Gross Sees No Liquidity in Bonds as Small Trades Move Market

This article by Madeline McMahon and Lisa Abramowicz for Bloomberg may be of interest to subscribers. Here is a section:

While the U.S. government bond market has almost tripled since 2007 to $12.5 trillion at the end of last year, average annual trading volumes have fallen 11 percent in the period, according to data compiled by the Securities Industry and Financial Markets Association. Activity has slowed as central banks hoard the debt and Wall Street firms use less of their own money to facilitate bigger trades.

Regulators are growing increasingly concerned that the U.S. Treasury market, which sets benchmark rates for everything from mortgages to corporate debt, is more vulnerable to unpredictable swings. On Oct. 15, yields on 10-year Treasuries plunged the most since 2009, without an obvious catalyst.

After data was released today showing slower growth in the U.S. than analysts expected, yields on the debt rose 2.9 percent, much to the confusion of many analysts.

The regulatory environment for insurance companies and pension funds has changed beyond recognition since the financial crisis. There are very strict rules on what constitutes Tier 1 capital and how much of it needs to be held. This means there are heavy penalties for not holding government bonds so investors have an incentive to hold onto positions. Add to this the increasingly massive size of central bank holdings and it is not difficult to understand that the market for Treasuries and other benchmark bonds might be illiquid.

This is an exaggerated example of the late stages of a buy and hold strategy. As with any market investors are converted to the buy and hold strategy because trading within a trend is more difficult than holding on, buying on weakness and having faith that new highs will eventually be sustained. This lasts for as long as it takes for supply to overwhelm demand.

At that point long-term holders become potential sources of future supply.

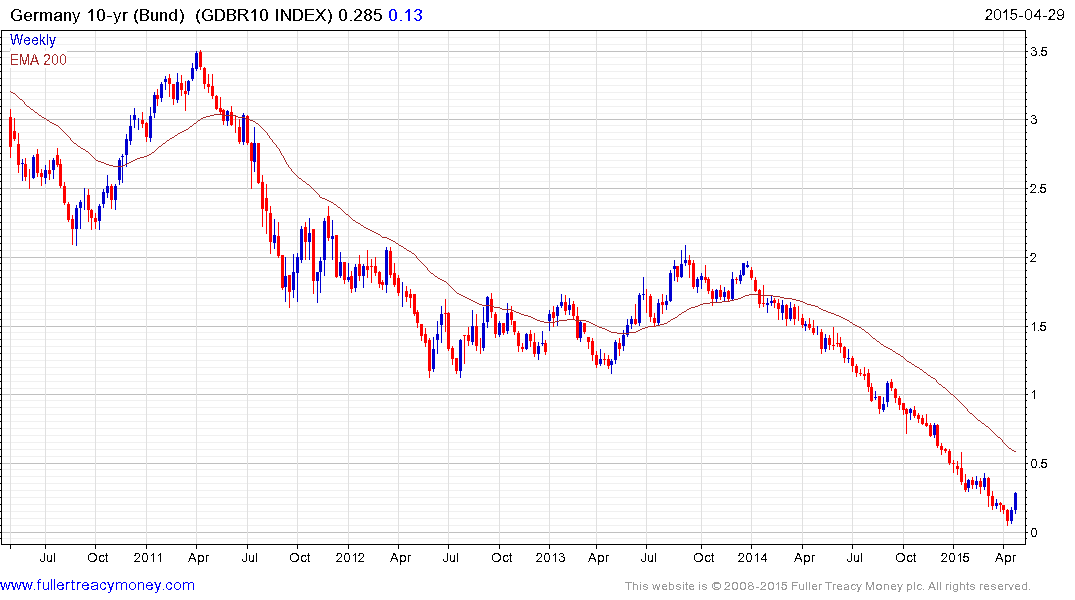

In the very short-term a number of high profile commentators were predicting Bund yields would go negative. They almost got there but today’s bounce is the largest since at least September and suggests that a near term low has been reached.

