Iron Ore in Longest Streak of Gains Since July on China Stimulus

This article by Jasmine Ng for Bloomberg may be of interest to subscribers. Here is a section:

The steel-making ingredient is set for the biggest annual loss in at least five years as BHP Billiton Ltd., Rio Tinto Group and Vale SA expanded output. Gripped by a property downturn and excess capacity, China is set to grow 7.4 percent this year, the slowest expansion since 1990. To support growth, the central bank will broaden the definition of a deposit in 2015, boosting the lending capacity of Chinese banks.

Iron ore received support “after the PBOC changed its savings deposit definitions, which effectively increases funds available for commercial bank lending,” Melinda Moore, a London-based analyst at Standard Bank Plc, said before today’s price data. China will probably scrap housing purchase limits next year, adding to positive sentiment, she said in a note.

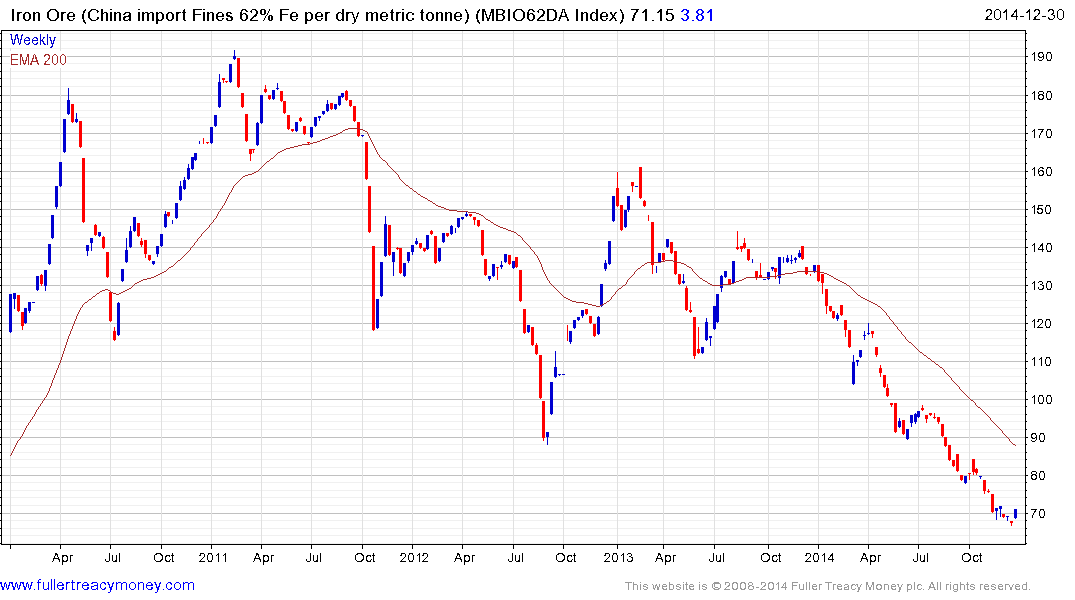

The decline in iron-ore prices has lost momentum somewhat over the last month. However a rally of more than $10 will be required to question the consistency of the medium-term decline. The four-day rally suggests that a reversionary move, back up towards the still declining 200-day MA, is increasingly likely.

At $70 the economic basis for a substantial amount of the additional supply brought online over the last decade will be in question and a number of smaller producers have already gone bust. One might conclude that the three majors are close to achieving their goal of preserving their cartel.

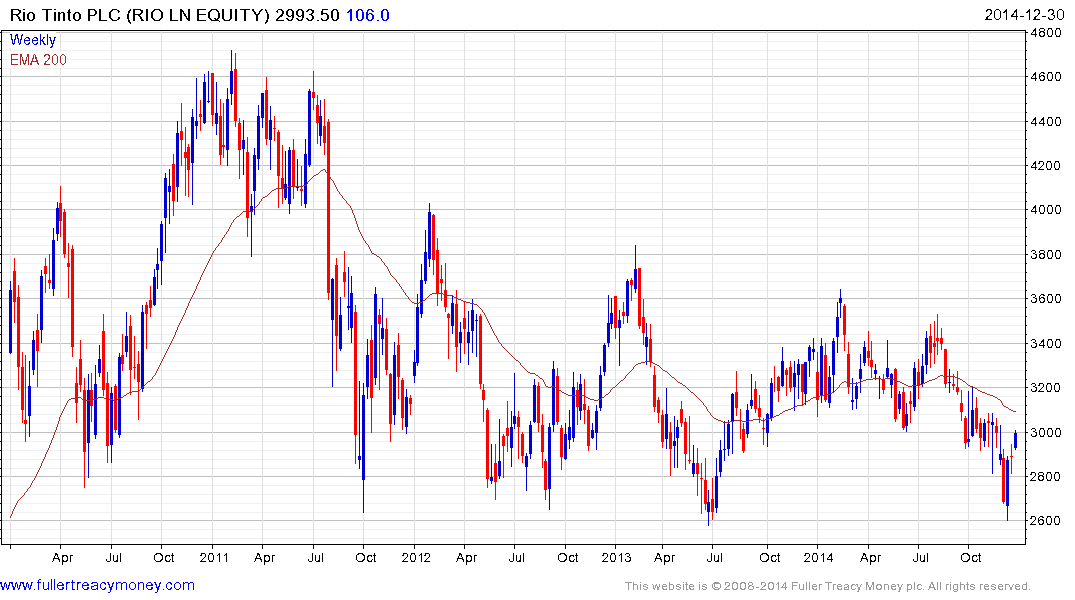

Of the three, Rio Tinto is bouncing most impressively, having found support in the region of the lower side of its three-year range.

Back to top