Investors Covet Gold Miners Once More in Search for Yield

This article by Luzi Ann Javier for Bloomberg may be of interest to subscribers. Here is a section:

The spread between the estimated dividend yield of companies on the S&P 500 Index and the BI Global Senior Gold Valuation Peers narrowed to 1.1 percent, from 1.61 percent in February, according to data compiled by Bloomberg. Meanwhile, both Goldman and Credit Suisse over the past two weeks have flagged prospects for higher dividends among gold-mining companies.

“Investors are hungry for yield,” and an increase in dividends may provide the catalyst for shares to move higher, Goldman analysts said in a Sept. 21 report.

And

Still, even with the cost cuts, miners’ prospects depend heavily on the outlook for gold prices, and a continued decline would hurt the companies’ balance sheets and drag valuations lower, said Dan Denbow, a portfolio manager at the $782 million USAA Precious Metals & Minerals Fund in San Antonio.

“If gold goes down, you’re going to lose more than just the dividend,” Denbow said in a phone interview. “When they’re buying gold miners, they’re thinking it’s going to go higher. That could be the only bet.”

Precious metals extended their decline today into an even more oversold condition but against the background of a Dollar which has been quite firm of late. Market participants are now probably waiting for a bullish catalyst in the form of a weaker Dollar or clear uptick in investment demand/safe haven buying to check the slide and pressure shorts not least as prices are still trading in the region of the trend mean.

Precious metal miners have turned in a mixed performance with a number still trading well above their respective 200-day MAs. For example Fresnillo (Est P/E 45.89, DY 0.55%), the world’s largest silver miner has been supported by the weakness of Sterling but encountered resistance below the overhead range this week and a clear upward dynamic would be required to check potential for a further test of underlying trading.

Australia’s Evolution Mining (Est P/E 9.41, DY 1.34%) bounced a month ago from the region of the trend mean and will need to hold that level during this pullback if potential for higher to lateral ranging is to be given the benefit of the doubt.

South Africa’s Sibanye Gold (Est P/E 6.93, DY 4.3%) is one of the highest yielding shares in the sector paying out 25-35% of normalised earnings in dividends. The share has almost halved since the August peak and is now testing the region of the June lows. While deeply oversold a clear upward dynamic will be required to signal demand is returning to dominance in this area.

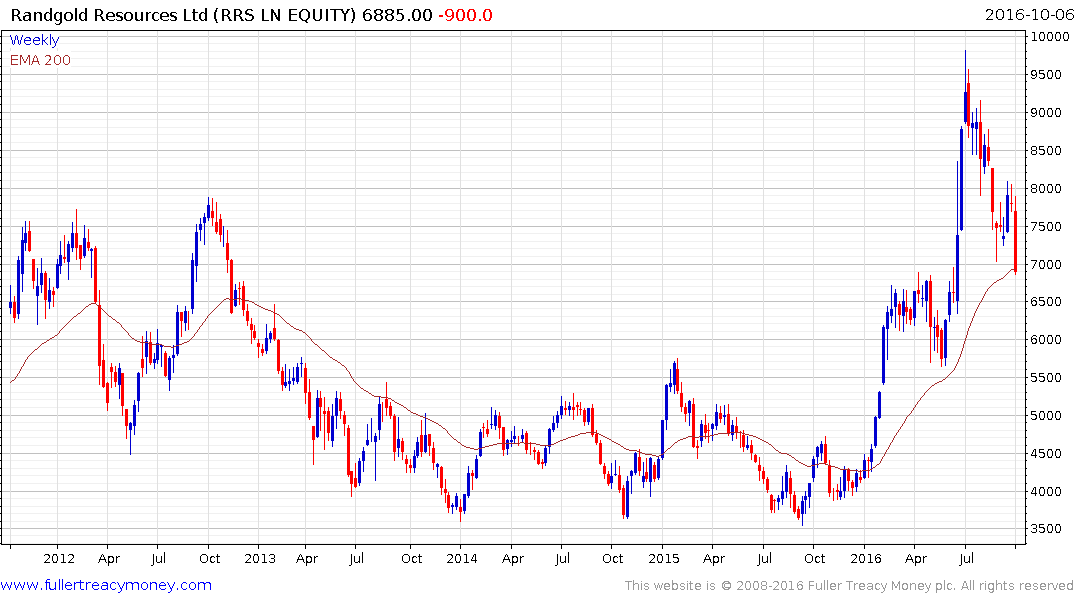

UK and US listed Randgold Resources (Est P/E 27.84, DY 0.66%) hit an accelerated peak near 10,000p in July, has now closed its overextension relative to the trend mean but has yet to demonstrate support in this area.

The problem for a number of these shares is that despite short-term oversold conditions, and increasing prospects for a bounce, potentially lengthy periods of support building are likely required before substantially higher levels can be sustained. The extent to which precious metals prices hold any rally will also have a significant influence on miners’ share prices.

Back to top