Japan Dividend Growth

As I mentioned in last night’s broadcast, I spent some time this morning going through Japan’s market in search of companies with strong dividend growth.

The primary reason for pursuing this question was to highlight many companies are growing dividends at a rate higher than 10% on a rolling 3-year basis. That helps to emphasise dividend growth is not some passing fad but has become part of the corporate culture.

To compile the list I screened for companies with a market cap greater than $1 billion, 3-year average dividend growth of greater than 10% and positive performance year to date. 270 stocks fit those criteria and several are household name brands.

The additional reason for considering dividend growth is it is generally viewed as a bulwark against the prospect of higher benchmark interest rates. Dividend growth at a rate quicker than the pace with which a central bank is hiking rates is about the best defense investors have against both inflation and the efforts to contain it. That’s one of the primary reasons defense shares are among the last to peak in a bull market.

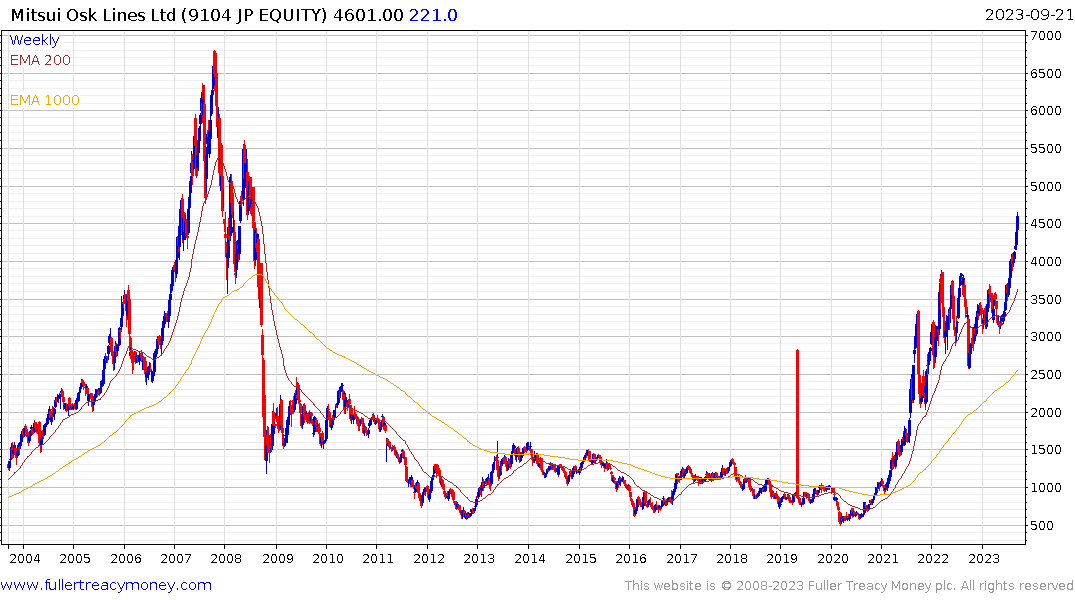

Mitsui OSK Lines continues to extend its breakout but is increasingly overextended in the short term.

Mitsui OSK Lines continues to extend its breakout but is increasingly overextended in the short term.

