DB Today Global Macro

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

European Equity Strategy - Weekly Fund Flows - Andreas Bruckner Over the course of last week, DM investors remained energized by heightened expectations of a regime change from monetary to fiscal policy. DM bond funds lost $3bn of assets, which is somewhat lighter than the previous week’s $8bn of outflows, but keeps DM bond fund redemptions on the fastest pace since the 2013 taper tantrum. Meanwhile DM equities garnered $7bn, which showed more constraint than the record-setting $33bn of the week prior, but still accentuated the rotation from bond funds to equity funds that has characterised investor flows since Donald Trump’s election victory on Nov 8. To put this in perspective, DM bond funds have seen $750bn more inflows than DM equity peers since 2007 ($1tn versus $250bn). Looking at the year on year changes of this ‘over-allocation’ since 2004, it seems to be primarily driven by the yearly changes in the US 10-year Treasury yield.

Here is a link to the full report.

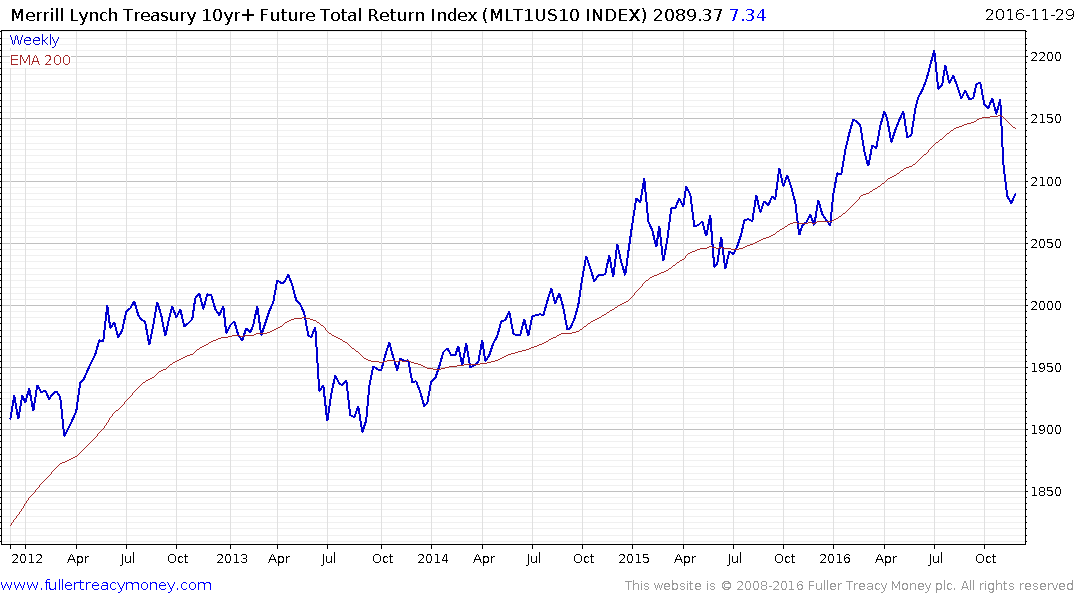

The sell-off in bonds will have sparked the interest of investors who have been conditioned to buy the dip. That is exactly what happened following the taper tantrum and on every other occasion when bonds sold off during what has been one of the most persistent bull markets in history.

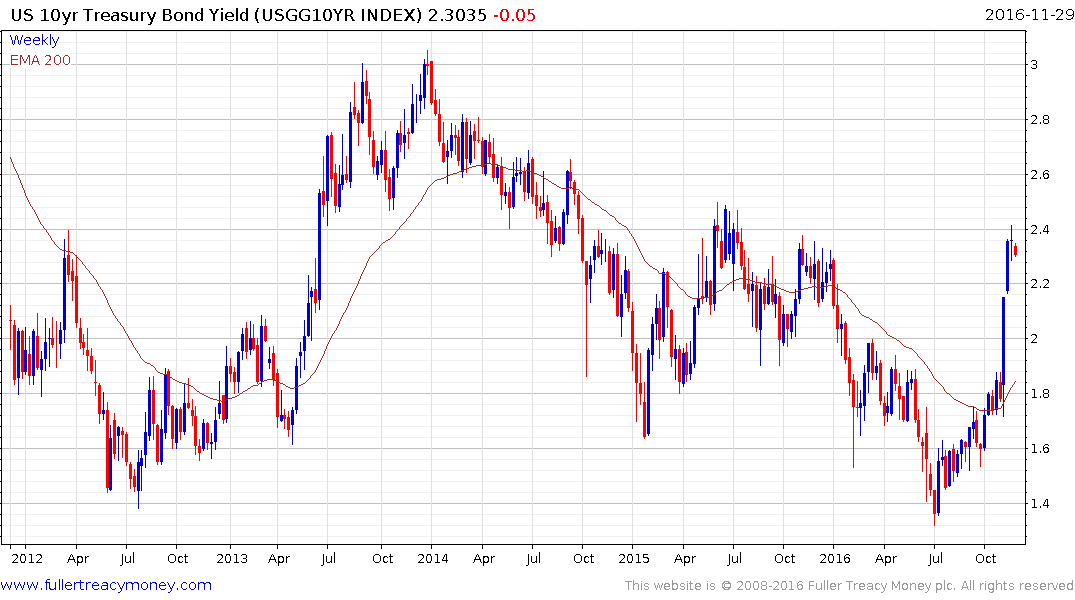

Jumps in yield bolster the attraction of bonds on a relative value basis and yields are now above that of the S&P500 for the first time since late last year. There has been a lot of talk about the end of the bond bull market and we have a great deal of sympathy with that view but it is also worth considering that a decades’ long bull market does not end overnight. There has been a substantial run-up in yields over the last few weeks and at least a pause is looking more likely than not.

If the bond bull market is in fact over then yields are unlikely to trade back below the 200-day MA. In short the buy the dips strategy will stop working.

The magnitude of the move in the Merrill Lynch 10-year US Treasury Futures Total Return Index is exactly the same at that which accompanied the taper tantrum. It will need to encounter resistance in the region of the trend mean and sustain a move to a new low to confirm top formation completion.