Indonesia Sailing Toward Upgrade as Last Major Asian Junk Debt

This article by Lilian Karunungan for Bloomberg may be of interest to subscribers. Here is a section:

Indonesia’s status as Asia’s last major economy without a full-investment grade may be near an end, boosting the appeal of the region just as other emerging markets such as Brazil and Poland suffer downgrades.

State-Owned Enterprises Minister Rini Soemarno said in Jakarta on Wednesday she expects an S&P Global Ratings upgrade in June, after the finance minister said May 11 the firm’s officials were impressed during a visit. Indonesia’s international bonds returned 10.1 percent this year, while its domestic bonds advanced 10 percent, both the best in emerging Asia, JPMorgan Chase & Co. indexes show. The cost to protect sovereign debt against non-payment dropped the most in Asia after Vietnam, sliding 41 basis points to 194 basis points.

Schroder Investment Management Ltd., Aberdeen Asset Management Plc and Natixis Asset Management are all predicting an upgrade as President Joko Widodo seeks to pay for better infrastructure by cutting fuel subsidies. Philippine peso sovereign debt rallied 7.7 percent this year as an incoming government sought to defend its full investment grade status, Bloomberg indices show. Bonds in Brazil delivered losses this month as its rating was cut, while the Polish zloty tumbled after the nation was downgraded in January.

“Once you become fully investment grade, it triggers a certain category of clients who were really excluded,” said Rajeev De Mello, who oversees about $10 billion as head of Asian fixed income at Schroder Investment in Singapore. “When we saw other countries move into that situation it usually had an impact.”

Indonesia’s local currency 10-year yield is 7.85% which is well above what is of offer from just about every other investment grade government bond. Indonesia hasn’t been upgraded just yet but there is potential for some contraction in sovereign spreads if that does in fact go ahead considering the search for yield that continues to characterise the market.

The Dollar experienced a steep decline following Indonesian central bank intervention in October with the rate moving from a peak near IDR15,000 to IDR13,000. It has since bounced suggesting a low of at least near-term significance and ranging below IDR15.000 represents the most likely scenario over the medium-term.

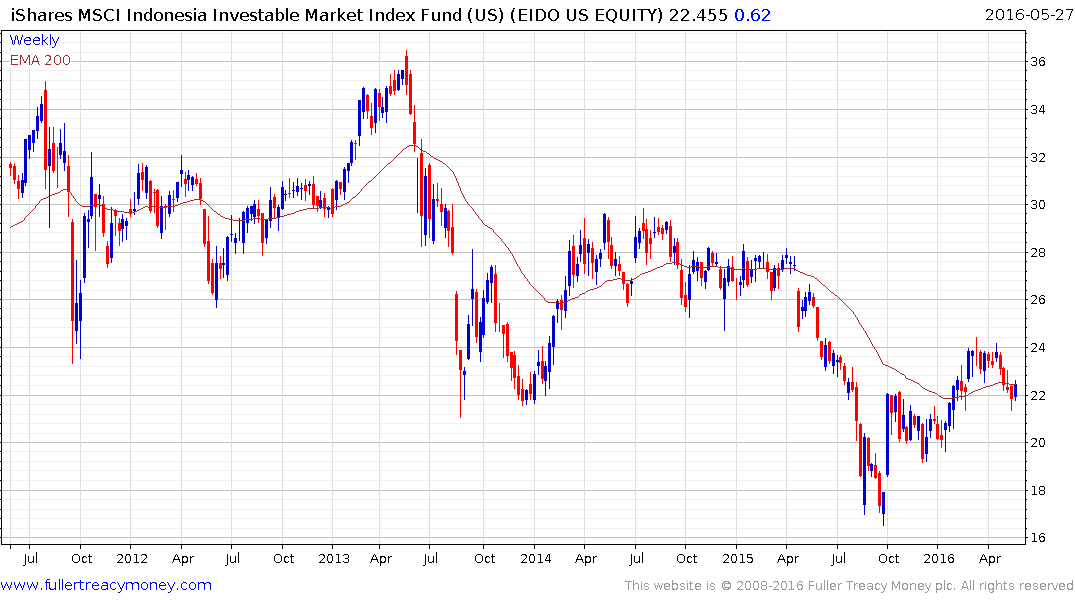

The iShares MSCI Indonesia ETF bounced from the region of the trend mean this week and a sustained move below last week’s low, near $31.30, would be required to question potential for some additional higher to lateral ranging.