Argentina Offers Tax Amnesty on Missing $500 Billion

This article by Charlie Devereux for Bloomberg may be of interest to subscribers. Here is a section:

The funds will pay a tax of between zero and 15 percent depending on the amount and when they are brought back into the country, the government said in a statement. The government needs to raise 47 billion pesos ($3.4 billion) to pay legal sentences awarded to pensioners, and another 75 billion pesos a year to pay higher pensions in future.

?“Today with this law we’re sending to Congress we’re seeking to repair years of injustice because we’ve found lots of situations where pensioners have made legal claims, won judgments and yet the state persists in seeking any trick to avoid paying,” Macri said in a televised speech.

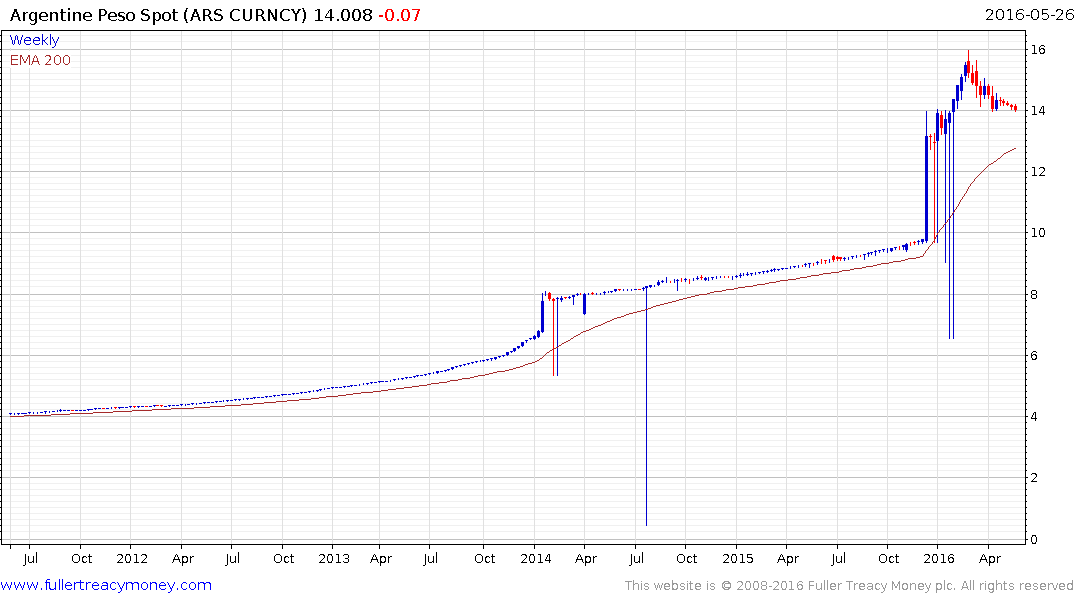

Macri will have to overcome people’s mistrust of the Argentine authorities for the amnesty to be a success. During the default of 2001, the government restricted bank withdrawals and converted people’s dollar savings into pesos during a period in which the local currency collapsed 75 percent. Still, an international tax sharing agreement that begins in 2017 will make it much more difficult for Argentines to continue hiding funds abroad, Finance Minister Alfonso Prat-Gay said.

The tax amnesty “is the first that rewards those who were up-to-date,” Prat-Gay said Friday. “We’re offering this last opportunity because from January the tax agency will have all the instruments it needs to search for that money in any part of the world.”

The Macri administration had to move fast to get as much done as possible before the honeymoon period of his tenure expires. Trying to encourage Argentines to repatriate funds from overseas is no small undertaking but would certainly help to replenish government coffers and stock economic growth.

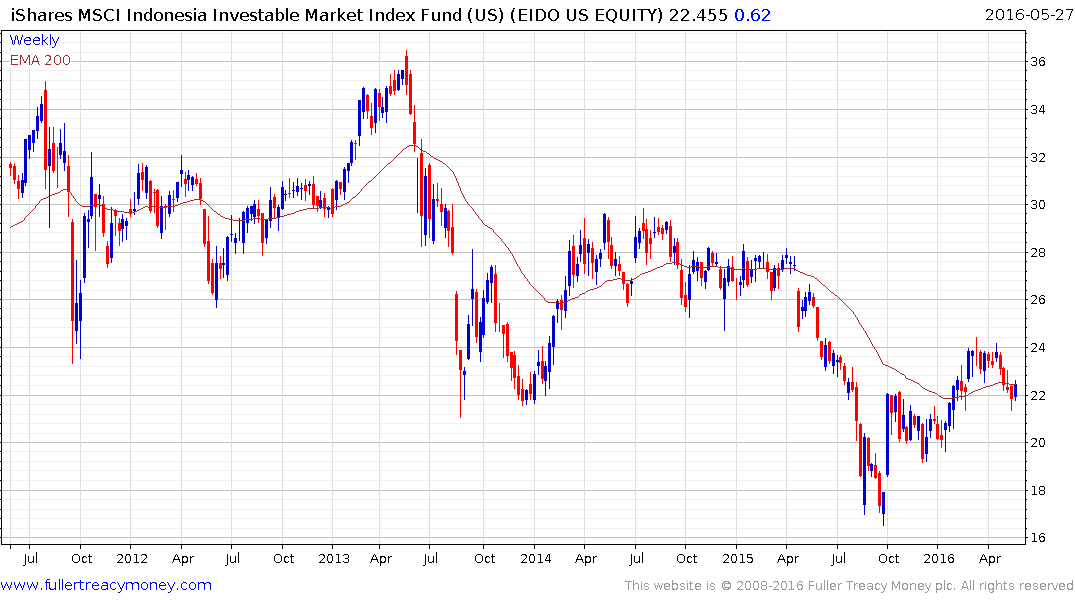

The Argentine Peso has been strengthening steadily since the devaluation following Macri’s election. Meanwhile the Global X MSCI Argentine ETF continues to trend back towards the upper side of its five-year base and a break in the progression of higher reaction lows would be required to question potential for additional upside.