Japanese Stocks Whipsaw After BOJ Unveils New ETF Buying Program

This article by Anna Kitanaka and Nao Sano for Bloomberg may be of interest to subscribers. Here is a section:

“Investors are losing hope because the amount isn’t big,” said Ayako Sera, a Tokyo-based market strategist at Sumitomo Mitsui Trust Bank Ltd., which has $453 billion under management.

“At first it seemed like the BOJ was progressing with easing, but when you look at what’s inside that, it’s nothing much.They’re focusing more on qualitative, rather than quantitative, easing.” The central bank kept its main target for monetary stimulus of 80 trillion yen ($650 billion) a year in asset purchases unchanged, indicating confidence in the economy after data from capital spending to business confidence and unemployment exceeded expectations. The announcement follows this week’s decision by the Federal Reserve to raise U.S. interest rates for the first time in almost a decade.

The central bank said it will extend the average maturity of holdings of Japanese government bonds to between seven and 12 years, and also boost the amount it can purchase in

Japanese real-estate investment trusts to 10 percent from the current 5 percent limit. It will also extend the time frame for selling the shares it purchases by five years, with the new deadline for completion being March 2026. The new ETF program will start from April, when the BOJ plans to resume selling shares it had purchased from banks.“The BOJ is slightly expanding areas related to ETF and bond holdings, but investors are starting to see that the changes aren’t as big as they thought,” said Hiroaki Hiwada, a Tokyo-based strategist at Toyo Securities Co. “Investors were buying on hope. People are disappointed after looking at the details closely.”

Quantitative easing has a diminishing return the longer a central bank persists with it because as asset prices increase more capital is needed to influence the same percentage gain. When the ECB announced it was not expanding its program at the last meeting the Euro surged from its lows. Today’s BoJ announcement that they are not accelerating their program has had the same effect.

The Dollar is now retesting the region of its 200-day MA against the Yen. The yearlong range represents a loss of momentum following a powerful move at the end of 2014. The BoJ has sold the Yen every time it has tested the region of the trend mean and a sustained move below ¥119 would be required to suggest they have ended that policy.

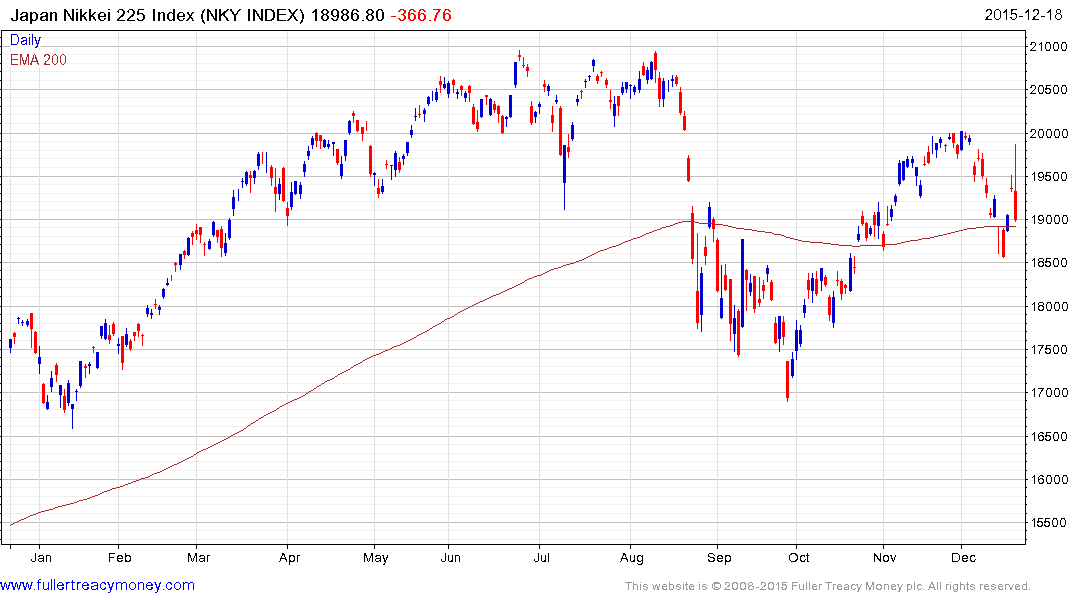

The Nikkei-225 experienced pretty extreme volatility today, encountering resistance in the region of 20,000 and finishing on the low of the day. A countermanding upward dynamic would be required to check current scope for a further test of underlying trading while a sustained move back above 20,000 will be required to question medium-term supply dominance.

At the other end of the scale the REIT sector is likely to be a beneficiary of the new direction chosen by the BoJ. The TSE REIT Index firmed today from the region of the 200-day MA and a sustained move below 1700 would be required to question medium scope for continued higher to lateral ranging.