Hedge funds are betting big against Australian banks

This article by Vera Sprothe for the Wall Street Journal appeared in the Australian and may be of interest to subscribers. Here is a section:

Many have failed to call correctly an end to an Australian housing price boom that has led to some of the country’s sleepiest towns becoming less affordable than New York. One investment manager’s experience underscores the high stakes involved. In 2010, Jeremy Grantham, co-founder of Boston-based hedge fund GMO and famous for predicting bubbles, found traction among short sellers when he said Australia’s property market was a bubble ready to burst. Instead, housing prices continued to climb.

This year, investors shorting Commonwealth Bank, the nation’s largest lender, would have made a profit, as the stock has plunged as much as 18 per cent since January 1. However, the shares have started rebounding in recent days. If they continue to rise, short sellers would be at risk of losses when they buy back the stock and return it to the original investor at a higher price.

The banks are benefiting from expectations the Australian central bank will further cut its benchmark rate this year from a record-low 1.75 per cent. This has helped to allay market concerns about intensifying mortgage distress among Australian households, which are among the most indebted in the world. Home loans account for the majority of Australian bank assets.

“It’s a tough trade,” Andrew Macken, a fund manager at Montgomery Global Investment Management in Sydney, said. “Australia’s major banks don’t make good shorts. Even if their profit prospects may look weaker than in the past, they’re still some of the most profitable in the world, competition is limited and they enjoy an implicit government guarantee.”

Is there a bubble developing in Sydney and Melbourne housing? Very probably. Is it at risk of popping? With the RBA cutting rates at least there is a monetary tailwind to support prices. What about the banks?

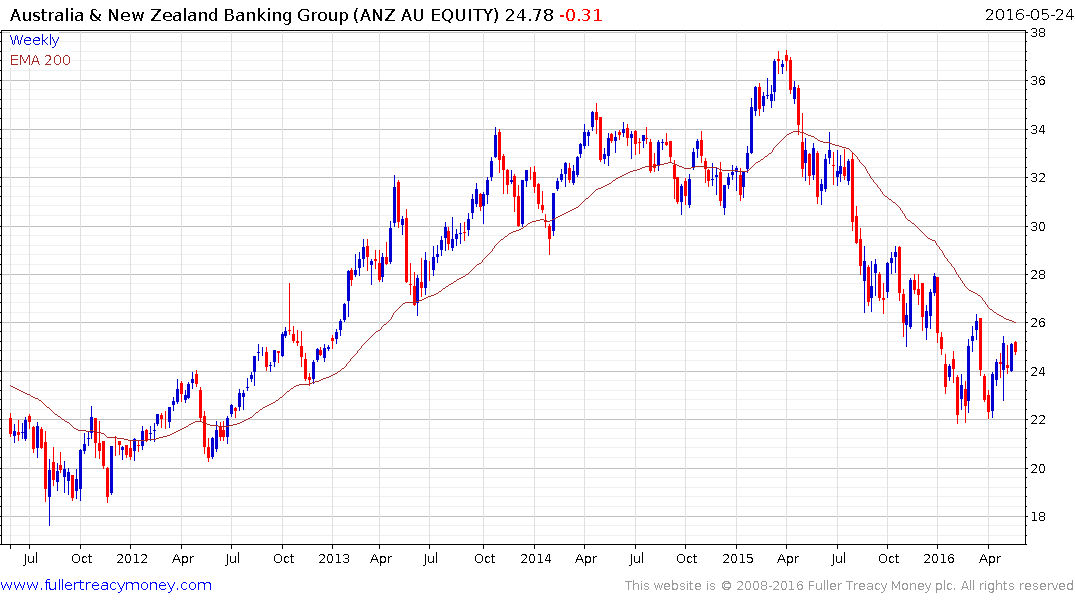

If we look at the chart for ANZ, Commonwealth Bank of Australia, National Australia Bank or Westpac the best time to open short positions was last year. The S&P/ASX has been trending lower since the March 2015 peak and is now testing the region of the trend mean. With the RBA back in easing mode bank lending margins will be under pressure but the risk of bad loans will be reduced. The Index needs to sustain a move back above the 6000 level to signal a return to demand dominance beyond the short term.