Honey, I shrunk the stock market

This report from Navallier Calculated Investing is a promotional piece but it contains a number of interesting charts and statistics relating to share buybacks. Here is a section:

Apple had completed $200 billion in share buy-backs since 2012. Apple’s cash hoard is so monstrous that six out of the 10 biggest share buy-backs in U.S. history were done by Apple. The $200 billion they’ve bought since 2012 is enough cash to buy all of Verizon, Coca-Cola, or Boeing. Chew on that for a minute.

Now, contemplate this: U.S. companies announced $201.3 billion in stock buybacks and cash takeovers in May 2018 alone. That’s a record monthly amount. Apple represents nearly half of that! Apple recently said it would buy back $100 billion more of its own stock. They didn’t specify when or how long that would take, but that’s about 10% of the market cap, currently at $1 trillion, the first trillion-dollar stock.

The buy-back announcements keep coming:

Broadcom (AVGO) pledged a $12 billion buy-back.

Micron (MU) pledged a $10 billion buy-back.

Facebook (FB) pledged a $9 billion buy-back.

T-Mobile (TMUS) pledged a $7.5 billion buy-back.

Qualcomm (QCOM) just upped the ante on their previous announcement to buy back $8.8 billion. On July 25th, 2018 QCOM said they would buy back $30 billion, more than 30% of the float!

Social media companies led an early pullback on the Nasdaq today as Facebook, Twitter and Alphabet were grilled in Washington. The questions being asked of these companies with regard to how they police their forums and the nature of the advertising being served to consumers/voters is understandably weighing on their performance. It is also leading to headlines along the lines of “technology stocks collapse” which if we look at the Nasdaq is clearly a case of hyperbole.

Apple’s action today reflects the fact there is someone, quite likely the company itself, buying the dips. That is a good part of the reason the share has been accelerating higher. Even so the risk of a reversion to the mean is rising.

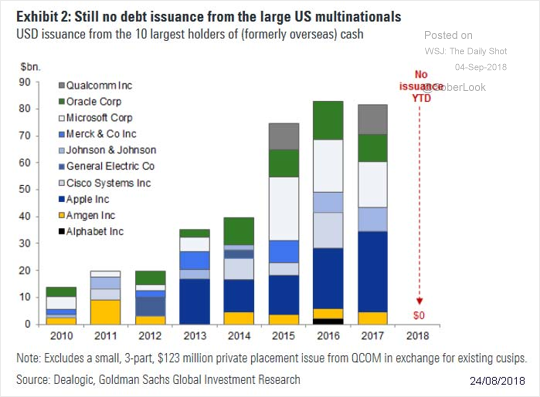

Overseas bond issuance was one of the primary mechanisms cash-rich firms used to repatriate profits ahead of the tax cuts. They have completely dispensed with that toolset since the tax cuts went into effect. That dearth of supply forces EU based yield-hungry investors to look further yield for bonds. This graphic of the bond issuance of US multinationals highlights how abrupt a change that has meant for the European bond corporate markets.

A point that is not getting much airtime is that the repatriation of overseas profits is a one-time boost for the stock market. Future overseas profits can still be repatriated but the quantities are likely to be less as the balances are drawn down.

Meanwhile companies will continue to issue debt to buy back their own shares as long as interest rates are low and the weighted average cost of capital can be improved. That represents an important source of fresh demand to fuel the stock market’s medium-term uptrend.

Bond issuance has been a major source of capital for companies since the advent of quantitative easing and the pace of issuance is not slowing down. In fact, if anything companies are in a hurry to get mergers done and to lock down low borrowing costs ahead of further interest rate hikes. The risk for next year and 2020 is that a great deal of debt needs to be refinanced and that will occur at higher borrowing costs due to interest rate hikes.

The 5-year Treasury yield is consolidating below 3% but a sustained move below the trend mean would be required to question medium-term scope for continued expansion.

The Nasdaq-100 is back testing the 7500 level which represents the region of the upper side of the underlying short-term range. A break back below that level would increase scope for a reversion back towards the trend mean which is currently near 7000.

The Russell 2000 is also testing the upper side of its most recent short-term range and is equally overextended relative to the trend mean.