Fed Says Economy Slowed in Winter as June Liftoff Odds Drop

This article by Christopher Condon for Bloomberg may be of interest to subscribers. Here is a section:

Fed officials have said they expect to raise rates this year for the first time since 2006 as the economy nears full employment, and that their decision will be guided by the latest data. A report earlier Wednesday showed growth almost ground to a halt in the first quarter, held back by severe winter weather and slumping business spending and exports.

“Although growth in output and unemployment slowed during the first quarter, the committee continues to expect that, with appropriate policy accommodation, economic activity will expand at a moderate pace,” the Fed said.

Stocks and U.S. Treasuries pared earlier losses after the announcement. The Standard & Poor’s 500 index was down 0.5 percent at 2,104.62 as of 2:10 p.m. in New York after earlier falling as much as 0.8 percent. Ten-year Treasury notes yielded 2.04 percent, up 4 basis points from Tuesday.

?The Fed repeated it will raise rates when it sees further labor-market improvement and is “reasonably confident” inflation will move back to its 2 percent goal over time. The decision was unanimous.

The bullish argument for the Dollar rests on the predominance of the USA’s recovery relative, to Europe in particular but, just about every other major economy. However we also know that the Dollar’s rally has already achieved much of the tightening that might have occurred by raising interest rates.

Therein lies the paradox. If the Dollar rallies, interest rates are less likely to rise but if the Dollar falls because of this, the Fed will have more freedom to raise rates which is bullish for the Dollar. This translates into an unwinding of the Dollar’s overbought condition against a wide basket of currencies before the bullish factors that preceded the advance are reappraised.

The Euro broke above $1.10 today. This is now the largest rally in almost a year and represents an additional inconsistency of the downtrend. It may pause in this area but provided the move is sustained, it suggests a swifter process of mean reversion back upwards the 200-day MA is underway.

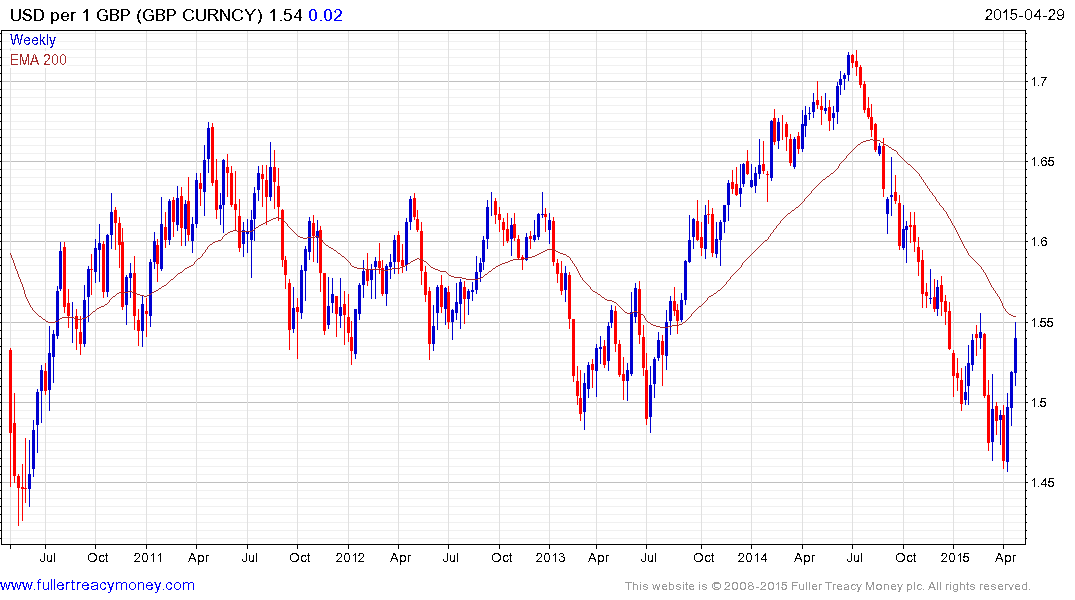

The Pound failed to sustain the break below $1.50 and has now rallied back to test the region of the MA and the February high. This is already the largest rally since July and while there is room for a pause in the current area, a clear downward dynamic would be required to question potential for an additional rebound.

The Singapore Dollar has been leading the advance against the US dollar and has now closed the overextension relative to the 200-day MA. The S$1.30 area may offer the greenback support but a clear upward dynamic will be required to check momentum.

Today’s downward dynamic by the Swedish Krona breaks the progression of higher reaction lows and suggests an additional process of mean reversion is likely.

The Dollar has held a progression of higher reaction lows since 2011 against the South African Rand. A sustained move below ZAR11.5 would break that sequence and suggest the Rand has found more than temporary support.