Half-hearted sanctions against Russia have already failed

This article by Ambrose Evans Pritchard for the Telegraph may be of interest to subscribers. Here is a section:

Goldman’s deep-dive into the effect of sanctions ought to end all wishful thinking. The US investment bank forecasts that the Russian economy will contract by 10pc this year, a bad recession but not an economic breakdown.

Growth will then recover to 2.4pc next year and 3.4pc in 2024 as the country adjusts. Exports will be back to 98pc of prior levels by early next year. If so, Putin is not going to lose sleep over this.

Russia’s trade will mostly be diverted rather than destroyed. There may even be some short-term growth stimulus as Russia replaces western goods with home-made manufactures. Putin has been building a fortress economy ever since the annexation of Crimea. Net foreign funding is negligible. Total public debt is 18pc of GDP, one of the lowest ratios in the world.

Over four-fifths of GDP come from sectors that import just 15pc or less of their inputs, falling to 7pc in the mining industry. This is a radically different economic structure from western states such as Poland.

“If Russia were fully integrated into global supply chains, restrictions on imports and exports would be immediately destructive. However, Russia largely exports goods that are almost fully produced locally,” said Mr Grafe.

Iran endured tougher sanctions without buckling. Cornell professor Nick Mulder, author of The Economic Weapon, said the country settled into a new equilibrium within a couple of months. “If Iran’s experience is any guide, Russia will survive and return to lacklustre growth,” he said.

“Historically, sanctions have hardly ever been successful in stopping wars,” he said. A rare exception was the Balkan ‘war of the stray dog’ in 1925. Needless to say, Putin’s war on Ukraine is not a border skirmish. It is a long-planned attempt to overturn the post-Cold War settlement and alter the world’s balance of power.

European ministers once again grappled with a hydrocarbon embargo – the fifth package of sanctions – at an EU meeting on Monday. Once again the proposals ran into resistance from Germany, with Italy and others happy to tuck in behind.

Here is a link to the full article.

Russia continues to make coupon payments. That indicates it has the capital available to do so and avenues are open. Without cutting Russia off from the financial system and banning energy purchases, the country can continue to operate effectively. Due to its size and dominance of several key commodity markets, Russia has ample scope to cause mischief on a grand scale.

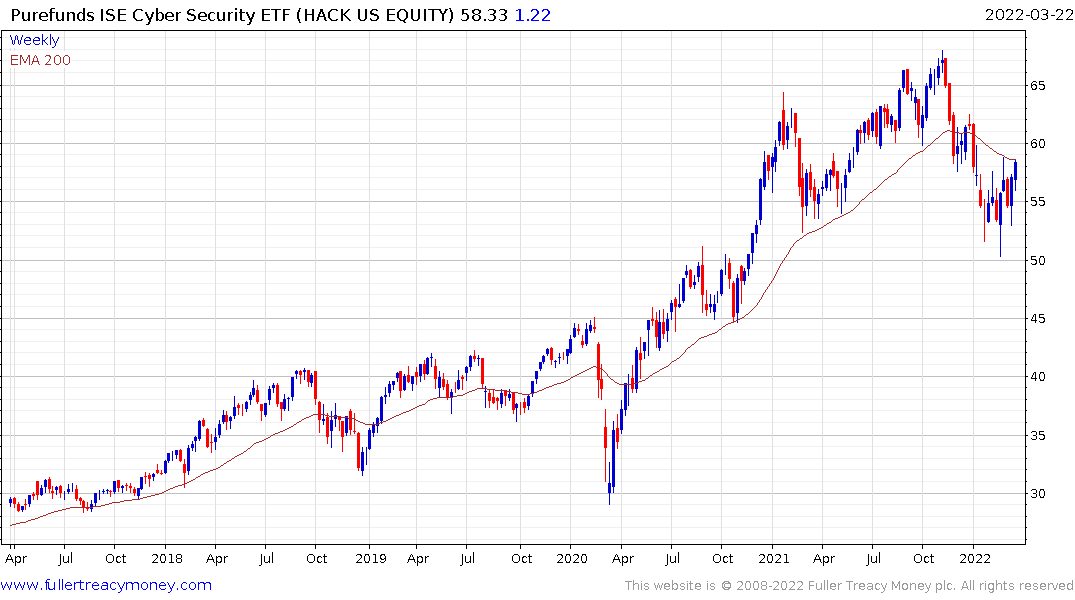

The cyber theatre for mischief making is only beginning to be explored but this is something Russia has plenty of experience with.

This article by Niall Ferguson reaches the same conclusion. Russia has ample resources to prosecute this war for as long as is required. Initial missteps are not permanent and will be learned from. Here is a section on the new Cold War:

I would put it like this: Cold War II is like a strange mirror-image of Cold War I. In the First Cold War, the senior partner was Russia, the junior partner was China — now the roles are reversed. In Cold War I, the first hot war was in Asia (Korea) — now it’s in Europe (Ukraine). In Cold War I, Korea was just the first of many confrontations with aggressive Soviet-backed proxies — today the crisis in Ukraine will likely be followed by crises in the Middle East (Iran) and Far East (Taiwan).

But there’s one very striking contrast. In Cold War I, President Harry Truman’s administration was able to lead an international coalition with a United Nations mandate to defend South Korea; now Ukraine has to make do with just arms supplies. And the reason for that, as we have seen, is the Biden administration’s intense fear that Putin may escalate to nuclear war if U.S. support for Ukraine goes too far.

I agree with this conclusion that China is likely to be emboldened by the success of Russia in deterring foreign direct military involvement by threatening nuclear retaliation. I also think it is foolhardy to think the Russian military has already been defeated.

The stock market is behaving as if the surprises are in the past. Until we see evidence of a deepening crisis, the rebound is likely to be sustained.