Oil Rises From Two-Week Low Amid Libya, Nigeria Supply Fears

This article by Mark Shenk for Bloomberg may be of interest to subscribers. Here is a section:

Oil rose from a two-week low on concern that supplies from Nigeria and Libya, holders of Africa’s largest crude reserves, will be disrupted.

Futures advanced 2.8 percent in New York. Royal Dutch Shell Plc and Chevron Corp. are evacuating workers from the Niger Delta because of deteriorating security, a union official said.

In Libya, some fields will be forced to halt output unless a port blockade is lifted, according to the National Oil Corp.Canada’s oil-sands companies curbed supply as wildfires ripped across Northern Alberta last week. Gains accelerated as global equities rose.

"The market is getting support from the disruption in Canadian oil sands production and increased threats to output in the Niger Delta," said Gene McGillian, a senior analyst and broker at Tradition Energy in Stamford, Connecticut.

"The underlying fundamentals remain weak. If not for supply disruptions and the decline in U.S. production, prices would be lower."

Crude has rebounded from a 12-year low earlier this year on signs the global oversupply will ease as non-OPEC output declines and regional supply faces threats in Africa and Canada.

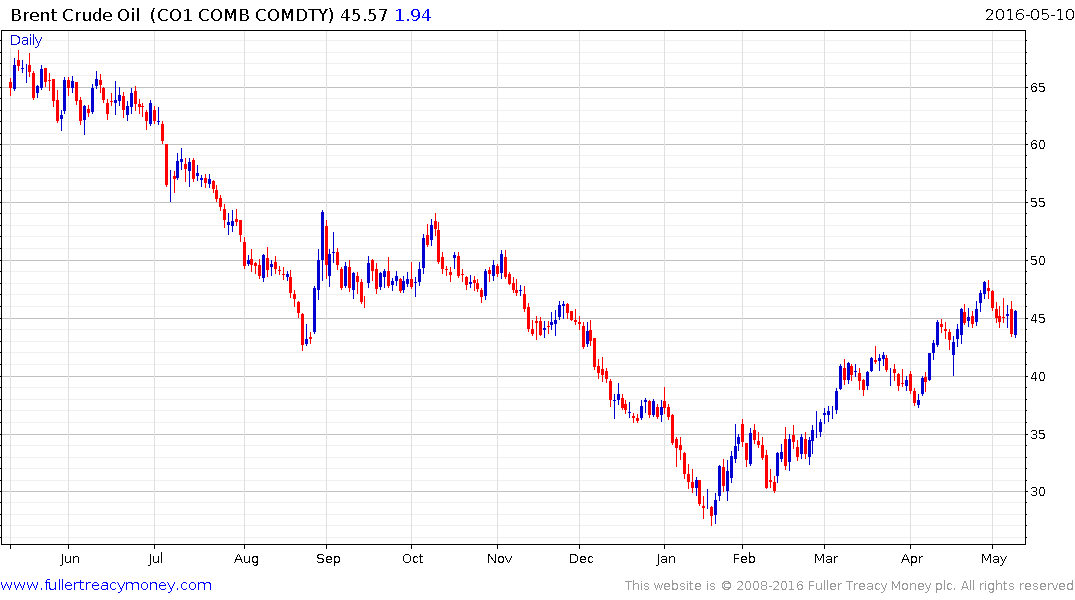

Oil prices have been the subject of a great deal of media coverage over the last few months not least because of Saudi Arabia’s court politics. There are so many moving parts to this market that we can really only be guided by the price action as an arbiter of what people are doing with their money.

Brent Crude is currently posting its fourth $5 reaction since hitting a medium-term low in January. A sustained move below yesterday’s low near $43.35 would be required to question the consistency of the four-month uptrend.

At some stage prices will have rallied enough to encourage marginal supply, not least unconventional oil, back into the market. However without a break in the progression of higher reaction lows we will not have evidence that point has been reached.