FBI Probes If Banks Hacked Back as Firms Explore Cyber Offensive

This article by Michael Riley and Jordan Robertson for Bloomberg may be of interest to subscribers. Here is a section:

“It’s kind of a Wild West right now,” said U.S. Representative Michael McCaul, the Texas Republican who is the chairman of the House Homeland Security Committee. Some victim companies may be conducting offensive operations “without getting permission” from the federal government, he said.

“They’re very frustrated,” McCaul said of these firms. Hacking costs the global economy as much as $575 billion annually, according to a study published in June by McAfee, a security-software maker owned by Intel Corp., and the Center for Strategic & International Studies. Counterstrikes are a small part of the overall cyber-security industry, which Gartner Inc. projects will surpass $78 billion in worldwide revenue next year.

There is a Chinese proverb along the lines of the worst thing that can happen is if the thief knows who you are. In other words thieves can’t steal from you if they do not know you exist. The problem we have as online citizens, as a LinkedIn profile exhibits, is that we are connected in ways we might not know. All of us have an online profile in one shape of form that is equally accessible to hackers. In this environment companies represent the highest profile targets.

The vast majority of internet security products on the market today focus on defence while a small number of government-sponsored and private companies focus on offensive strategies. It is inevitable that corporations, that feel underserved by their respective governments, will take matters into their own hands by targeting predatory groups in a proactive manner across national boundaries.

EMC Corp has been forming a first step above its long-term base since 2011 and is now in the process of breaking out. A sustained move below the 200-day MA, currently in the region of $28 would be required to begin to question medium-term recovery potential.

Check Point Software Technologies has rallied impressively over the last two months and is becoming increasingly overextended relative to the 200-day MA. While some consolidation is increasingly likely, a sustained move below $70 would be required to question medium-term upside potential.

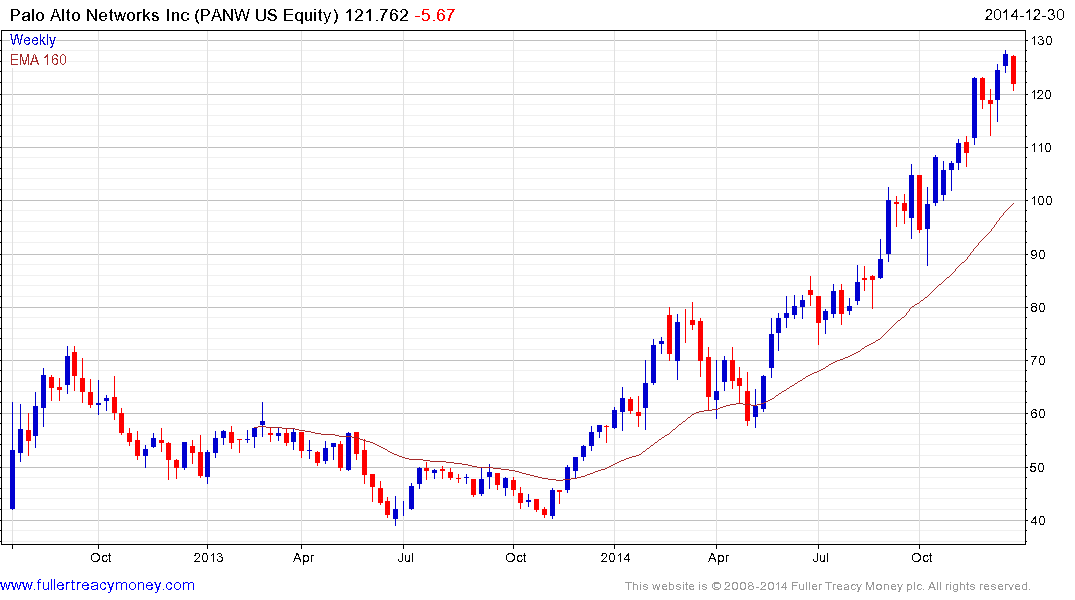

Palo Alto Networks IPOed in 2012 and has been trending consistently higher since June. While somewhat overextended relative to the trend mean, a sustained move below it would be required to question medium-term uptrend consistency.

Fortinet Inc broke out of a three-year range two weeks ago. Some consolidation of recent gains is looking increasingly likely but a sustained move below $27 would be required to question medium-term upside potential.