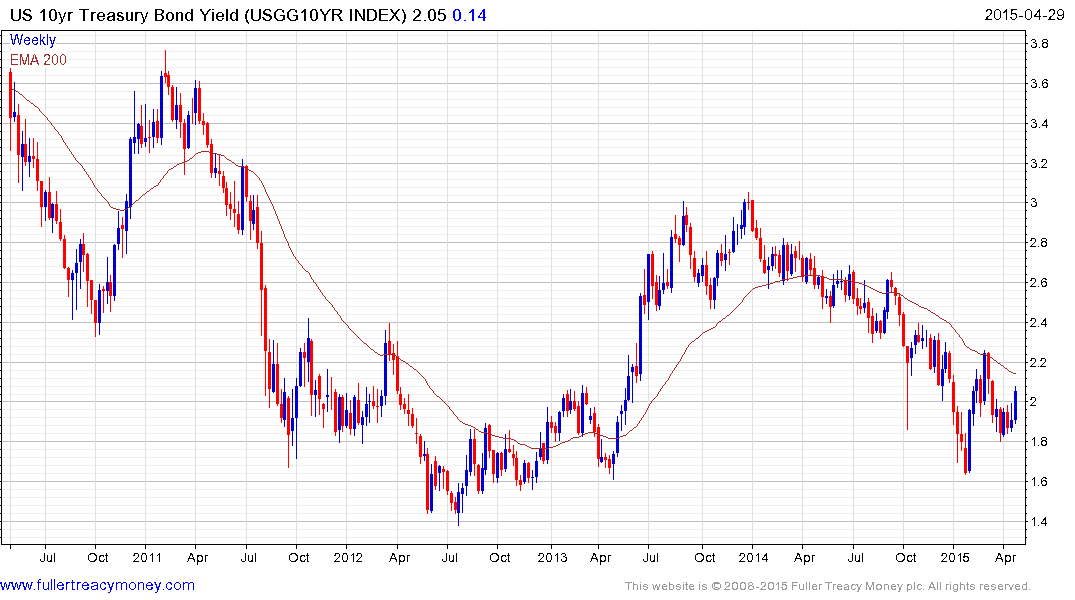

US 10-year Treasury yields found support above 1.5% from January and posted a higher reaction low from early this month. A sustained move above 2.15% would break the more than yearlong progression of lower rally highs and confirm a return to supply dominance beyond the short term.

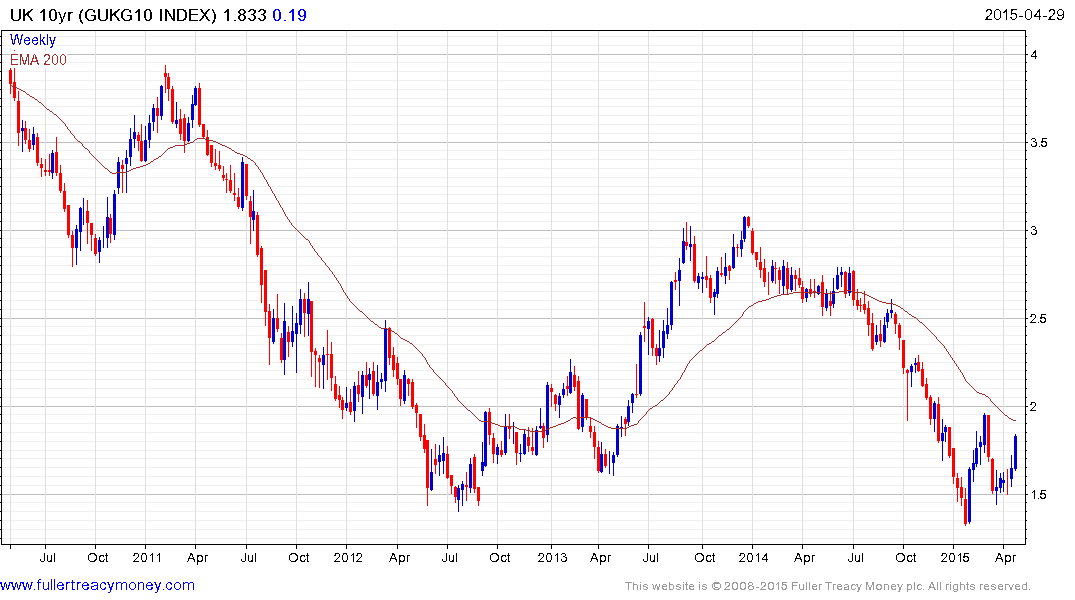

UK Gilts share a similar pattern over the last year.

Back to top