Euro Gains With Stocks as Italy Vote Absorbed in 'Three Minutes"

This article by Eddie Van Der Walt and Aleksandra Gjorgievska for Bloomberg may be of interest to subscribers. Here is a section:

The common European currency rose against the dollar even as Italy slid into political limbo after Italian Prime Minister Matteo Renzi’s resignation opened the door to fresh elections. The euro earlier fell to its weakest in 20 months. European shares headed for the biggest gain three weeks, while the cost of insuring Italian bank bonds against default jumped. Gold headed for the lowest close since February, Treasury 10-year yields rose to 2.42 percent and a gauge of equity-market volatility slid.

Political risk from Italy hasn’t spread beyond its borders as markets were correctly positioned for the anti-establishment mood sweeping around the world. This was a departure from the Brexit referendum and Donald Trump’s surprise election, when traders were caught out by populist votes.

“After Brexit, it took three days for markets to shake it off, with Trump it took three hours, with Italy it took three minutes,” said Guillermo Hernandez Sampere, head of trading at MPPM EK in Eppstein, Germany. His firm oversees $260 million. “The outcome was not as much of a surprise as many expected it to be -- markets learned their lesson.”

The Italian decision to vote No on the referendum was widely anticipated with the risk residing in whether a snap election would be called. With that option being swept aside soon after the decision, some of the shorts on the Euro were closed in what is a classic example of “sell the rumour, buy the news”.

The Euro posted a large upside key day reversal to confirm a low of at least near-term significance in the region of the lower side of an almost two-year range. Upside follow through tomorrow would confirm the signal and suggest at least a reversionary rally is underway.

The benefits of the reduction in risk were not evenly spread throughout European stock markets. The DAX for example has firmed once more from the region of the trend mean and a sustained move below 10,250 would be required to question near-term potential for a successful upward break.

The Italian Index continues to be weighed down by its banks, where the $5 billion capital raising Banca Monte dei Paschi di Siena is currently attempting remains a worry. One important fact is that relative weighting of banks has been substantially reduced. The Index is testing the upper side of a six-month range but will need to sustain a move above 17,500 to confirm a return to demand dominance beyond the short term.

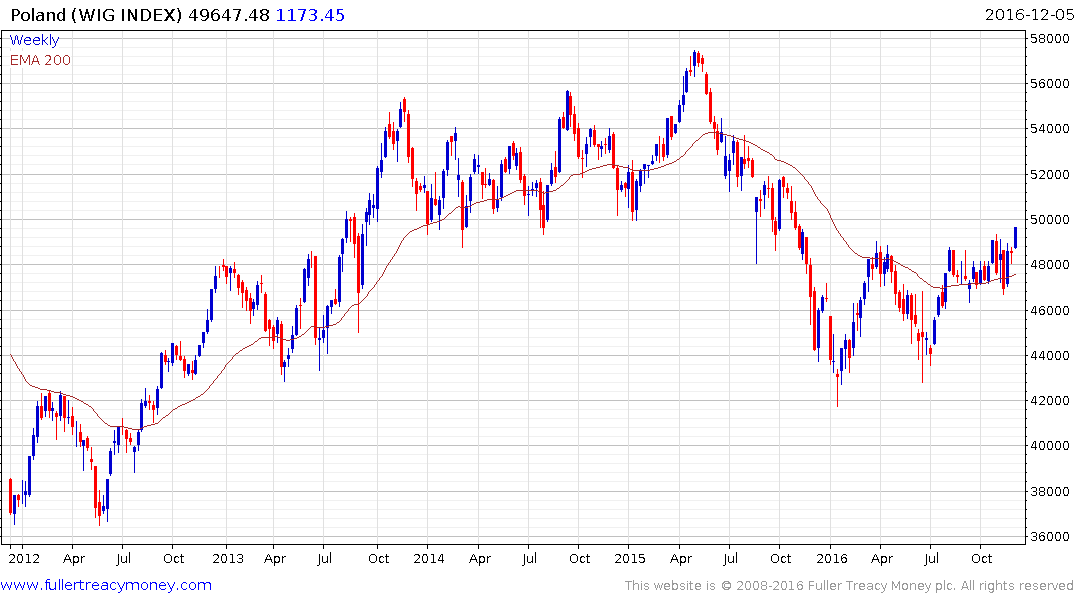

Some of the most compelling bullish signals in Europe today occurred outside the Eurozone. The Polish Index broke out to a new 12-month high to reassert medium-term demand dominance.

The Russian market continues to trend higher on firmer oil prices.