How Apple Lost China to Two Unknown Local Smartphone Makers

This article from Bloomberg News may be of interest to subscribers. Here is a section:

“Oppo and Vivo are willing to share their profit with local sales. The reward was an extremely active and loyal nationwide sales network,” said Jin Di, an IDC analyst based in Beijing. While they declined to detail their subsidy program, she estimates the two were the top spenders in the past year. “They’re doing something different -- they do local marketing.”

China had for years driven Apple’s and Samsung’s growth. The U.S. company generated almost $59 billion of sales from the region in fiscal 2015, which was more than double the level just two years earlier. During that time its shares surged more than 60 percent. At its peak, Greater China yielded almost 30 percent of its revenue and Apple was neck-and-neck with Xiaomi for the mantle of market leader as users clamored for the larger iPhone 6 models. Even as the domestic economy began to sputter, Chief Executive Officer Tim Cook spent a good chunk of an earnings call last year talking up the country’s promise, saying Apple’s investing there “for the decades ahead.”

Mobile devices is an increasingly competitive market. The speed with which new companies seem to come and go is alarming from an investors’ perspective because no sooner does one seem to have conquered the world than they are being supplanted by an even more revolutionary start up.

As with many sectors the market is being divided between companies offering premium products like Apple and Samsung and those competing on price. The problem for the latter group is that Samsung is producing smartphones as an OEM supplier for the Indian market that retail at $20. The race to survive on the thinnest possible margin is not a great business model for upstart Chinese and Indian companies.

Meanwhile Apple and Alphabet don’t just sell phones. They are creating an ecosystem of apps without which a smartphone is pretty much useless. That is a clear delineation between the premium providers and the rest because app stores represent incremental additional revenue on top of the upfront handset sale.

Apple rallied to break a more than yearlong downtrend from September and found support two weeks ago in the region of the trend mean. A sustained move below $100 would be required to question medium-term scope for additional higher to lateral ranging.

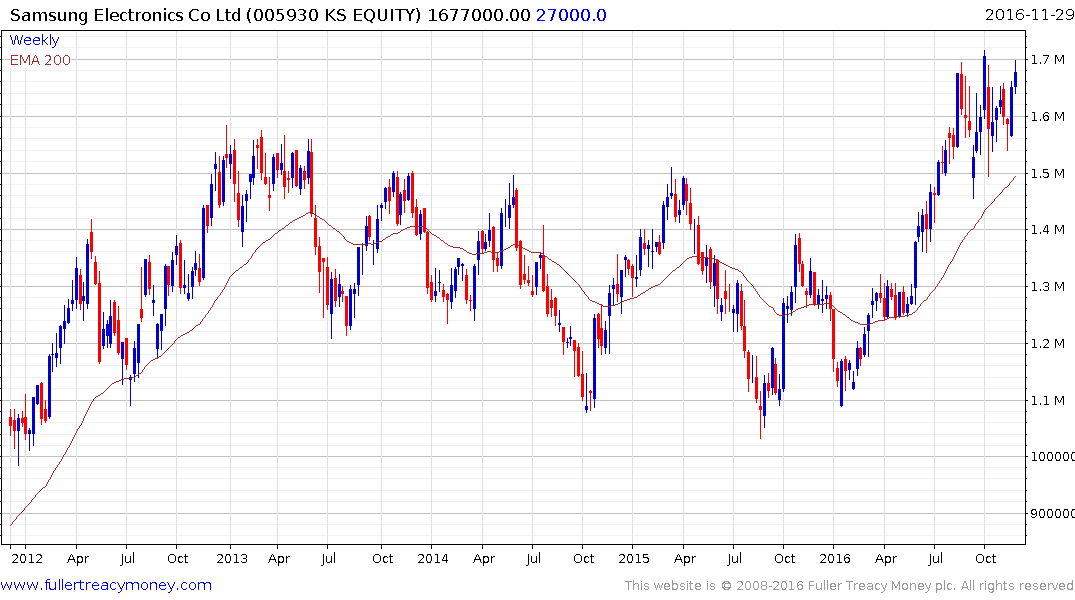

Samsung Electronics appears to be on the cusp of splitting in two, with the self-destruction of the Note 7 apparently acting as a catalyst. Considering it is a company that already has a considerable number of separately listed entities the split between consumer electronics and household goods will offer pureplays in each but that is probably all. The share broke out to new highs in August and has been consolidating above the underlying four-year range since. A sustained move below the trend mean would be required to question medium-term scope for additional upside.