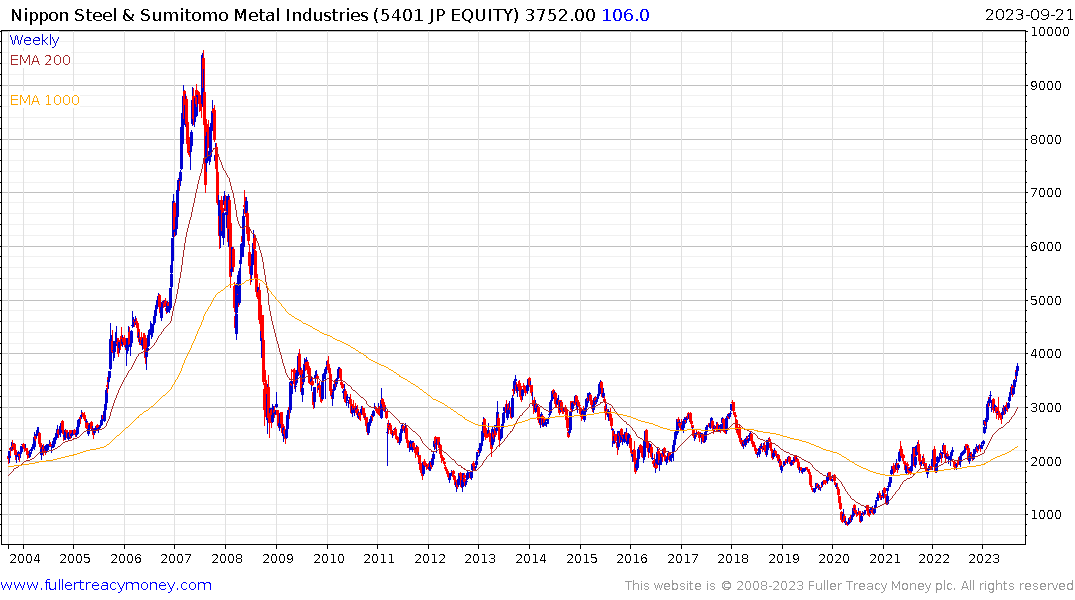

Japan’s steel sector remains in a strong recovery. Nippon Steel has the highest dividend growth rate (162%) in the group as well as the higher yield (4.79%).

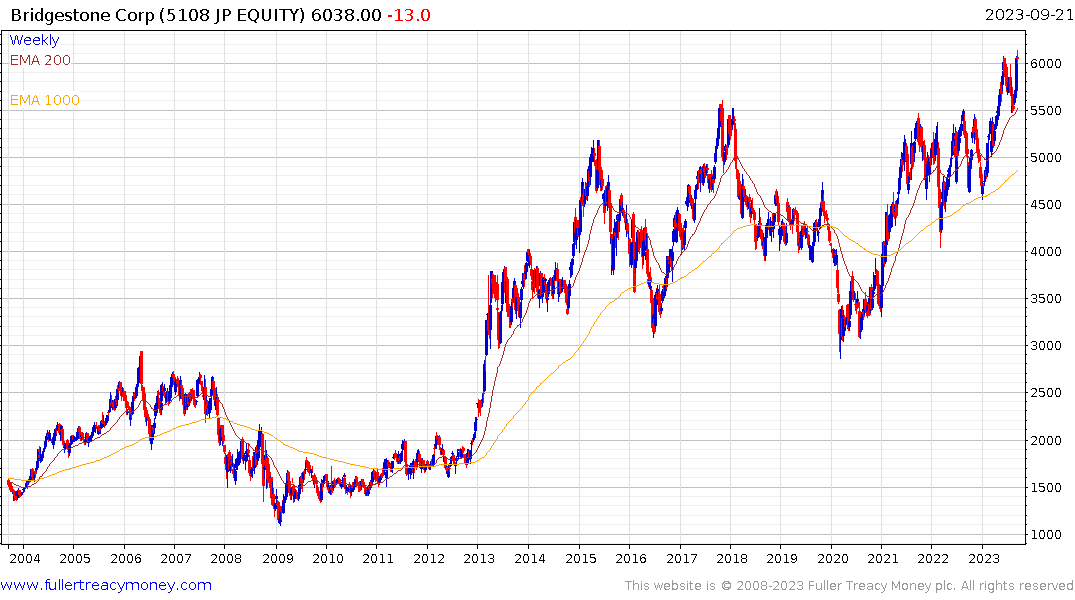

Bridgestone is breaking out of a five year range.

Bridgestone is breaking out of a five year range.

