How We Think About Recession Risk

Thanks to a subscriber for this report from Goldman Sachs which may be of interest. Here is a section:

The US economy does not appear to be on the brink of recession at the moment. In thinking about the odds of a recession next year, we break the risks into three categories: (1) the risk that a recession will prove necessary to bring inflation down, (2) the risk that the Fed will cause a recession that is not necessary, and (3) the risk that something else will cause a recession.

The odds that a recession will prove necessary have fallen a little because the first two steps of the required adjustment—slowing GDP growth to a below-potential pace and rebalancing supply and demand in the labor market— have gone remarkably well so far. But it would be premature to say that this risk has fallen too much until we see consistent evidence that labor market rebalancing is slowing wage growth and breaking the wage-price feedback loop.

The odds that the Fed will cause a recession that is not necessary have likely risen somewhat. It is increasingly clear that shelter and health care inflation— and by extension commonly used measures of the underlying inflation trend such as trimmed-mean inflation—are likely to remain uncomfortably high throughout 2023 and would even if the labor market rebalanced tomorrow. While it is not our base case, we see some risk that too great a focus on lagging indicators, too little patience, or tightening too quickly to gauge the impact on the economy could result in a recession that is not necessary.

Here is a link to the full report.

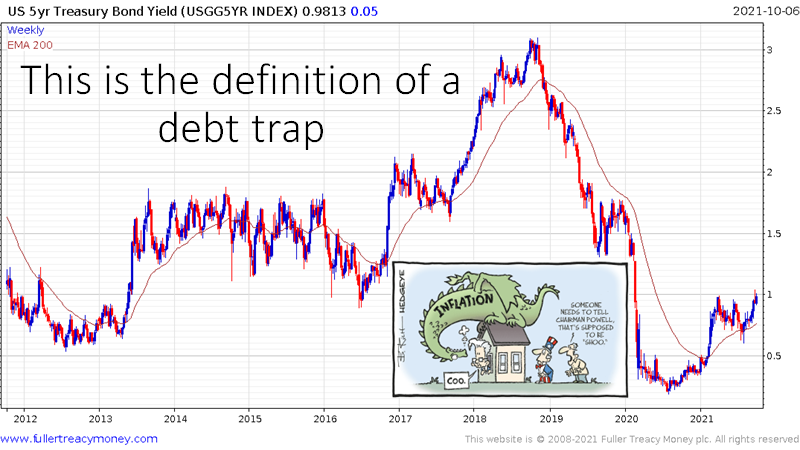

I used this slide in my IFTA conference slide deck a year ago. At the time, worry about inflation was not urgent even through the 5-year has broken highs and had first step above the base characteristics.

As I thought about what to talk about at the NAAIM conference today, I thought it would be time to update my chart. In the last year, yields have surged and instead of the illusory dragon, today Jay Powell is being tasked with slaying the inflation dragon.

The thing to remember is that we have two examples of quantitative tightening leading to deflationary fears.

In 2012/14 the ECB removed €1 trillion from its balance sheet. Yields went up first because investors were more concerned about the central banks selling bonds. However, as the process matured focus turned to the lack of liquidity and the difficulty of the economy to function without it. Yields collapsed and fell so fast that the ECB panicked that it was sparking a deflationary cycle.

In 2018/19, the Fed took $750 billion out of circulation. Ahead of the pandemic, bond yields were at record lows and investors were a lot more concerned about permanently low inflation than anything else. Bond yields initially rallied as supply increases and subsequently collapsed as deflationary fears triumphed.

Today, the latest quantitative tightening program has only just begun. The continued high inflation numbers are inflating the principal values of TIPS so the run-off does not look as intense as the headline figures suggest. Bond yields are ramping higher because of the increase in supply hitting the market and the dearth of traditional buyers. However, all of the available evidence suggests quantitative tightening leads to deflation.

Bonds yields are currently rallying but deflationary fears will prevail as a recession unfolds. That suggests there is a significant buying opportunity in bonds evolving.

.png)

The reason the Dollar has been so firm is because the federal Reserve has been so eager to raise rates to get inflation under control and more so than most other developed markets. The fact Europe is dealing with a war on its doorstep, Japan and China are both devaluing their currencies and commodity currencies have been mixed have also contributed to that outperformance. Every one of those trends is already well understood and mature.

With the PMI now below 50, that is another necessary condition for a recession in the USA. When the Dollar rolls over as inflationary pressures moderate next year, gold has significant scope to repeat the 2021 rally.

.png)

My base case is shorter, sharper cycles so rallies, when they begin, will be strong but the subsequent declines will also be surprising vicious.