would be required to question medium-term type-2 top formation completion characteristics.

The Latin America Dollar Index, which is dominated by the Brazilian Real and Mexican Peso continues to extend the breakdown from its overhead two-year range.