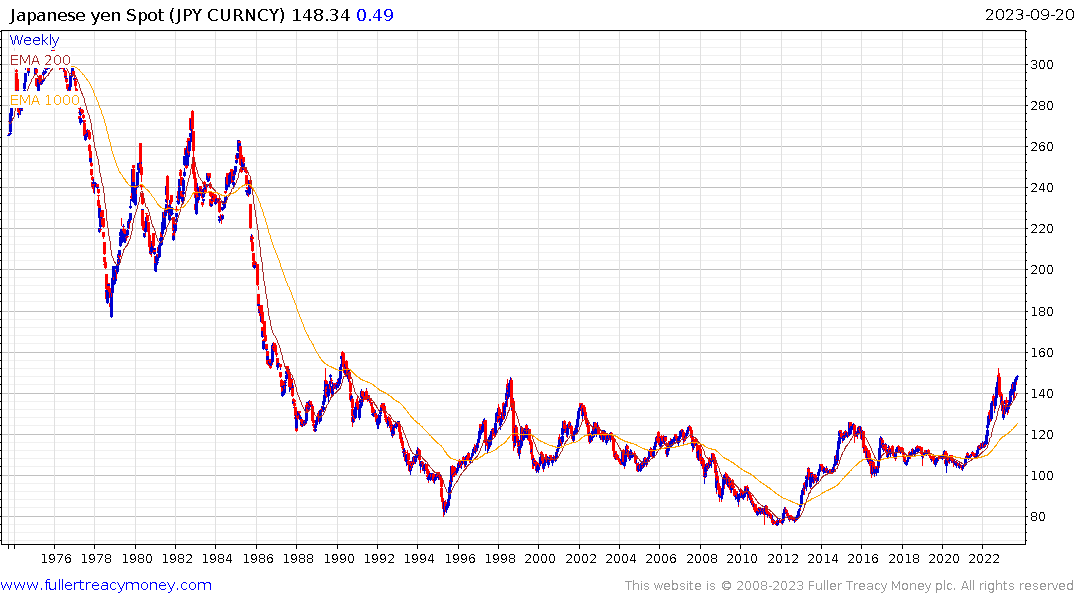

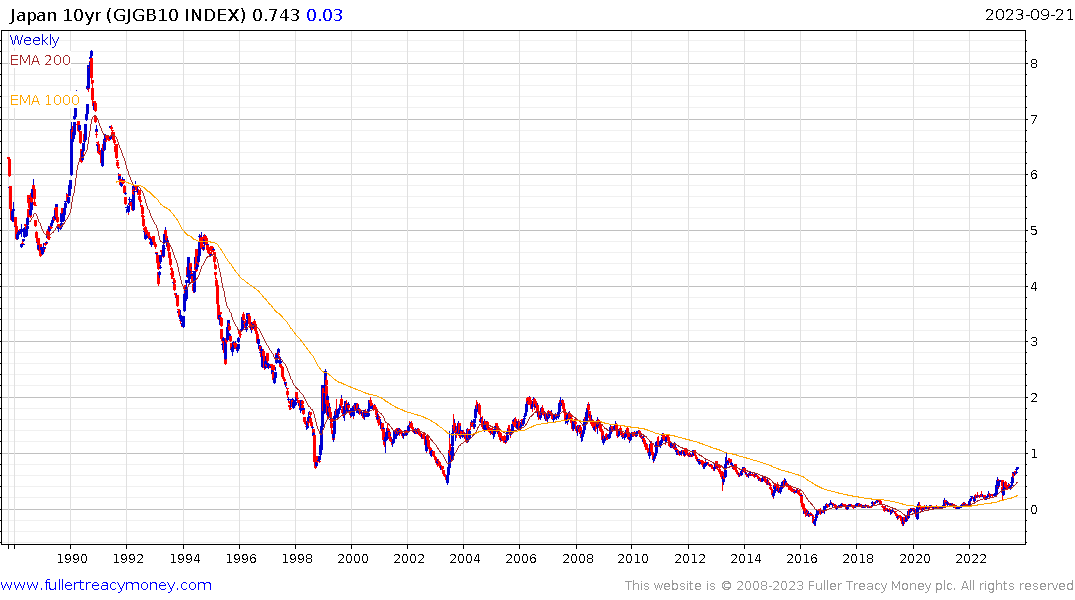

One of the most hotly anticipated central bank actions is the Bank of Japan’s ultimate decision to raise rates. As the Yen trends lower and approaches the psychological ¥150 area versus the US Dollar speculation is increasing the Bank of Japan will finally act to limit some of the nascent inflationary pressures.

A pause in the current area to unwind the short-term oversold condition is likely. However, the long-term chart looks like a long US Dollar base formation is about to be completed. That suggests clear evidence of central bank action to change rates may be required to alter trading behaviour beyond short-term swings. The prospect of the Bank of Japan raising rates is the market equivalent of the Ross Ice Shelf breaking off and speeding up the flow of glaciers into the Southern Ocean. Japanese investors have trillions of Yen invested overseas. It’s the biggest carry trade in the world. Zero interest rate yen have been a major source of funding for speculative trades for decades. Unwinding that leverage could result in significant asset price contraction globally.

The prospect of the Bank of Japan raising rates is the market equivalent of the Ross Ice Shelf breaking off and speeding up the flow of glaciers into the Southern Ocean. Japanese investors have trillions of Yen invested overseas. It’s the biggest carry trade in the world. Zero interest rate yen have been a major source of funding for speculative trades for decades. Unwinding that leverage could result in significant asset price contraction globally.