Information Gaps and Shadow Banking

This article by Kathryn Judge from Columbia University School of Law may be of interest to subscribers. Here is a section:

This article argues that information gaps—pockets of information that are pertinent and knowable but not currently known—are a byproduct of shadow banking and a meaningful source of systemic risk. It lays the foundation for this claim by juxtaposing the regulatory regime governing the shadow banking system with the incentives of the market participants who populate that system. Like banks, shadow banks rely heavily on short-term debt claims designed to obviate the need for the holder to engage in any meaningful information gathering and analysis. The securities laws that prevail in the capital markets, however, both presume and depend on providers of capital playing the lead role performing these functions. In synthesizing insights from diverse bodies of literature and situating those understandings against the regulatory architecture, this article provides one of the first comprehensive accounts of how the information related incentives of equity and money claimants explain many core features of both securities and banking regulation.

The article’s main theoretical contribution is to provide a new explanation for the inherent fragility of institutional arrangements that rely on money claims. The literature on bank runs typically focuses on either coordination problems among depositors or information asymmetries between depositors and bank managers to explain bank runs. This article provides a third explanation, one which complements the established paradigms. It shows how information gaps increase the probability of panic by increasing the range of signals that can cast doubt on whether short-term debt that market participants had been treading like money remain sufficiently information insensitive to merit such treatment. It further examines how information gaps also impede the market and regulatory responses required to dampen the effects of a shock once panic takes hold. Evidence from the 2007-2009 financial crisis is consistent both with the article’s claims regarding the ways shadow banking creates information gaps and how those gaps contribute to fragility.

The shadow banking sector has benefitted inordinately from quantitative easing because the cost of leverage has been so low and access to the sea of liquidity issued by central banks has been limited to a relatively small number of market participants. That fact alone has contributed to the rise of populist movements, but the prospect of rising interest rates in response to proposed fiscal stimulus represents a challenge for the shadow banking sector.

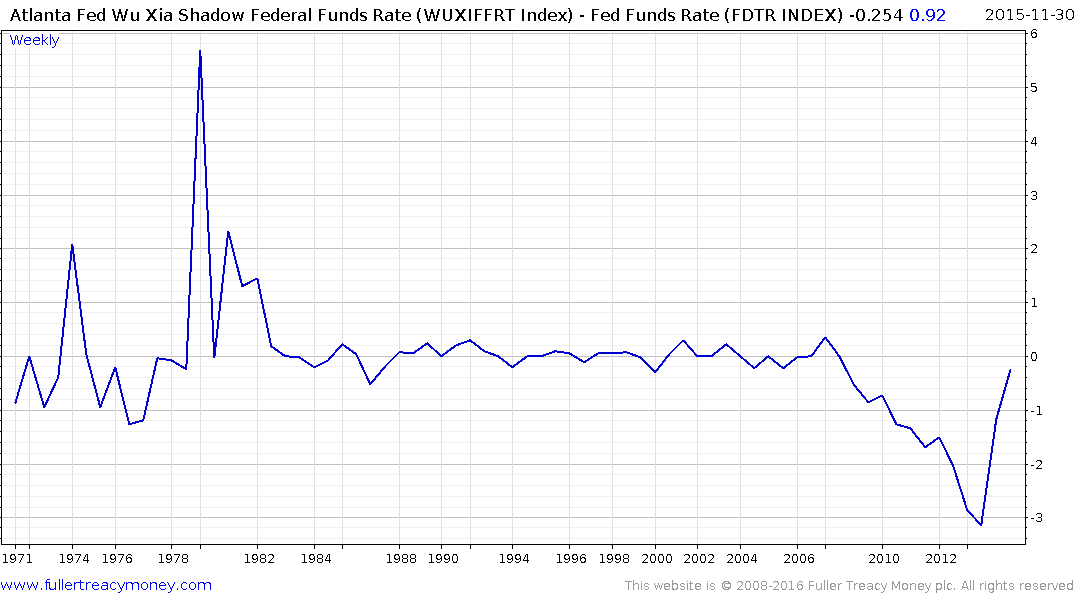

The Wu Xia Shadow Banking Fed Funds rate was trading at negative 300 basis points as recently as last year but the spread has more recently contracted to only 25 basis points. That represents substantial tightening for highly leveraged strategies that reaped outsized profits from the era of quantitative easing. It could also help to explain the size of the sell-off in government bonds that has occurred recently. The shadow banking sector is no longer making money from its leveraged long bond or “risk parity” strategy and a contraction in the above spread but likely be required to reanimate animal spirits.