IMF's Georgieva Expects Third of World to Suffer Recession

This article from Bloomberg may be of interest to subscribers. Here is a section:

“We expect one-third of the world economy to be in recession,” Georgieva told CBS’s ‘Face the Nation’ in an interview aired Jan. 1. “Why? Because the three big economies — US, EU, China — are all slowing down simultaneously.”

The IMF already warned in October that more than a third of the global economy will contract and that there is a 25% chance of global GDP growing by less than 2% in 2023, which it defines as a global recession.

Examining the three biggest economies on CBS, Georgieva painted a mixed picture of their ability to withstand the downturn.

While “the US may avoid recession,” the European Union has been “very severely hit by the war in Ukraine — half of the EU will be in recession next year,” she said. At the same time, China faces a “tough year.”

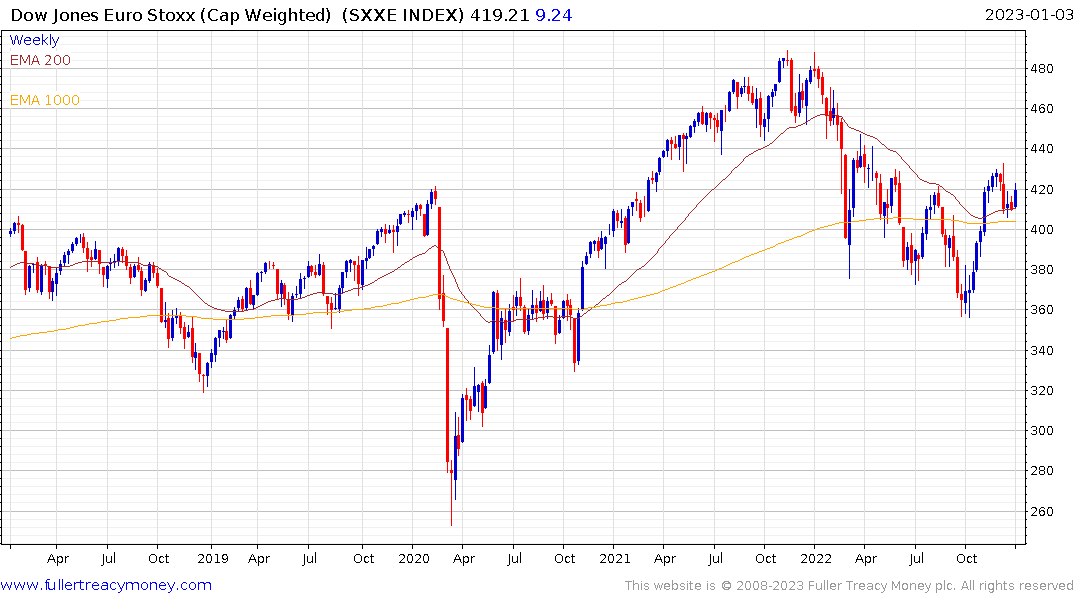

The negative economic consequences of the war in Ukraine were rapidly priced into European stocks last year. However, a crisis needs to be seen to be getting worse, if it is to continue to exert an influence on prices.

The net effect of the war has been to create new supply chains. Russian exports of key commodities are still finding their way to markets but the routes are changing. Meanwhile, Germany accepted its first shipment of LNG via the new Wilhelmshaven terminal today.

That project was completed in a timeline that left even China’s vaunted infrastructure construction speed in the dust. It helps to highlight in stark terms that bureaucratic sclerosis is a choice, borne of planning corruption and loose timelines, rather than inevitability. Developed countries really can build quickly when the need arises. That should be a source of optimism for the future.

.png)

Both the Euro STOXX and FTSE-100 were firm today and extended their bounces from their respective trend means. That’s positive action and suggests investors are eager to give the benefit of the doubt to an easing of stress in the energy sector. Nevertheless, the odds of recessions are high and it would be foolhardy to price in full recovery while the ECB is still engaged in both quantitative tightening and raising rates. That’s a recipe for choppy trading at best.