Inflation, El Nino, and Fishmeal

Thanks to a subscriber for this report from Jeffrey D.Saut for Raymond James. Here is a section:

Some inflation numbers were reported last week. They read: April PPI jumped 0.5% month/month, +2.5% year/year; +2.2% year/year was expected. Meanwhile, core PPI increased by 0.4% month/month, +1.9% year/year; +0.2% month/month and +1.6% year/year were expected. The inflation report reminded us of something Pippa Malmgren (a policy consultant to numerous presidents) said to us at a recent national conference. She opined that when inflation goes from 1% to 2.5%, or maybe even 3.0%, it’s a really big deal; and we agree. Shortly after parsing those inflation figures I read something about the El Niño that is expected to “hit” in the back half of 2017. As paraphrased from the eagle-eyed David Lutz’s blog “What Traders Are Watching,” (Jones Trading):

The headline read, “Full-Fledged El Niño Increasingly Likely in Second Half 2017.” The U.S. government’s Climate Prediction Center (CPC) last month forecast El Niño conditions would prevail by the end of the northern hemisphere summer, but put the probability at only 50 percent. Most El Niño indicators have strengthened since then so the probability is likely to be revised higher when the CPC issues its next forecast later in May. Aussie’s wheat crop could see further drought damage. Sugar cane will also be impacted. Dryness in Southeast Asia could depress harvest levels of crops including rice and sugar in Thailand, Robusta coffee in Vietnam, and will add stress to rubber and palm oil trees in Indonesia and Malaysia. El Niño has also been linked to a weaker Indian monsoon and lower than average rainfall could affect crops including rice, wheat, cotton, and sugar. Indian farmers are large buyers of gold, and analysts at UBS last year raised concerns that a potential weak monsoon could hit purchases of the precious metal. El Niño has tended to impact cocoa production in West Africa. Meanwhile, Peru’s anchovy catch is almost always affected by the weather event, and is the main ingredient for fishmeal. Interestingly, this “fishmeal” inference made me recall that a severe El Niño was responsible for the term "core inflation," which excludes food and energy prices in its inflation figures for those of you who don't eat or drive.

Here is a link to the full report.

Inflation has been largely absent from official figures for what feels like a long time and the bond market is still of the opinion that it is not about to make a comeback anytime soon. However there are increasing signs that wage demands are rising and that can’t but contribute to the official inflation figures eventually.

That suggests the bond market is either correct that there is going to be no growth and deflation will remain the dominant force or it is badly wrong and will need to play catch up in a hurry.

The 2-year yields have base formation completion characteristics and market sentiment is a textbook example of disbelief, which is the first psychological perception stage of a new bear market.

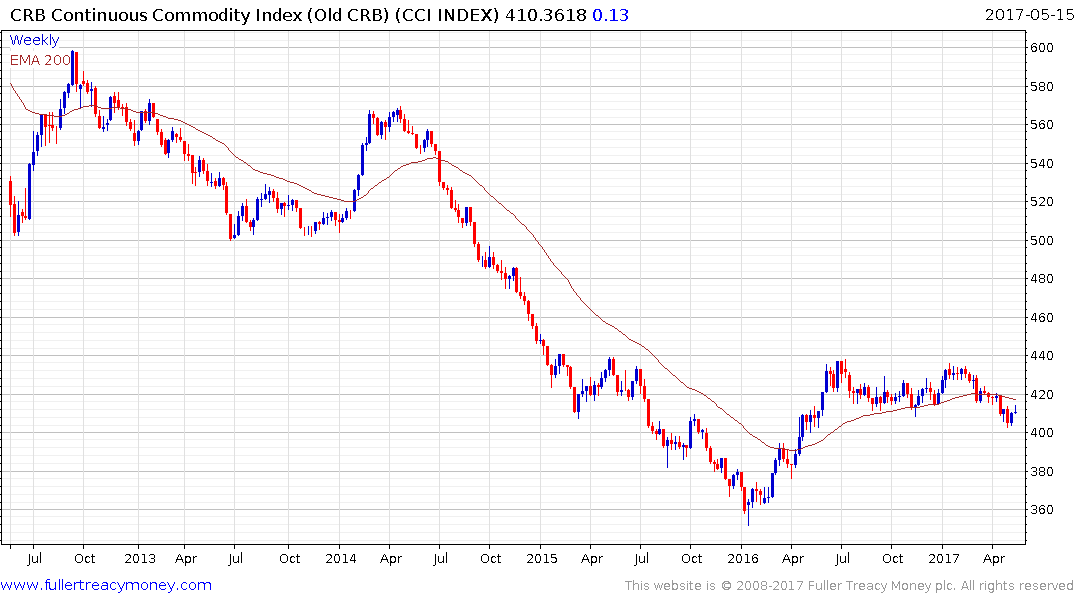

The Continuous Commodity Index has been led lower by agricultural commodities. It has stabilized near the psychological 400 area but will need to continue to hold if meaningful uptrend consistency deterioration is to be avoided.