Hedge Funds Bullish on the Philippines as Duterte Wins Election

This article by Suzy Waite for Bloomberg may be of interest to subscribers. Here is a section:

"Politics in Southeast Asia are always volatile and unpredictable," Alex Klein Tank, a managing director at Bangkok- based Civetta, said. "But we stick with the fundamentals and I don’t think the growth trajectory on the Philippines will be derailed by the election."

Civetta’s long-only equity fund has about 40 percent of its portfolio invested in the Philippines. It holds shares of four companies: EEI Corp., a Quezon City-based construction company; San Miguel Pure Foods Co.; 8990 Holdings Inc., a low-cost housing developer; and Xurpas Inc., a mobile e-commerce company, Klein Tank said in a telephone interview. The fund, which returned 15 percent this year through April 30, may add to its holdings if there is weakness in coming weeks, he said.

"Foreign hedge funds get nervous, but things will go back to normal and countries like the Philippines will continue to grow," Klein Tank said.

Above all else Duterte is anti-crime and has been a vocal critic of ineffectual governance so his accession to the Presidency is a potential positive if he can impose stronger standards in government.

An interesting development is that during his campaign Duterte mentioned he had been partly funded by a Chinese man. Whether that is part of the Philippines wealthy domestic population of Chinese heritage or mainland Chinese has yet to be fully clarified but he has said he is open to discussing how to jointly develop energy resources in the South China Sea with China. There is no doubt China wants to avoid having to deal with the UN on its maritime claims so it may be willing to offer the new president concessions to reach an accommodation that would help it with its other territorial disputes in the region. This article from Forbes may also be of interest.

The Philippines Composite Index bounced emphatically on the election result, from the region of the trend mean and is now working on an upside weekly key reversal. A sustained move below 7000 would be required to question potential for additional higher to lateral ranging.

The Philippine Peso steadied on the news and a sustained move below PHP46 would signal more than temporary demand dominance.

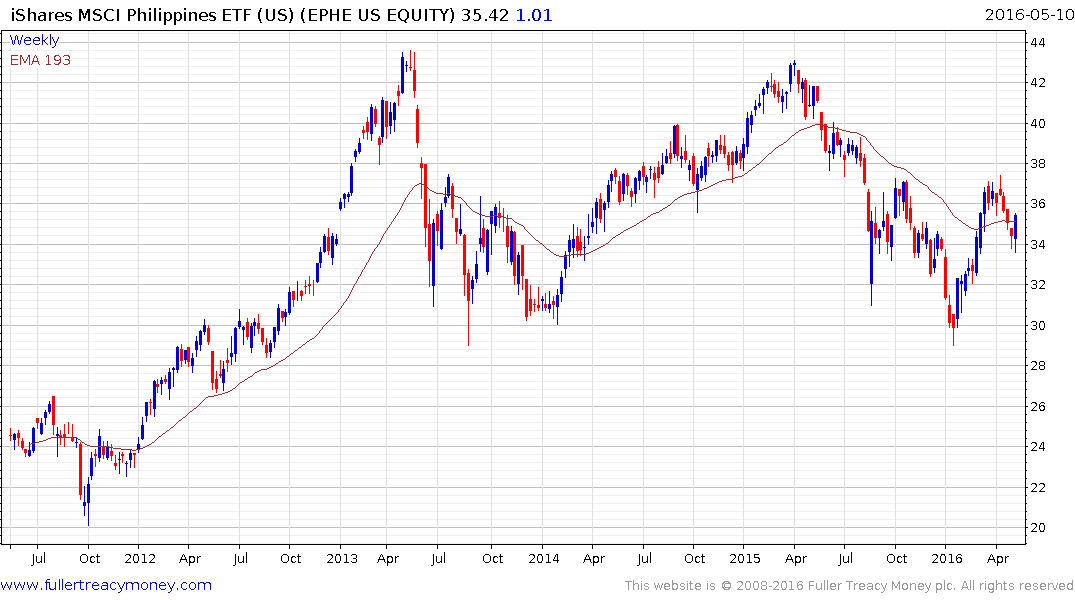

The US listed iShares MSCI Philppines ETF (AUM 236 million) shares a similar pattern to the national Index

![]()

The UK listed, Pound denominated, db x-trackers MSCI Philippines ETF (AUM £34.5 million) also shares a similar pattern.