Insights in 140 Words August 1st 2014

Thanks to a subscriber for this edition of Deutsche Bank’s weekly missive which may be of interest to subscribers. Here is a section:

Reluctant party animals at the best of times, German insurers will not be celebrating this week’s record high in 10- year Bund prices. Prolonged low interest rates are kryptonite for insurers as a string of bankruptcies in Japan during the late- 1990s demonstrated. Life insurers with large duration mismatches are the worst affected - Moody’s estimates the German sector has an average maturity of 20 years for liabilities versus six years for assets. High guaranteed returns on past policies don’t help either. Sure guaranteed rates on new policies are down to 1.75 per cent from 4 per cent in 2000 but the average for the outstanding stock is still near 3 per cent. Thankfully investment returns remain above that for now. But Bundesbank stress tests suggest that if German bond yields stay low then investment returns could drop below guaranteed minimums by 2016.

Here is a link to the full article.

The German 10-year Bund yield has steadily compressed this year amid mounting geopolitical pressure and the uneven recovery in the banking sector. This has increased demand for a safe haven and the yield has returned to test the 2012 and 2013 lows. There is little prospect of the ECB raising short-term interest rates ahead of the Fed, while Mario Draghi is at the helm so demand for the Bund as a benchmark remains robust. Nevertheless, this area represents a potential point of resistance and a clear upward dynamic would suggest the yield has found at least a near-term low.

Allianz hit a medium-term peak in January following a consistent advance and has been ranging below €130 since. It will need to hold the €120 area if the medium-term progression of higher reaction lows is to remain intact.

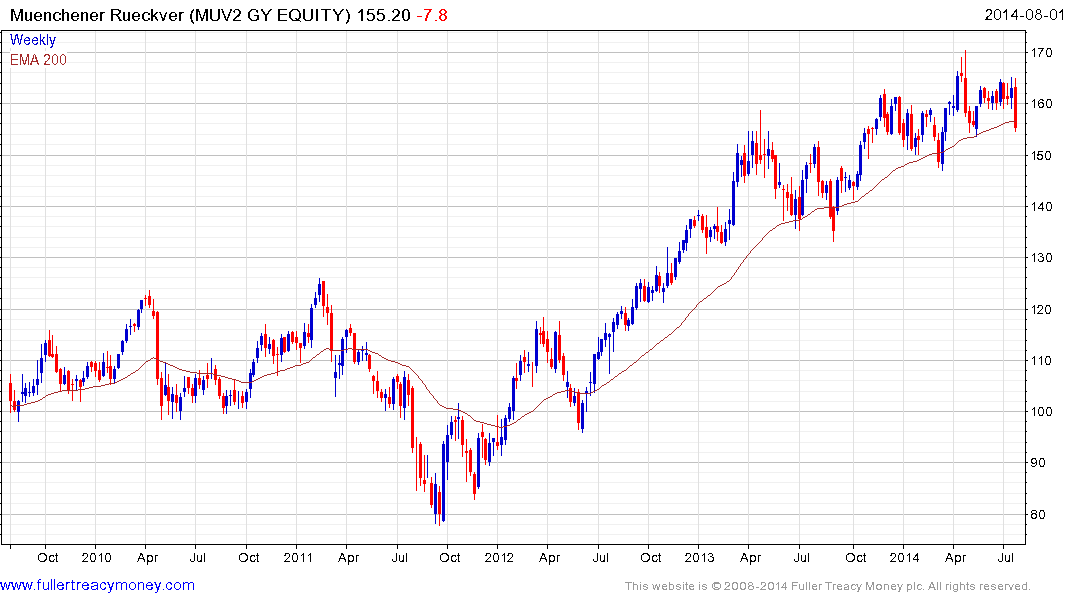

Muenchener Rueckversicherungs has experienced a greater loss of momentum over the last 18 months and will need to continue to find support in the region of the 200-day MA if medium-term scope for continued higher to lateral ranging is to be given the benefit of the doubt.

UK listed Aviva broke out to new five year highs in March and has returned to test the region of the 200-day MA over the last month. It will need to continue to find support in the region of 465p to confirm a return to medium-term demand dominance.

Back to top