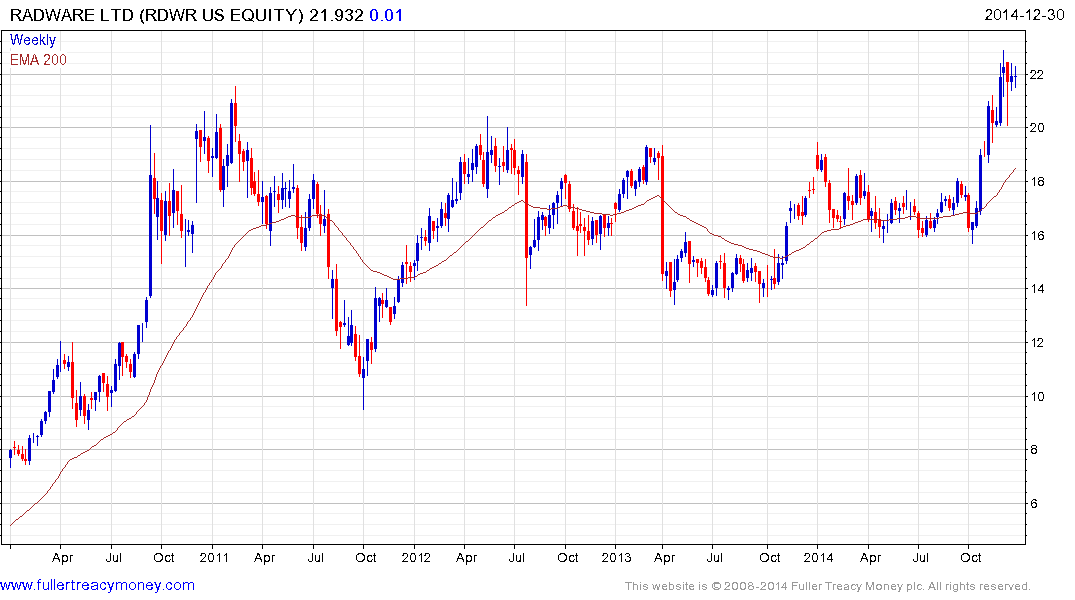

Radware has a similar pattern.

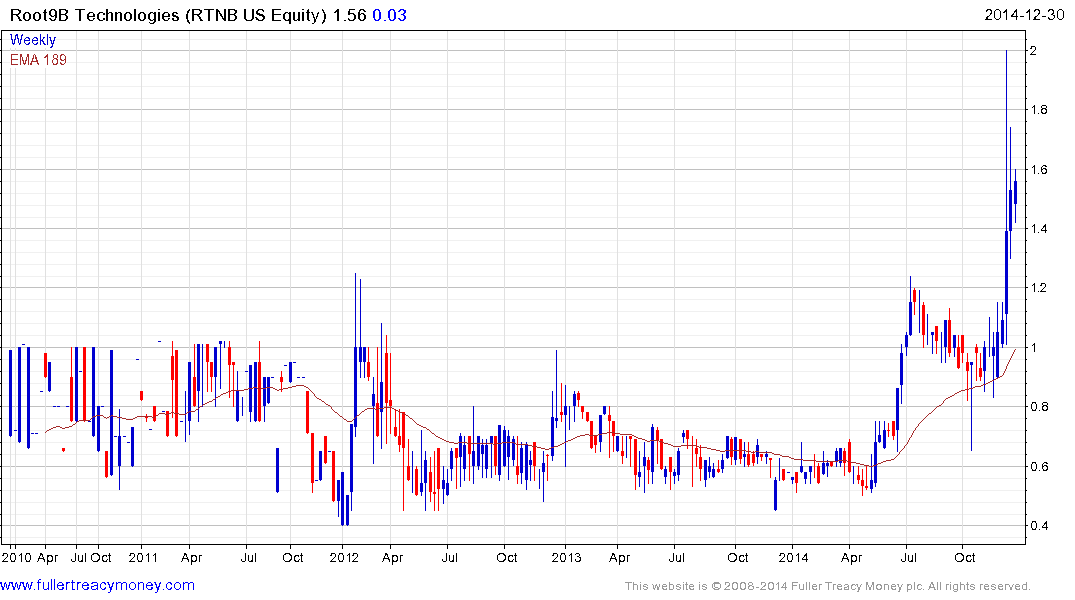

Root9B Technology only has a market cap of $50 million but the share popped above $1 earlier this month as hacking took centre stage in the media.