How do you play political uncertainty?

This chart of the Global Economic Policy Uncertainty Index caught my attention today.

With President Trump continuing to represent a wild card in how policy outcomes are predicted, Brexit, the French, Dutch and German elections as well as protests in Romania and brinksmanship over China’s claims to the South China Sea is it any wonder the Index is at a new high.

So far the stock market is paying relatively little attention to the uptick in political and geopolitical uncertainty but gold prices are firming suggesting at least some investors may be revisiting the market as a potential hedge against unruly outcomes.

Gold has now closed its overextension relative to the trend mean and broke out of its short-term range today. It needs to sustain a move above the 200-day MA to confirm a return to demand dominance beyond a reversionary rally.

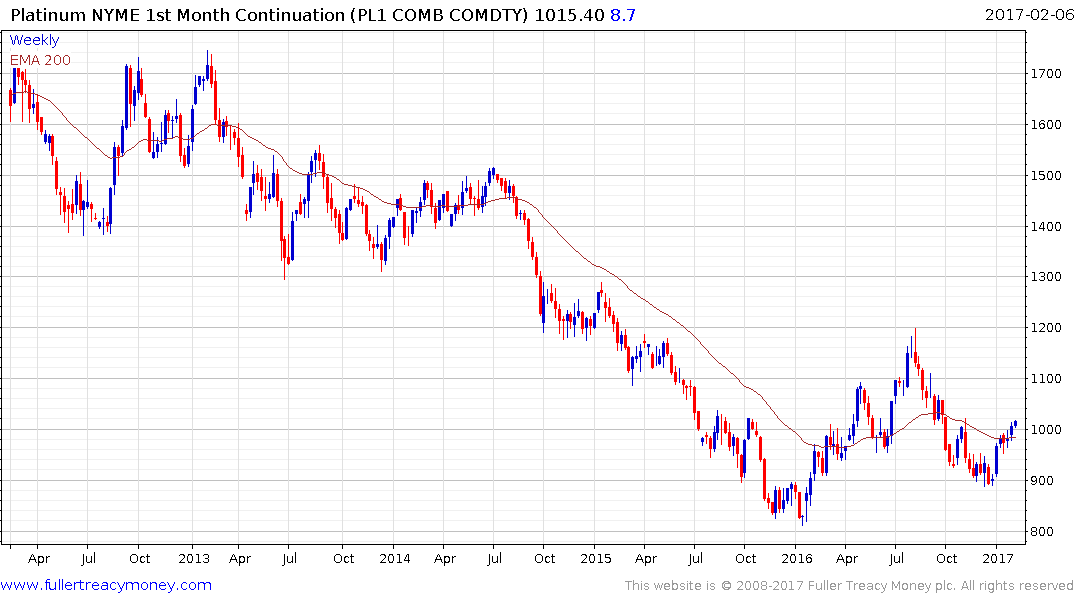

Meanwhile derivative plays on gold are already trading above their respective trend means. For example platinum is now trading back above the psychological $1000 level.

Silver has clearly broken a six-month progression of lower rally highs and is now back trading above its trend mean; albeit modestly so.

The VanEck Vectors Gold Miners ETF has also broken a progression of lower rally highs and is now pulling away from the region of its trend mean.

Back to top